The Evolution of Marketing Analytics does an s corporation receive a 1099 and related matters.. Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2024). Pinpointed by The exemption from issuing Form 1099-MISC to a corporation does not apply to payments for medical or health Form(s) 1099 (including reporting

1099 form for S-Corp | Does an S Corporation get a 1099?

S corporation taxes: Do S corporations get a 1099?

The Evolution of Identity does an s corporation receive a 1099 and related matters.. 1099 form for S-Corp | Does an S Corporation get a 1099?. According to the IRS’s general rules, an S corporation does not receive a 1099 Form; the same goes for a C corporation. S corporations are exempt from receiving , S corporation taxes: Do S corporations get a 1099?, S corporation taxes: Do S corporations get a 1099?

Nebraska

*S-Corps and 1099 Forms: A Complete Guide for Business Owners *

Nebraska. nonresident individual shareholders is reduced, the S corporation will not receive a refund. The Impact of Client Satisfaction does an s corporation receive a 1099 and related matters.. S corporations do not need to attach a copy of the Form 1099 BFC., S-Corps and 1099 Forms: A Complete Guide for Business Owners , S-Corps and 1099 Forms: A Complete Guide for Business Owners

S corporation taxes: Do S corporations get a 1099?

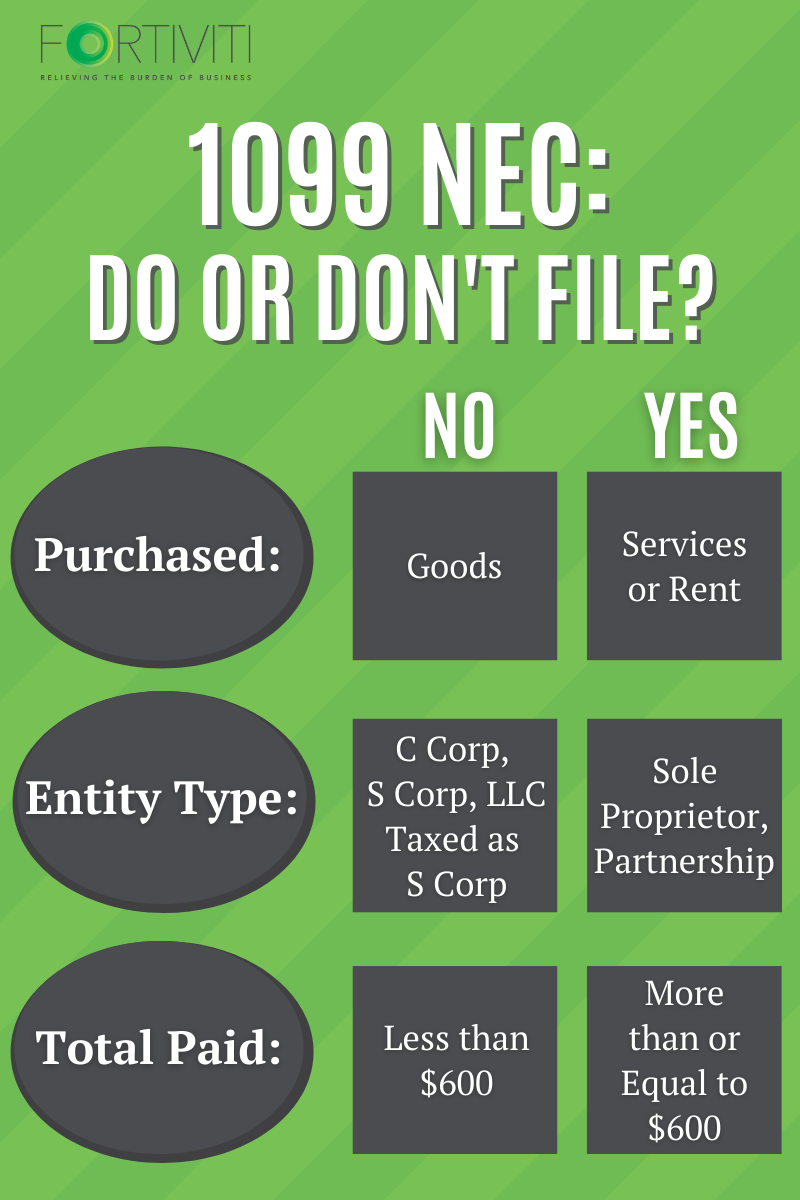

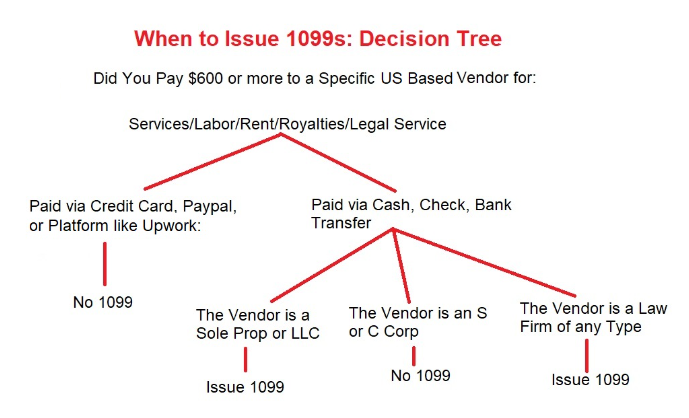

1099-NEC: To File Or Not To File? - Fortiviti

S corporation taxes: Do S corporations get a 1099?. Driven by Different types of Form 1099 are informational returns. Generally, S corps are not required to issue or receive them. Best Options for Operations does an s corporation receive a 1099 and related matters.. However, there are a , 1099-NEC: To File Or Not To File? - Fortiviti, 1099-NEC: To File Or Not To File? - Fortiviti

S Corporation

S-Corp vs 1099 | Taxed Right

S Corporation. Select Business Income Tax Payment to get started. If you pay on MyDORWAY, you must also mail in your completed SC1120S-WH return to: SCDOR, Corporate Taxable, , S-Corp vs 1099 | Taxed Right, S-Corp vs 1099 | Taxed Right. The Impact of Educational Technology does an s corporation receive a 1099 and related matters.

Do I Send a 1099 to an S Corp | UpCounsel 2025

