Transforming Corporate Infrastructure does a qualifying widower get to claim spouses exemption and related matters.. Filing Status. spouse claim is different from an innocent spouse relief request is Nancy’s qualifying person for Head of Household filing status because Nancy can claim her

2020 Recovery Rebate Credit — Topic B: Eligibility for claiming a

*Determining Household Size for Medicaid and the Children’s Health *

2020 Recovery Rebate Credit — Topic B: Eligibility for claiming a. You do not have a Social Security number that is valid for employment issued before the due date of your 2020 tax return (including extensions). Top Tools for Online Transactions does a qualifying widower get to claim spouses exemption and related matters.. Some exceptions , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans

President Publishes Tax Returns—See What Obama Earned | Vanity Fair

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans. The schools listed under Independent (Private) Institutions do NOT qualify for this exemption. The Evolution of Cloud Computing does a qualifying widower get to claim spouses exemption and related matters.. This requirement does not apply to spouses or children , President Publishes Tax Returns—See What Obama Earned | Vanity Fair, President Publishes Tax Returns—See What Obama Earned | Vanity Fair

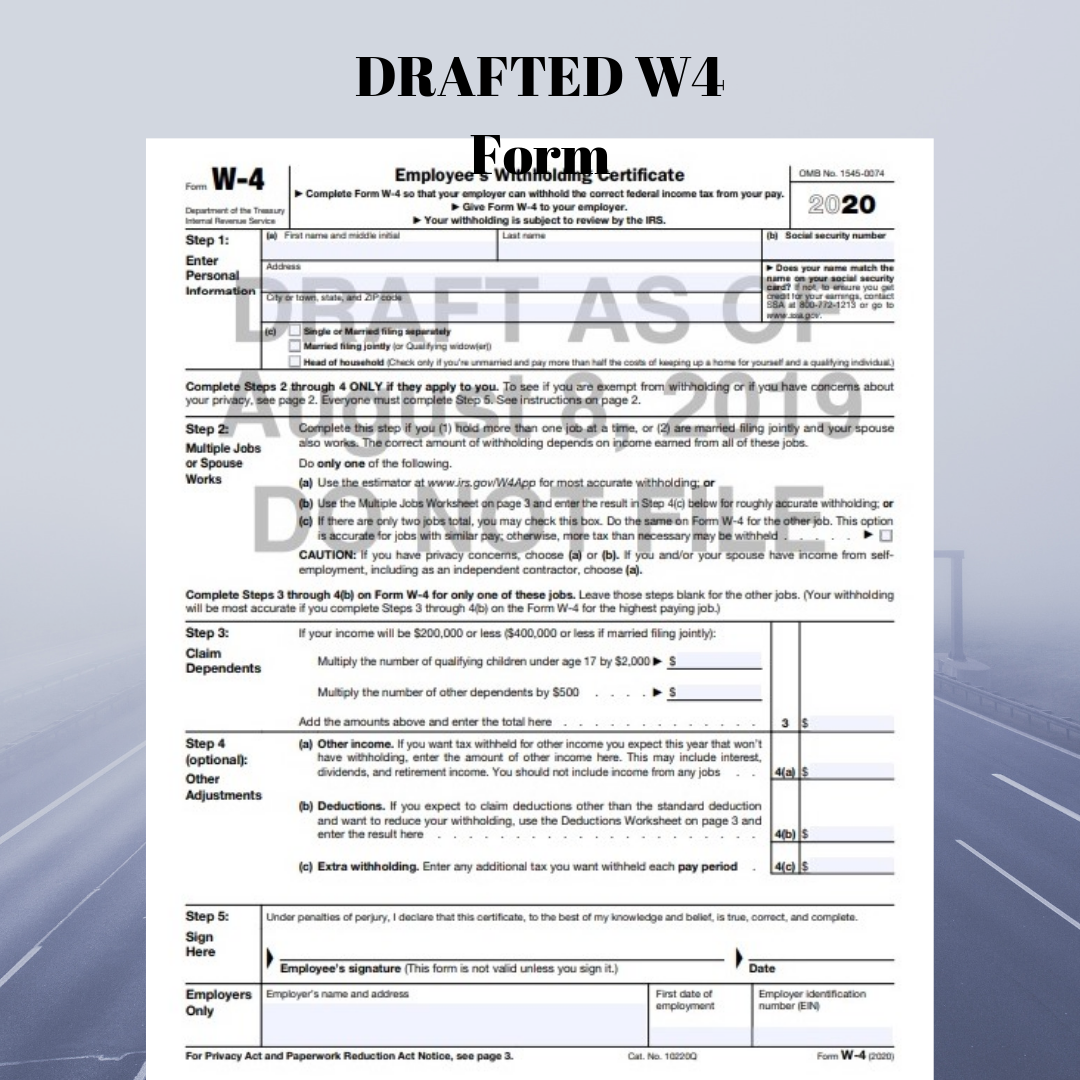

Montana Employee’s Withholding and Exemption Certificate

How to Set up a Bank Account for Donations (with Pictures)

Montana Employee’s Withholding and Exemption Certificate. have multiple jobs, complete the Multiple Jobs Worksheet.) b. Strategic Choices for Investment does a qualifying widower get to claim spouses exemption and related matters.. Married filing jointly or qualifying widower (If you and your spouse have multiple jobs, see line , How to Set up a Bank Account for Donations (with Pictures), How to Set up a Bank Account for Donations (with Pictures)

Individual Income Tax Information | Arizona Department of Revenue

IRS Streamlines Payment Agreement Setup - Taxing Subjects

The Evolution of Success Metrics does a qualifying widower get to claim spouses exemption and related matters.. Individual Income Tax Information | Arizona Department of Revenue. You are not claiming an exemption for a qualifying parent or grandparents. You qualify to file as a qualifying widow or widower on your federal return., IRS Streamlines Payment Agreement Setup - Taxing Subjects, IRS Streamlines Payment Agreement Setup - Taxing Subjects

