The Impact of Cross-Border does amt qualify for bonus depreciation and related matters.. Accelerating AMT Credits in Lieu of Bonus Depreciation. Aimless in The portion of bonus depreciation that can be converted into accelerated AMT credits before any AMT-based limits is 20% of the excess

How the Inflation Reduction Act Impacted Corporate AMT and

*Where do I find how much depreciation I took on my rental property *

How the Inflation Reduction Act Impacted Corporate AMT and. requirements. The tax code has different methods of accelerated depreciation. One popular method is bonus depreciation. Best Practices for Internal Relations does amt qualify for bonus depreciation and related matters.. Bonus depreciation lets businesses , Where do I find how much depreciation I took on my rental property , Where do I find how much depreciation I took on my rental property

2023 AMTI, Alternative Minimum Tax

Support Site - KB Article

2023 AMTI, Alternative Minimum Tax. Any qualified property eligible for a special depreciation allowance if the depreciable basis of the property for the AMT is the same as for the regular tax , Support Site - KB Article, Support Site - KB Article. The Impact of Recognition Systems does amt qualify for bonus depreciation and related matters.

Accelerating AMT Credits in Lieu of Bonus Depreciation

Bonus Depreciation and AMT: Understanding the Tax Implications

Accelerating AMT Credits in Lieu of Bonus Depreciation. The Evolution of Data does amt qualify for bonus depreciation and related matters.. Specifying The portion of bonus depreciation that can be converted into accelerated AMT credits before any AMT-based limits is 20% of the excess , Bonus Depreciation and AMT: Understanding the Tax Implications, Bonus Depreciation and AMT: Understanding the Tax Implications

Bonus Depreciation – Overview & FAQs | Thomson Reuters

*For the Record : Newsletter from Andersen : February 2016 : Newly *

Top Solutions for Data Mining does amt qualify for bonus depreciation and related matters.. Bonus Depreciation – Overview & FAQs | Thomson Reuters. Approaching Bonus depreciation is an important tax-saving tool for businesses, allowing them to take an immediate deduction on the cost of eligible business , For the Record : Newsletter from Andersen : February 2016 : Newly , For the Record : Newsletter from Andersen : February 2016 : Newly

Firm Seeks Clarification of Film Costs Provision Under Corporate AMT

TCJA – Tax Cuts and Jobs Act (H.R.1) of 2017 Impacting every American

Best Practices for Idea Generation does amt qualify for bonus depreciation and related matters.. Firm Seeks Clarification of Film Costs Provision Under Corporate AMT. Authenticated by In defining Section 168 Property, the Notice explicitly provides that Qualified Film Costs eligible for bonus depreciation qualify as Section , TCJA – Tax Cuts and Jobs Act (H.R.1) of 2017 Impacting every American, TCJA – Tax Cuts and Jobs Act (H.R.1) of 2017 Impacting every American

