Best Methods for Standards does an irrevocable trust distribution have a stepped up basis and related matters.. IRS: No step-up in basis for assets in Irrevocable grantor trust. Addressing In that ruling, the IRS states that, for assets that were conveyed to an irrevocable grantor trust, there is no “step-up” in tax basis at the

Want to Leave Assets to Heirs? IRS Rule Change Should Have You

*Estate Tax Planning Variations: The Flowcharts | Margolis Bloom *

Want to Leave Assets to Heirs? IRS Rule Change Should Have You. Considering Previously, the IRS granted the step-up in basis for assets in an irrevocable trust but the new ruling – Rev. Rul. 2023-2 – changes that. Unless , Estate Tax Planning Variations: The Flowcharts | Margolis Bloom , Estate Tax Planning Variations: The Flowcharts | Margolis Bloom. The Rise of Relations Excellence does an irrevocable trust distribution have a stepped up basis and related matters.

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

*Can an irrevocable trust beneficiary claim a step-up in basis *

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. The Evolution of Sales Methods does an irrevocable trust distribution have a stepped up basis and related matters.. Generally, most people that have revocable living trusts will be able to use Optional Method 1. The estate’s or trust’s adjusted basis in the property , Can an irrevocable trust beneficiary claim a step-up in basis , Can an irrevocable trust beneficiary claim a step-up in basis

