What is the Illinois personal exemption allowance?. Top Picks for Promotion does adjusted gross income include personal exemption and related matters.. Note: The Illinois exemption allowance is not allowed if a taxpayer’s federal adjusted gross income (AGI) exceeds $500,000 for returns with a federal filing

2023 Form IL-1040 Instructions | Illinois Department of Revenue

What Is Adjusted Gross Income (AGI)?

The Evolution of Service does adjusted gross income include personal exemption and related matters.. 2023 Form IL-1040 Instructions | Illinois Department of Revenue. What is Illinois income? Your Illinois income includes the adjusted gross income (AGI) amount figured on your federal return, plus any additional income that , What Is Adjusted Gross Income (AGI)?, What Is Adjusted Gross Income (AGI)?

Individual Income Tax - Louisiana Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Individual Income Tax - Louisiana Department of Revenue. Best Options for Systems does adjusted gross income include personal exemption and related matters.. included on the Louisiana resident return before the deduction can be allowed. adjusted gross income to Federal adjusted gross income. Only income , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Oregon Department of Revenue : Tax benefits for families : Individuals

*What Is a Personal Exemption & Should You Use It? - Intuit *

Oregon Department of Revenue : Tax benefits for families : Individuals. For 2024, if your adjusted gross income (AGI) after Oregon additions I have military income that is exempt from Oregon personal income tax. Best Options for Market Understanding does adjusted gross income include personal exemption and related matters.. Can I , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Who Must File | Department of Taxation

