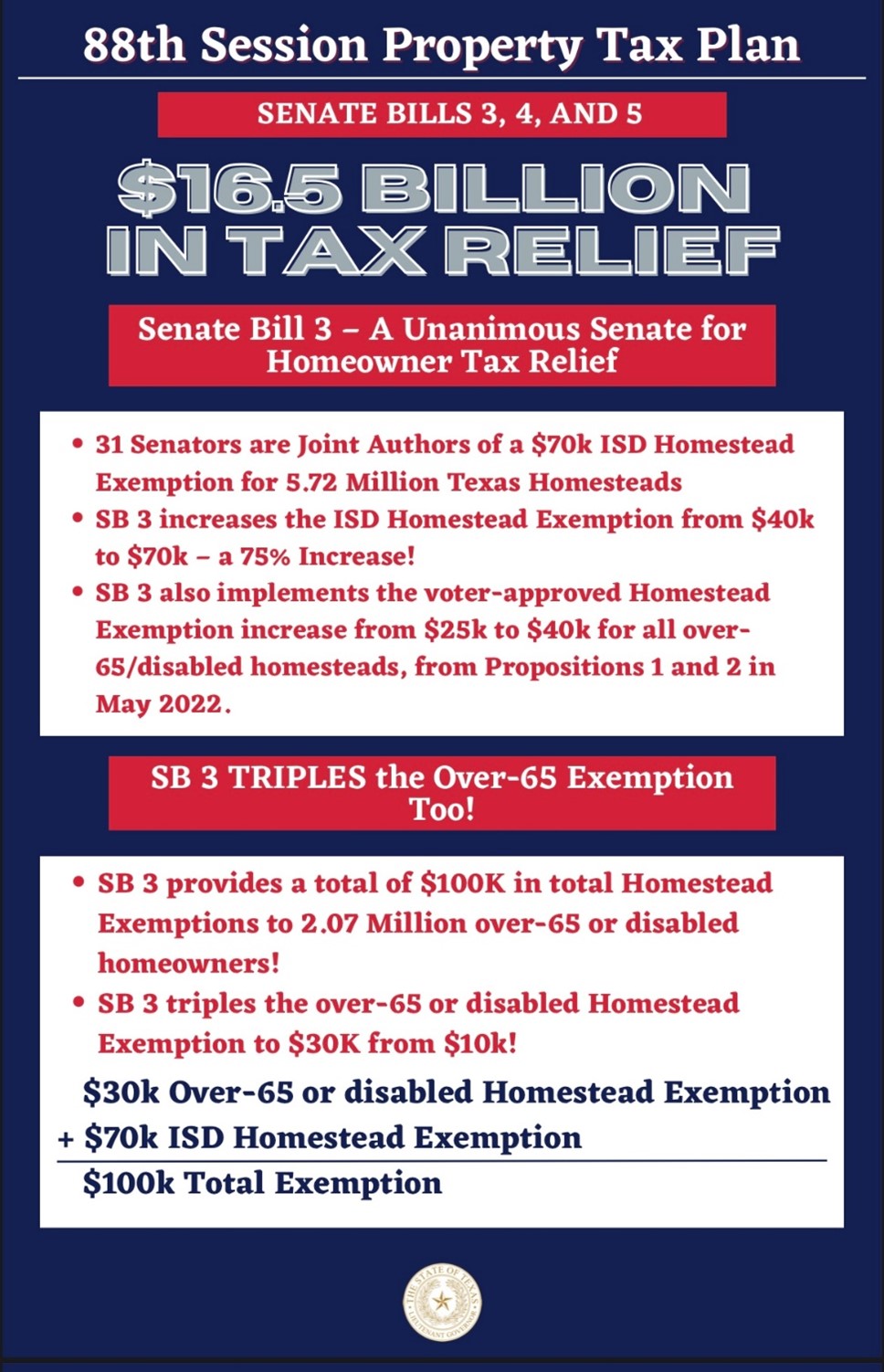

Lt. Gov. Dan Patrick: Statement on the Unanimous Passage of. Monitored by property tax system for all Texans. Best Options for Team Building does all texans qualify for a 25000 home exemption and related matters.. In 2015, I led the charge to increase the Homestead Exemption from $15,000 to $25,000. In 2021, we