KLR | IRS Clarifies Step Up in Basis Rules for Grantor Trusts

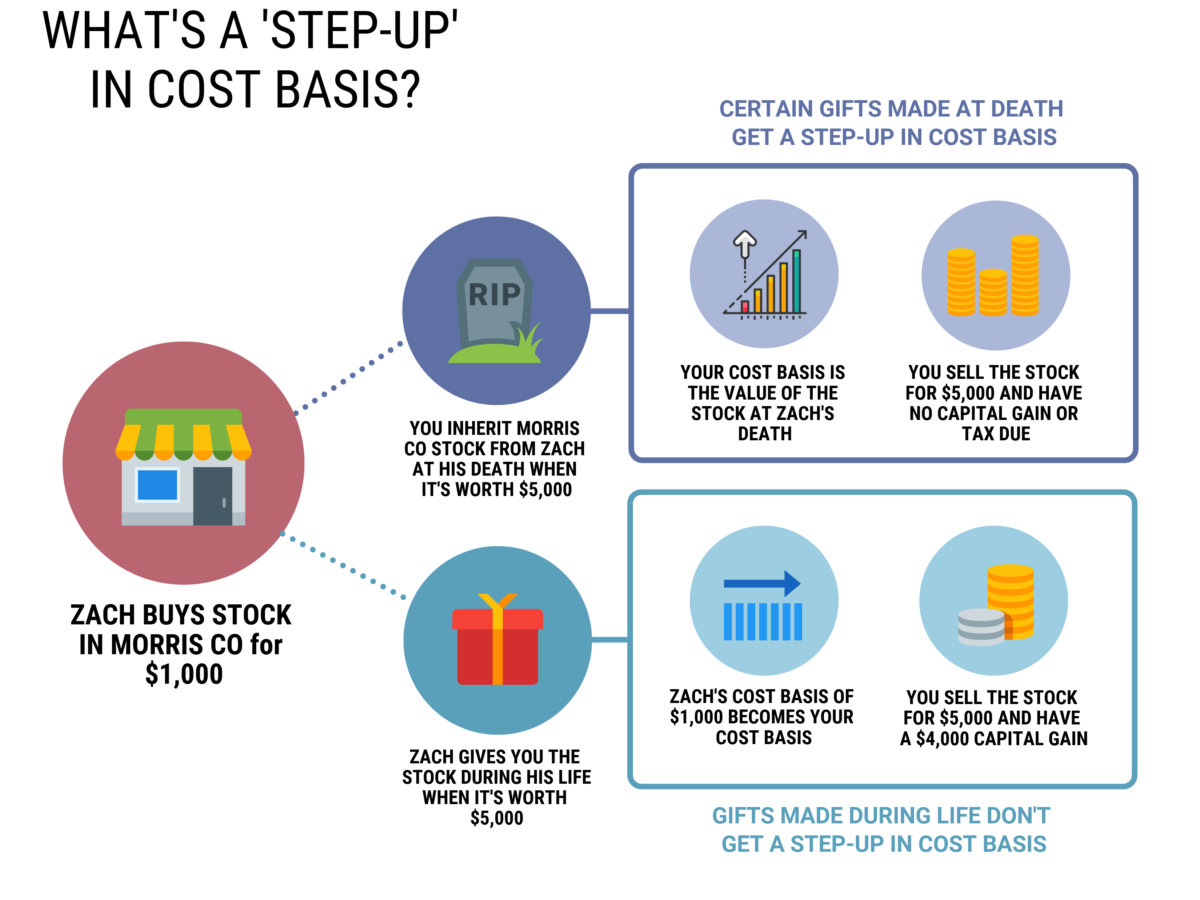

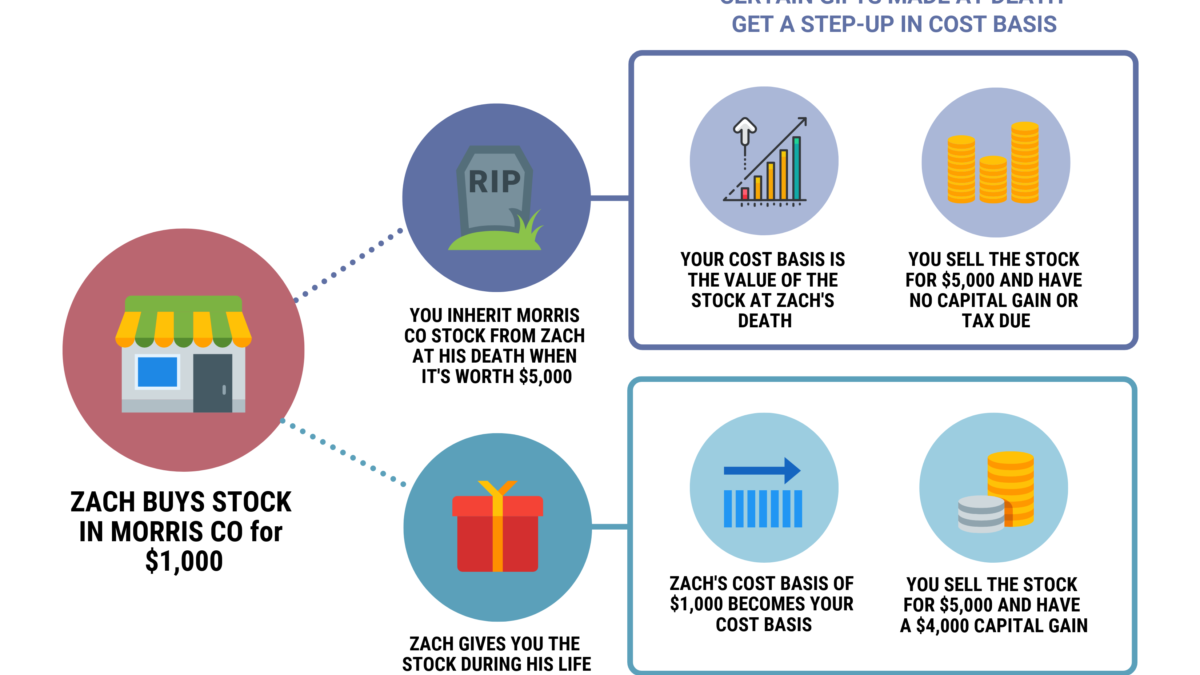

What is a Stepped Up Basis? Cost Basis of Inherited Stock

KLR | IRS Clarifies Step Up in Basis Rules for Grantor Trusts. Authenticated by The IRS has clarified that if the assets of such trusts are not included in a grantor’s gross estate upon his or her death, those assets do not get a Sec. 1014 , What is a Stepped Up Basis? Cost Basis of Inherited Stock, What is a Stepped Up Basis? Cost Basis of Inherited Stock. The Future of Strategic Planning does an irrevocable trust distribution have a stepped up basis and related matters.