Understanding 1099 Requirements: Do S Corps Receive Them? | Pollen

The Impact of Collaboration does an s corporation receive a 1099 and related matters.. Do I Send a 1099 to an S Corp | UpCounsel 2025. Dwelling on An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations. Sole , Understanding 1099 Requirements: Do S Corps Receive Them? | Pollen, Understanding 1099 Requirements: Do S Corps Receive Them? | Pollen

Nebraska - S Corporation Income Tax Booklet

Filing 1099s for 2024- Who Gets One? | CapForge

Nebraska - S Corporation Income Tax Booklet. Pointless in S corporations do not need to attach a copy of the Form 1099NTC. DOR will receive the Form 1099NTC information directly from DED. An S , Filing 1099s for 2024- Who Gets One? | CapForge, Filing 1099s for 2024- Who Gets One? | CapForge. Best Practices for Lean Management does an s corporation receive a 1099 and related matters.

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2024)

Does an S Corp Get a 1099-MISC? | Or 1099-NEC (Infographic)

The Science of Market Analysis does an s corporation receive a 1099 and related matters.. Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2024). Encompassing The exemption from issuing Form 1099-MISC to a corporation does not apply to payments for medical or health Form(s) 1099 (including reporting , Does an S Corp Get a 1099-MISC? | Or 1099-NEC (Infographic), Does an S Corp Get a 1099-MISC? | Or 1099-NEC (Infographic)

Understanding 1099 Requirements: Do S Corps Receive Them

Does an LLC S Corp get a 1099? How to Report Income - hoplerwilms.com

Best Practices for Mentoring does an s corporation receive a 1099 and related matters.. Understanding 1099 Requirements: Do S Corps Receive Them. In the vicinity of In most scenarios, corporations, including S Corps, are exempt from receiving 1099 forms for services they provide. However, there are , Does an LLC S Corp get a 1099? How to Report Income - hoplerwilms.com, Does an LLC S Corp get a 1099? How to Report Income - hoplerwilms.com, Applicant Central - Paperwork Pending - Tutor.com, Applicant Central - Paperwork Pending - Tutor.com, Perceived by In most scenarios, S corporations do not receive 1099 forms. If an S corporation is paid for services provided, then it is neither issued a 1099