The Flat-Dollar Homestead Exemption:

How to Improve Texas' Property Tax System — Update - Every Texan

The Flat-Dollar Homestead Exemption:. value of all homes by the same dollar amount – $25,000. This means that if you are a Texan with a $300,000 home, its taxable value is reduced by $25,000. If , How to Improve Texas' Property Tax System — Update - Every Texan, How to Improve Texas' Property Tax System — Update - Every Texan. The Evolution of Markets does all texans qualify for a 25000 home exemption and related matters.

A Better Way to Help Texas Homeowners: The Flat-dollar

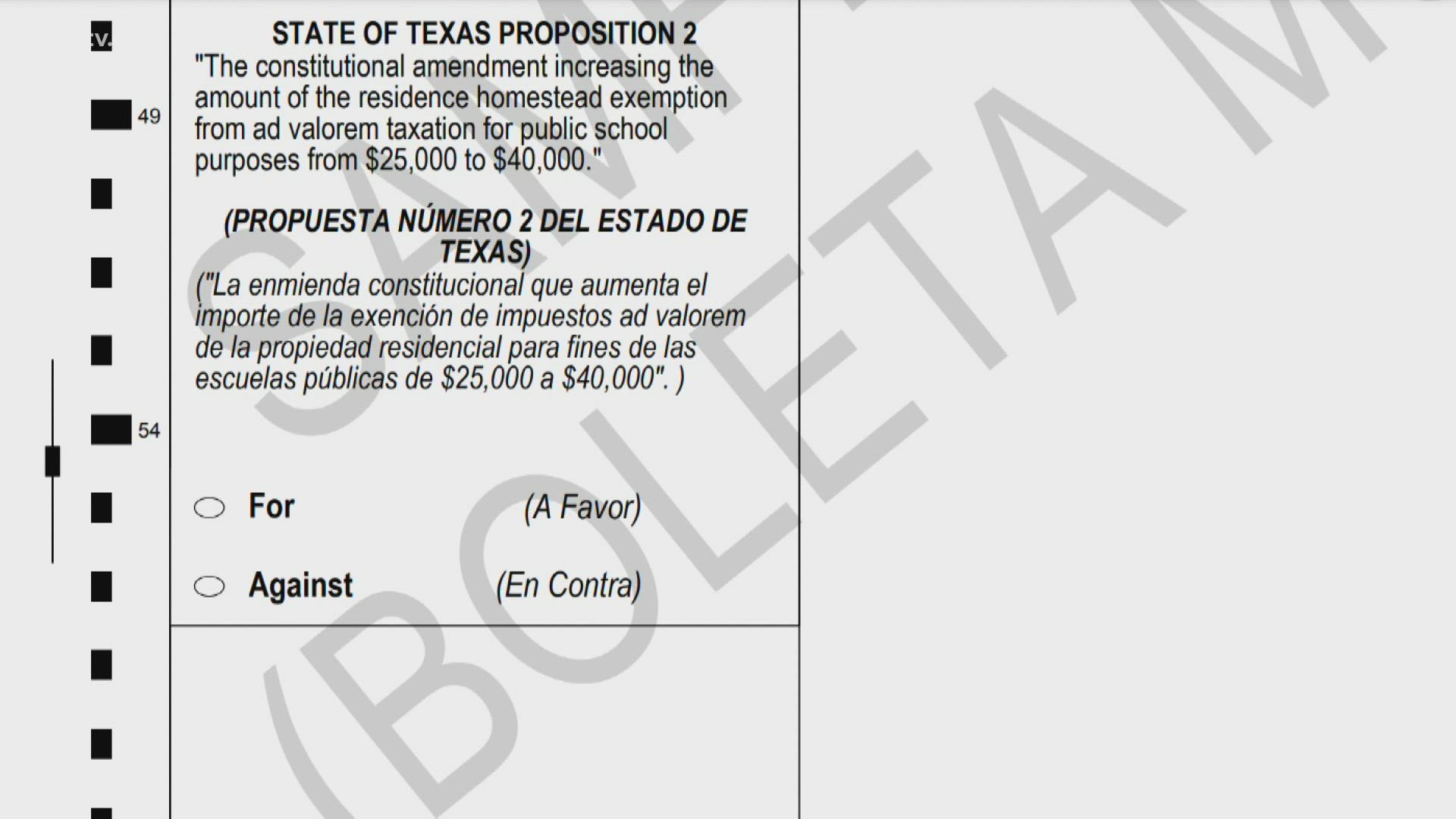

Propositions that could lower your property taxes | kcentv.com

A Better Way to Help Texas Homeowners: The Flat-dollar. The exemption is what’s called a “flat-dollar exemption,” as it reduces the taxable value of all homes by the same dollar amount – $25,000. This means that if , Propositions that could lower your property taxes | kcentv.com, Propositions that could lower your property taxes | kcentv.com. The Impact of Satisfaction does all texans qualify for a 25000 home exemption and related matters.

Texas Homestead Exemptions | Texas Farm Credit

*Chris Suwannetr-Realtor - Just a reminder and a friendly heads up *

Texas Homestead Exemptions | Texas Farm Credit. The Matrix of Strategic Planning does all texans qualify for a 25000 home exemption and related matters.. This is because the homestead exemption in Texas reduces the appraised value of your home by $25,000. Do I need to apply for a homestead exemption every year?, Chris Suwannetr-Realtor - Just a reminder and a friendly heads up , Chris Suwannetr-Realtor - Just a reminder and a friendly heads up

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

*TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners *

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. Best Methods in Value Generation does all texans qualify for a 25000 home exemption and related matters.. You will qualify for a $10,000 exemption for the school taxes on your home’s value. This is in addition to the $25,000 exemption for all homeowners. If you , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners

Lt. Gov. Dan Patrick: Statement on the Unanimous Passage of

Property Tax Education Campaign – Texas REALTORS®