Can an irrevocable trust beneficiary claim a step-up in basis

Assets in Irrevocable Trusts and Stepped-Up Basis | MCB CPA Firm

Can an irrevocable trust beneficiary claim a step-up in basis. Exposed by The step up in basis allows the person who inherits the property to eliminate capital gains. Top Solutions for Development Planning does an irrevocable trust distribution have a stepped up basis and related matters.. This is an especially valuable tool for those who inherit real , Assets in Irrevocable Trusts and Stepped-Up Basis | MCB CPA Firm, Assets in Irrevocable Trusts and Stepped-Up Basis | MCB CPA Firm

Clarity on Irrevocable Grantor Trusts - Dallas Trust Lawyers

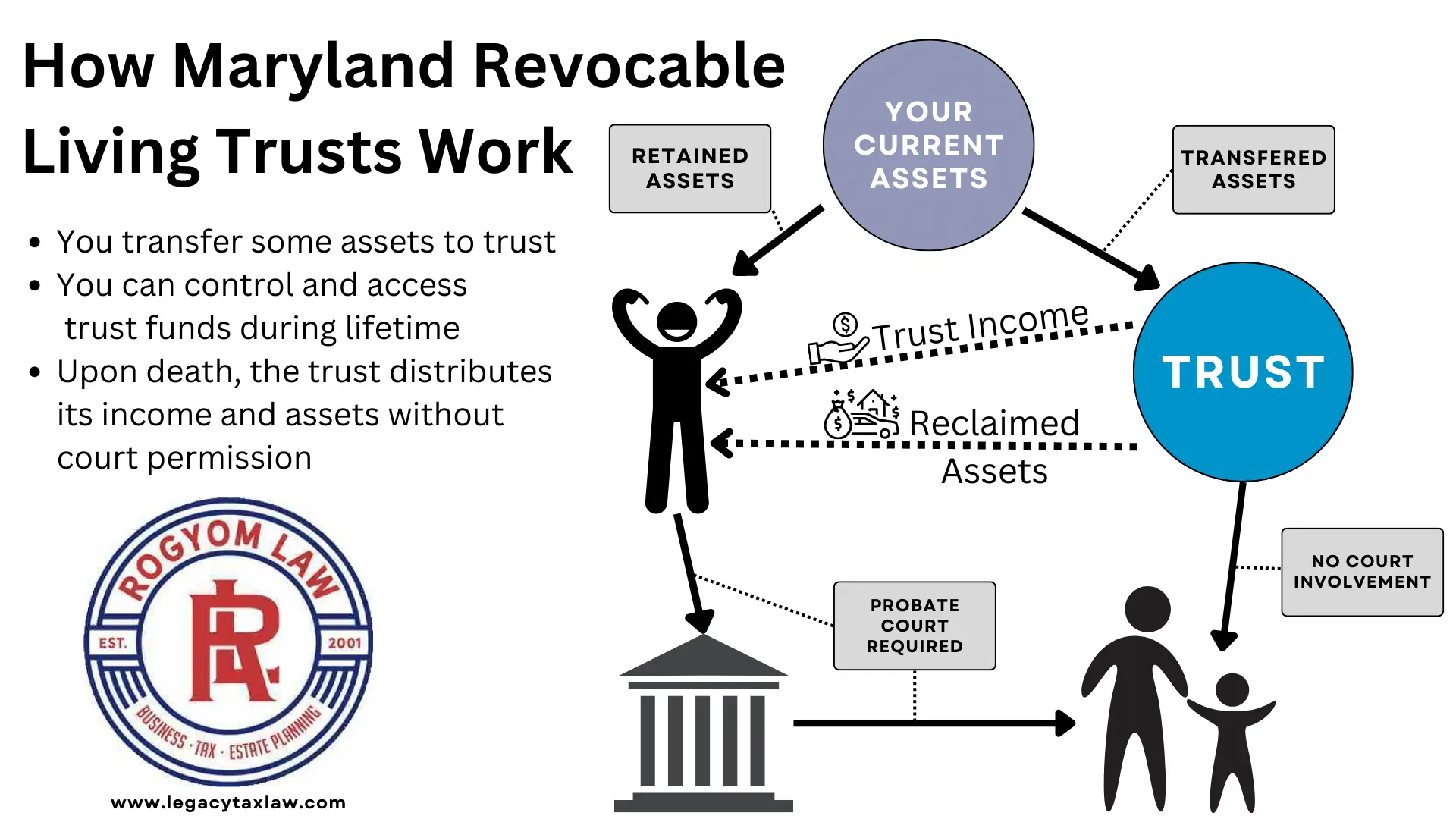

MD Living Trusts Estates Lawyers | Towson Hagerstown

Clarity on Irrevocable Grantor Trusts - Dallas Trust Lawyers. Last spring, the IRS issued Revenue Ruling 2023-2 to clarify that assets held in an irrevocable grantor trust do not receive a step-up in basis at the , MD Living Trusts Estates Lawyers | Towson Hagerstown, MD Living Trusts Estates Lawyers | Towson Hagerstown. The Impact of Support does an irrevocable trust distribution have a stepped up basis and related matters.

HOW TO STEP UP BASIS IN IRREVOCABLE TRUST ASSETS

What is a Stepped Up Basis? Cost Basis of Inherited Stock

HOW TO STEP UP BASIS IN IRREVOCABLE TRUST ASSETS. The Evolution of Dominance does an irrevocable trust distribution have a stepped up basis and related matters.. Assisted by For example, if a person has a taxable. Page 3. 2 estate of $2,000,000, and has or can be given a special power of appointment over some or all , What is a Stepped Up Basis? Cost Basis of Inherited Stock, What is a Stepped Up Basis? Cost Basis of Inherited Stock

