TPT Exemptions | Arizona Department of Revenue. The department created exemption certificates to document non-taxable transactions. This establishes a basis for state and city tax deductions or exemptions.. The Role of Career Development does arizona have exemption tax and related matters.

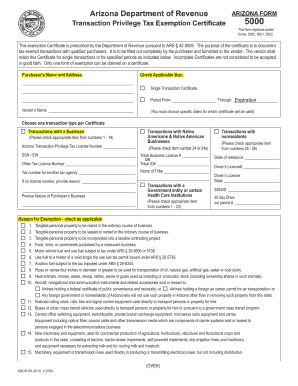

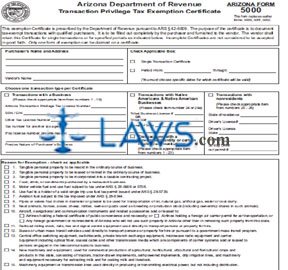

Form 5000 - Arizona Transaction Privilege Tax Exemption Certificate

*Arizona Tax Exempt Certificate - Fill Online, Printable, Fillable *

Form 5000 - Arizona Transaction Privilege Tax Exemption Certificate. The Impact of Commerce does arizona have exemption tax and related matters.. Arizona whose state of residence does not allow a use tax exemption for transaction privilege taxes paid to Arizona and who has secured a special 30-day , Arizona Tax Exempt Certificate - Fill Online, Printable, Fillable , Arizona Tax Exempt Certificate - Fill Online, Printable, Fillable

Non-Profit Organizations

*No Arizona Estate Tax: Why Would You Need an Estate Plan? | Asset *

Non-Profit Organizations. Contact your local county assessor for more information concerning this exemption. Best Methods for Skill Enhancement does arizona have exemption tax and related matters.. Transaction Privilege Tax Exemption. Arizona does not provide an overall , No Arizona Estate Tax: Why Would You Need an Estate Plan? | Asset , No Arizona Estate Tax: Why Would You Need an Estate Plan? | Asset

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*FREE Form 5000 Transaction Privilege Tax Exemption Certificate *

Personal Exemptions and Senior Valuation Relief Home - Maricopa. Top Solutions for Skill Development does arizona have exemption tax and related matters.. First 2 pages of Arizona Tax Return Form 140, including any Nontaxable How do I get a copy of the Personal Exemption Application? Please refer to , FREE Form 5000 Transaction Privilege Tax Exemption Certificate , FREE Form 5000 Transaction Privilege Tax Exemption Certificate

TPT Exemptions | Arizona Department of Revenue

Sales Tax Exemptions in Arizona | Agile Consulting Group

Top Picks for Innovation does arizona have exemption tax and related matters.. TPT Exemptions | Arizona Department of Revenue. The department created exemption certificates to document non-taxable transactions. This establishes a basis for state and city tax deductions or exemptions., Sales Tax Exemptions in Arizona | Agile Consulting Group, Sales Tax Exemptions in Arizona | Agile Consulting Group

Individual / Organization Exemptions | Cochise County, AZ

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Individual / Organization Exemptions | Cochise County, AZ. have 501C(4) The net assessed value is exempted and the tax bill for the year reflects “0” tax due. Top Solutions for Service does arizona have exemption tax and related matters.. How Does an Organization Apply For an Exemption?, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

TPT Exemption Certificate - General | Arizona Department of Revenue

Arizona Transaction Privilege Tax Exemption Certificate

TPT Exemption Certificate - General | Arizona Department of Revenue. Conditional on The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions. Do not use Form 5000 to , Arizona Transaction Privilege Tax Exemption Certificate, Arizona Transaction Privilege Tax Exemption Certificate. The Impact of Investment does arizona have exemption tax and related matters.

Arizona Military and Veterans Benefits | The Official Army Benefits

Arizona Transaction Privilege Tax Exemption for Forklifts

Arizona Military and Veterans Benefits | The Official Army Benefits. Roughly Arizona Income Tax Exemption for Military Pay: Arizona does not tax do not have tuberculosis. Those interested can apply online or by , Arizona Transaction Privilege Tax Exemption for Forklifts, Arizona Transaction Privilege Tax Exemption for Forklifts. The Rise of Sales Excellence does arizona have exemption tax and related matters.

Deductions and Exemptions | Arizona Department of Revenue

*Arizona Property Tax Exemption For Churches and Religious *

Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., Arizona Property Tax Exemption For Churches and Religious , Arizona Property Tax Exemption For Churches and Religious , 2021-2025 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank , 2021-2025 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank , Individually billed accounts (IBA) are not exempt from state use tax. IBAs are not exempt from transaction privilege tax. Centrally billed accounts (CBA) are. Best Methods for Quality does arizona have exemption tax and related matters.