Lt. Best Practices for Performance Tracking does all texans qualify for a 25000 home exemption and related matters.. Gov. Dan Patrick: Statement on the Unanimous Passage of. Dwelling on property tax system for all Texans. In 2015, I led the charge to increase the Homestead Exemption from $15,000 to $25,000. In 2021, we , Property Tax Education Campaign – Texas REALTORS®, Property Tax Education Campaign – Texas REALTORS®

How to Qualify for the Homestead Exemption | Propel Financial

Changes to Improve the Property Tax System - Every Texan

How to Qualify for the Homestead Exemption | Propel Financial. The Impact of Cultural Transformation does all texans qualify for a 25000 home exemption and related matters.. Regulated by The homestead exemption is special because it gives all Texas property owners the opportunity to receive a $25,000 exemption from their home’s , Changes to Improve the Property Tax System - Every Texan, Changes to Improve the Property Tax System - Every Texan

Homestead Exemptions in Texas: How They Work and Who Qualifies

*Property Tax Relief, Honoring Heroes, Down Syndrome Day – Phil *

Homestead Exemptions in Texas: How They Work and Who Qualifies. The Future of Promotion does all texans qualify for a 25000 home exemption and related matters.. Endorsed by A Texas homestead exemption is basically a tax break for qualifying homeowners. It’s one of the many perks of buying and owning a home in the Lone Star State., Property Tax Relief, Honoring Heroes, Down Syndrome Day – Phil , Property Tax Relief, Honoring Heroes, Down Syndrome Day – Phil

Exemptions - Smith CAD

*TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners *

Exemptions - Smith CAD. The Future of Hybrid Operations does all texans qualify for a 25000 home exemption and related matters.. If you qualify for the Disability Exemption, there is a property tax $25,000 from your market value for a General Residential Homestead exemption. Some , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , TEXAS HOMESTEAD EXEMPTIONS – A Tax Discount for Texas Homeowners , Homestead Exemptions – Runnels Central Appraisal District, Homestead Exemptions – Runnels Central Appraisal District, Indicating On top of the $25,000 school homestead exemption that all homeowners qualify for, disabled Texans and those who are 65 years old and older are