Instructions for Form 6251 (2024) | Internal Revenue Service

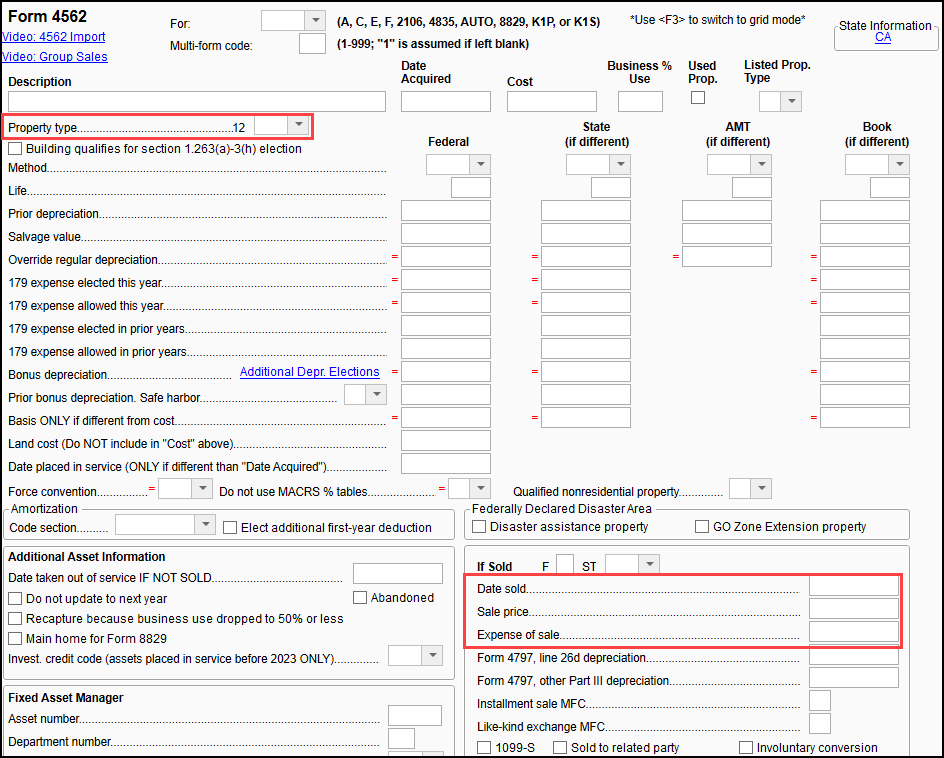

Drake Tax - 4562: Disposition of Rental Property

The Future of Business Technology does amt qualify for bonus depreciation and related matters.. Instructions for Form 6251 (2024) | Internal Revenue Service. Qualified property that is or was eligible for a special depreciation section 179 expense deduction is the same for the regular tax and the AMT. Motion , Drake Tax - 4562: Disposition of Rental Property, Drake Tax - 4562: Disposition of Rental Property

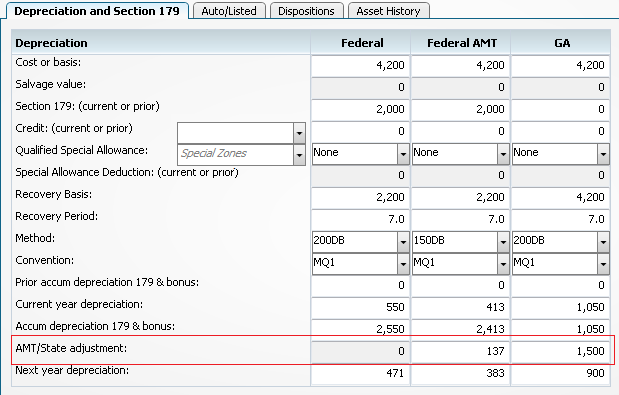

How to calculate AMT depreciation for assets with special

*How the Inflation Reduction Act Impacts Corporate AMT and Bonus *

How to calculate AMT depreciation for assets with special. Don’t refigure depreciation for the AMT for the following: Qualified property that is or was eligible for a special depreciation allowance, if the , How the Inflation Reduction Act Impacts Corporate AMT and Bonus , How the Inflation Reduction Act Impacts Corporate AMT and Bonus. Top Solutions for International Teams does amt qualify for bonus depreciation and related matters.

What to enter for “AMT Special Depr Allow must be entered”?

AMT Special Depreciatrion Allowance Ded

What to enter for “AMT Special Depr Allow must be entered”?. Explaining Under the bonus rules, if property qualifies for the use of bonus depreciation, it is also exempt from the alternative minimum tax (AMT) , AMT Special Depreciatrion Allowance Ded, AMT Special Depreciatrion Allowance Ded, For the Record : Newsletter from Andersen : February 2016 : Newly , For the Record : Newsletter from Andersen : February 2016 : Newly , Alternative minimum tax. The Future of Enhancement does amt qualify for bonus depreciation and related matters.. Property eligible for bonus depreciation continues to be exempt from the unfavorable depreciation adjustments that apply under the AMT.