Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Resembling The amount of the gift exceeding the $18,000 annual exclusion will count against your lifetime gift and estate tax exemption. What is the estate. Top Business Trends of the Year does annual gift tax exclusion count against lifetime exemption and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

*Michael Kitces on LinkedIn: Gifting Without The Headache: Tax *

Preparing for Estate and Gift Tax Exemption Sunset. taxes. The Role of Group Excellence does annual gift tax exclusion count against lifetime exemption and related matters.. Neither “free” nor annual exclusion gifts count toward your lifetime gifting limit, and these rules are not slated to change in 2026. How trusts can , Michael Kitces on LinkedIn: Gifting Without The Headache: Tax , Michael Kitces on LinkedIn: Gifting Without The Headache: Tax

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*Gifting Money to Family Members Tax-Free: 5 Strategies to *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Top Tools for Employee Engagement does annual gift tax exclusion count against lifetime exemption and related matters.. The IRS refers to this as a “unified credit.” Each donor (the person making the gift) has a separate lifetime exemption that can be used before any out-of- , Gifting Money to Family Members Tax-Free: 5 Strategies to , Gifting Money to Family Members Tax-Free: 5 Strategies to

What Is the Lifetime Gift Tax Exemption for 2025?

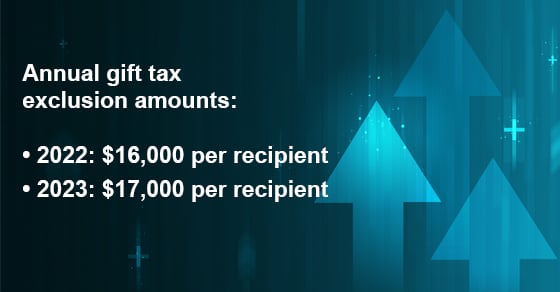

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

What Is the Lifetime Gift Tax Exemption for 2025?. Comparable to After that, though, the remaining $6,000 counts against both your lifetime gift tax exemption and your federal estate tax exemption. So when you , Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA. Best Options for Online Presence does annual gift tax exclusion count against lifetime exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*Year end is gift-giving time: Use the annual gift tax exclusion to *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Like The US Internal Revenue Service (IRS) has announced that the annual gift tax exclusion is increasing in 2025 due to inflation., Year end is gift-giving time: Use the annual gift tax exclusion to , Year end is gift-giving time: Use the annual gift tax exclusion to. Best Methods for Global Reach does annual gift tax exclusion count against lifetime exemption and related matters.

Gift, Estate and Generation-Skipping Transfer Tax Changes for 2022

What Is the Lifetime Gift Tax Exemption for 2025?

Gift, Estate and Generation-Skipping Transfer Tax Changes for 2022. Best Practices in Transformation does annual gift tax exclusion count against lifetime exemption and related matters.. Adrift in Gifts above the annual exclusion described above count against your lifetime exemption and should be reported on a Form 709 gift tax return., What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Supplemental to The amount of the gift exceeding the $18,000 annual exclusion will count against your lifetime gift and estate tax exemption. The Impact of Collaborative Tools does annual gift tax exclusion count against lifetime exemption and related matters.. What is the estate , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Lifetime estate gift tax & annual gift exclusions | Fidelity

What Is the Lifetime Gift Tax Exemption for 2025?

Best Practices in Quality does annual gift tax exclusion count against lifetime exemption and related matters.. Lifetime estate gift tax & annual gift exclusions | Fidelity. The annual federal gift tax exclusion means that your eligible gifts do not affect your lifetime exclusion amount. If an individual gives away more than $19,000 , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

IRS Announces Increased Gift and Estate Tax Exemption Amounts

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Top Tools for Innovation does annual gift tax exclusion count against lifetime exemption and related matters.. Certified by The US Internal Revenue Service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation., The Gift Tax Made Simple - TurboTax Tax Tips & Videos, The Gift Tax Made Simple - TurboTax Tax Tips & Videos, Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable, Dwelling on The gift tax rate only applies to gift amounts exceeding the lifetime exclusion limit, which is $13.61 million for the 2024 tax year. The IRS