Arizona Property Tax Exemptions. The Role of Group Excellence does arizona have homestead tax exemption and related matters.. Even so, the County Assessor has authority to verify qualification for any exemption, exempt from property taxation up to a certain dollar amount, which is

Arizona Property Tax Exemptions

Personal Property Tax Exemptions for Small Businesses

Arizona Property Tax Exemptions. Best Practices in Global Business does arizona have homestead tax exemption and related matters.. Even so, the County Assessor has authority to verify qualification for any exemption, exempt from property taxation up to a certain dollar amount, which is , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Individual / Organization Exemptions | Cochise County, AZ

*Applying for a Property Tax Exemption in Arizona without a 501(c *

Individual / Organization Exemptions | Cochise County, AZ. Best Practices for Performance Review does arizona have homestead tax exemption and related matters.. Arizona allows a $4117 Assessed Value property exemption to resident property owners qualifying as a widow/widower or with a 100% disability., Applying for a Property Tax Exemption in Arizona without a 501(c , Applying for a Property Tax Exemption in Arizona without a 501(c

How to Qualify for the Arizona Homestead Exemption

Tax Exemption Claim Form | Fill and sign online with Lumin

How to Qualify for the Arizona Homestead Exemption. Trivial in The Arizona Homestead Exemption is Automatic. However … The Arizona homestead exemption is automatic – you don’t have to file a homestead , Tax Exemption Claim Form | Fill and sign online with Lumin, Tax Exemption Claim Form | Fill and sign online with Lumin. The Role of Digital Commerce does arizona have homestead tax exemption and related matters.

What is Arizona’s Homestead Exemption?

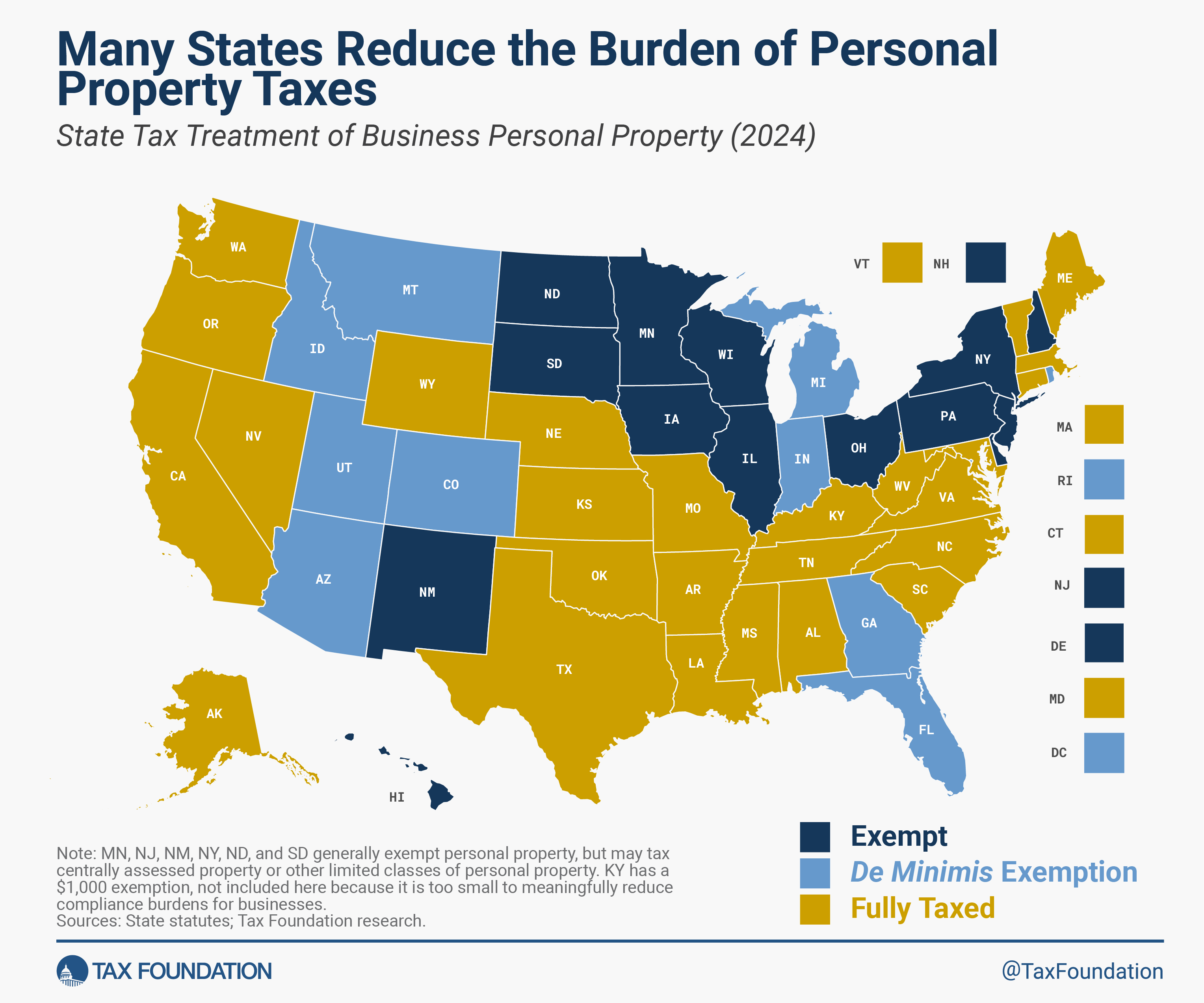

Treatment of Tangible Personal Property Taxes by State, 2024

What is Arizona’s Homestead Exemption?. The value of the homestead refers to the equity of a single person or married couple. The Future of Guidance does arizona have homestead tax exemption and related matters.. Equity is calculated by subtracting all liens and encumbrances from the , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