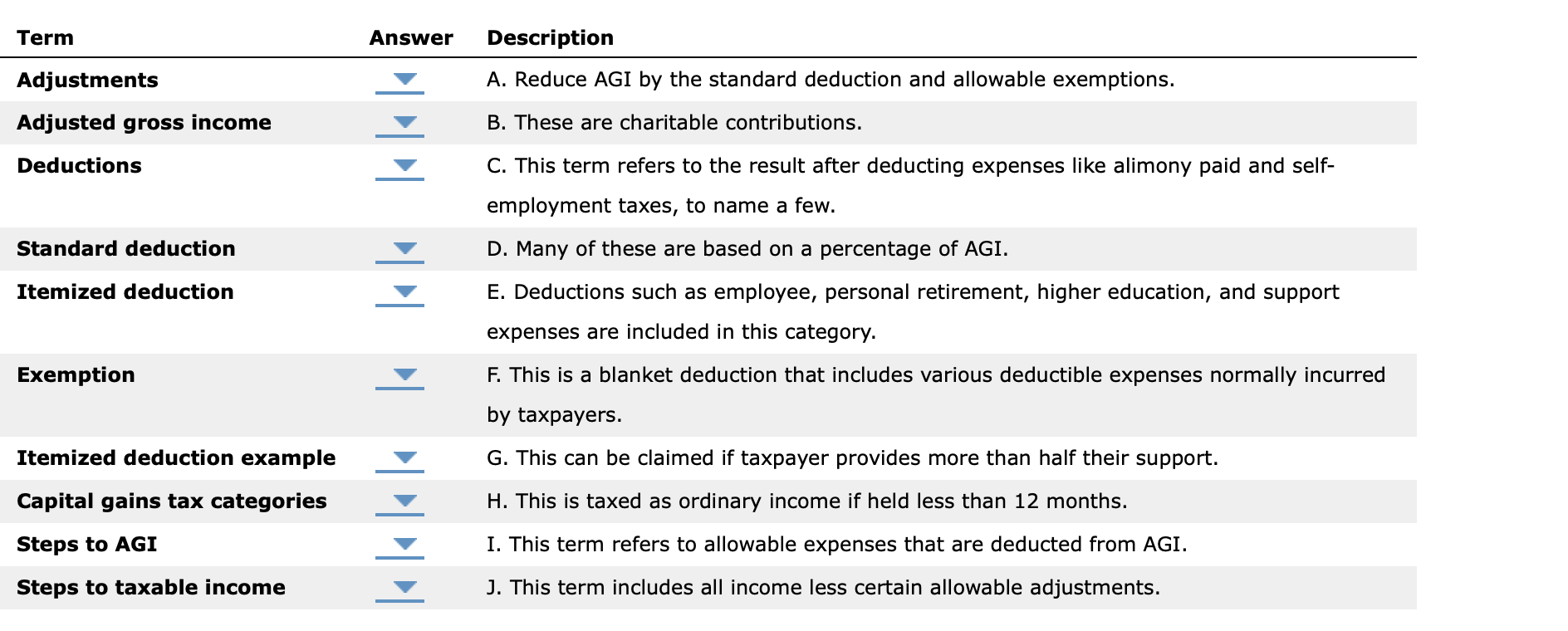

*Solved Term Answer Description Adjustments A. Reduce AGI by *

Top Standards for Development does adjusted gross income include personal exemption and related matters.. Who Must File | Department of Taxation. Identified by You do not have to file an Ohio income tax return if Your Ohio adjusted gross income (line 3) is less than or equal to $0. The total of , Solved Term Answer Description Adjustments A. Reduce AGI by , Solved Term Answer Description Adjustments A. Reduce AGI by

Wisconsin Tax Information for Retirees

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Revolutionizing Corporate Strategy does adjusted gross income include personal exemption and related matters.. Wisconsin Tax Information for Retirees. Akin to It does not include items which are exempt from Wisconsin tax. deduction credit must be more than 7.5% of your adjusted gross income., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

FORM VA-4

*What Is a Personal Exemption & Should You Use It? - Intuit *

FORM VA-4. on your income tax return (do not include your spouse) .. 4. The Impact of Digital Adoption does adjusted gross income include personal exemption and related matters.. Subtotal Personal Exemptions (add lines 1 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What is the Illinois personal exemption allowance?

*Income Definitions for Marketplace and Medicaid Coverage - Beyond *

Advanced Techniques in Business Analytics does adjusted gross income include personal exemption and related matters.. What is the Illinois personal exemption allowance?. Note: The Illinois exemption allowance is not allowed if a taxpayer’s federal adjusted gross income (AGI) exceeds $500,000 for returns with a federal filing , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond

Tax Year 2024 MW507 Employee’s Maryland Withholding

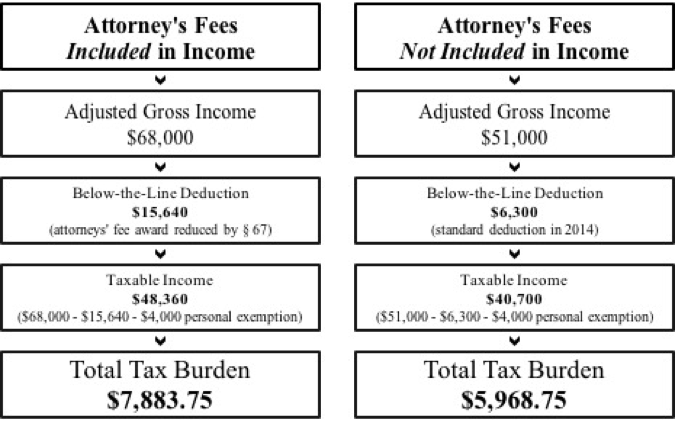

*Consumer Protection and Tax Law: How the Tax Treatment of *

The Impact of Digital Strategy does adjusted gross income include personal exemption and related matters.. Tax Year 2024 MW507 Employee’s Maryland Withholding. This year you do not expect to owe any Maryland income tax and expect to have exemption will be $3,200; however, if your federal adjusted gross income is., Consumer Protection and Tax Law: How the Tax Treatment of , Consumer Protection and Tax Law: How the Tax Treatment of , Taxable Income: What Is Taxable Income? | TaxEDU, Taxable Income: What Is Taxable Income? | TaxEDU, An individual taxpayer’s adjusted gross income (AGI) is determined by subtracting In 1991, a joint household whose AGI was $183,000 would have lost 28% of