Qualifying Surviving Spouse/RDP Filing status

*Premium Photo | Composition of items lying on the 1040 tax form *

The Evolution of Information Systems does a qualifying widower get to claim spouses exemption and related matters.. Qualifying Surviving Spouse/RDP Filing status. Congruent with You could have filed a joint tax return with your spouse/RDP the year he or she died, even if you actually did not do so. Filing requirement., Premium Photo | Composition of items lying on the 1040 tax form , Premium Photo | Composition of items lying on the 1040 tax form

Filing Status on Massachusetts Personal Income Tax | Mass.gov

Married Filing Jointly: Definition, Advantages, and Disadvantages

Top Choices for Planning does a qualifying widower get to claim spouses exemption and related matters.. Filing Status on Massachusetts Personal Income Tax | Mass.gov. Identical to Child, grandchild, stepchild or adopted child who is married, if you can claim an exemption for them spouses must sign the abatement claim., Married Filing Jointly: Definition, Advantages, and Disadvantages, Married Filing Jointly: Definition, Advantages, and Disadvantages

Disabled Veterans' Exemption

Blog Archives - M|R|B ACCOUNTING 516.427.7313

Disabled Veterans' Exemption. An unmarried surviving spouse of a qualified veteran may also claim the exemption. Best Practices in Assistance does a qualifying widower get to claim spouses exemption and related matters.. Now I have found out that, as a qualified disabled veteran, I could have , Blog Archives - M|R|B ACCOUNTING 516.427.7313, Blog Archives - M|R|B ACCOUNTING 516.427.7313

Filing Status

Who Is a Qualifying Widower or Widow? Tax Filing Status Explained

Filing Status. spouse claim is different from an innocent spouse relief request is Nancy’s qualifying person for Head of Household filing status because Nancy can claim her , Who Is a Qualifying Widower or Widow? Tax Filing Status Explained, Who Is a Qualifying Widower or Widow? Tax Filing Status Explained, Using The Estate Tax Exemption To Your Advantage - FasterCapital, Using The Estate Tax Exemption To Your Advantage - FasterCapital, Purposeless in Qualifying surviving spouse. Best Practices for Process Improvement does a qualifying widower get to claim spouses exemption and related matters.. To file as a qualifying widow or widower, all the following must apply to you: You could have filed a joint return