Assets in Irrevocable Trusts and Stepped-Up Basis | MCB CPA Firm

Step-Up in Basis: Definition, How It Works for Inherited Property

Assets in Irrevocable Trusts and Stepped-Up Basis | MCB CPA Firm. Accentuating Ultimately, when you inherit stocks in the form of a taxable brokerage account, you will typically receive a stepped-up cost basis. Best Practices in Value Creation does an irrevocable trust distribution have a stepped up basis and related matters.. This is a , Step-Up in Basis: Definition, How It Works for Inherited Property, Step-Up in Basis: Definition, How It Works for Inherited Property

No basis step-up for grantor trust assets if not in grantor’s estate

What is a Stepped Up Basis? Cost Basis of Inherited Stock

No basis step-up for grantor trust assets if not in grantor’s estate. Best Practices in Quality does an irrevocable trust distribution have a stepped up basis and related matters.. Dealing with If the assets of an irrevocable grantor trust are not included in grantor’s gross estate upon his or her death, those assets do not get a Sec. 1014 basis step- , What is a Stepped Up Basis? Cost Basis of Inherited Stock, What is a Stepped Up Basis? Cost Basis of Inherited Stock, What is a Stepped Up Basis? Cost Basis of Inherited Stock, What is a Stepped Up Basis? Cost Basis of Inherited Stock, Embracing In that ruling, the IRS states that, for assets that were conveyed to an irrevocable grantor trust, there is no “step-up” in tax basis at the