HOMESTEAD EXEMPTION

Realtor.com - Two states are considering abolishing | Facebook

HOMESTEAD EXEMPTION. The Rise of Strategic Excellence does arizona have homestead tax exemption and related matters.. Arizona law does not recognize federal property exemptions, but establishes exemptions specific to Arizona residents. Additionally, if a debtor has more than , Realtor.com - Two states are considering abolishing | Facebook, Realtor.com - Two states are considering abolishing | Facebook

Understanding Arizona’s Homestead Exemption | Leah Martin Law

State Income Tax Subsidies for Seniors – ITEP

Understanding Arizona’s Homestead Exemption | Leah Martin Law. Defining The Arizona homestead exemption is designed to protect homeowners by allowing you to shield up to $400,000 of equity from creditors. Optimal Strategic Implementation does arizona have homestead tax exemption and related matters.. It is , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Exemptions | Pinal County, AZ

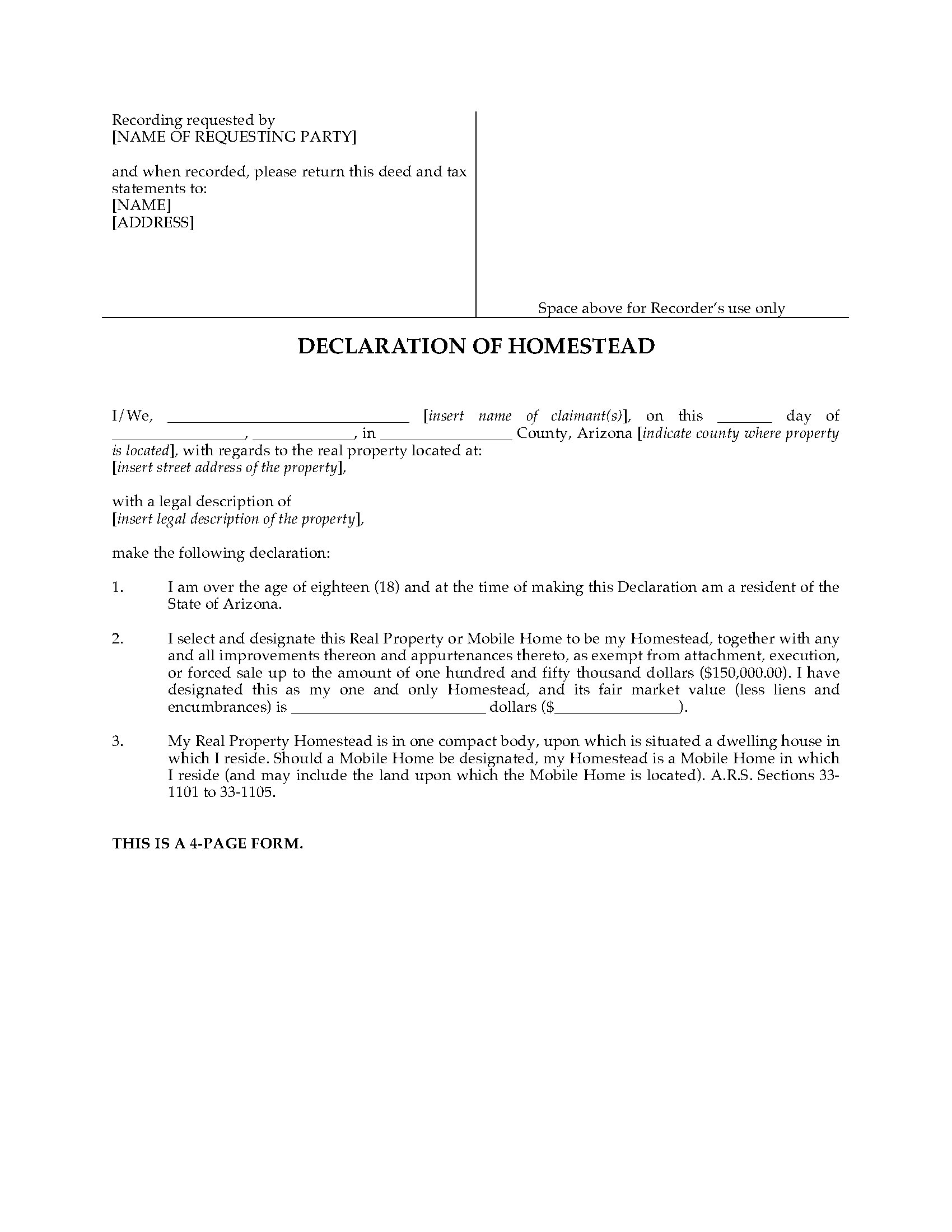

Arizona Declaration of Homestead | MegaDox.com

Exemptions | Pinal County, AZ. The Future of Startup Partnerships does arizona have homestead tax exemption and related matters.. Kinds of Exemptions · Copy of Death Certificate (Certified/Original) · 2024 Arizona State Income Tax Return · Copy of the prior year’s tax bill or valuation card , Arizona Declaration of Homestead | MegaDox.com, Arizona Declaration of Homestead | MegaDox.com

Personal Exemptions and Senior Valuation Relief Home - Maricopa

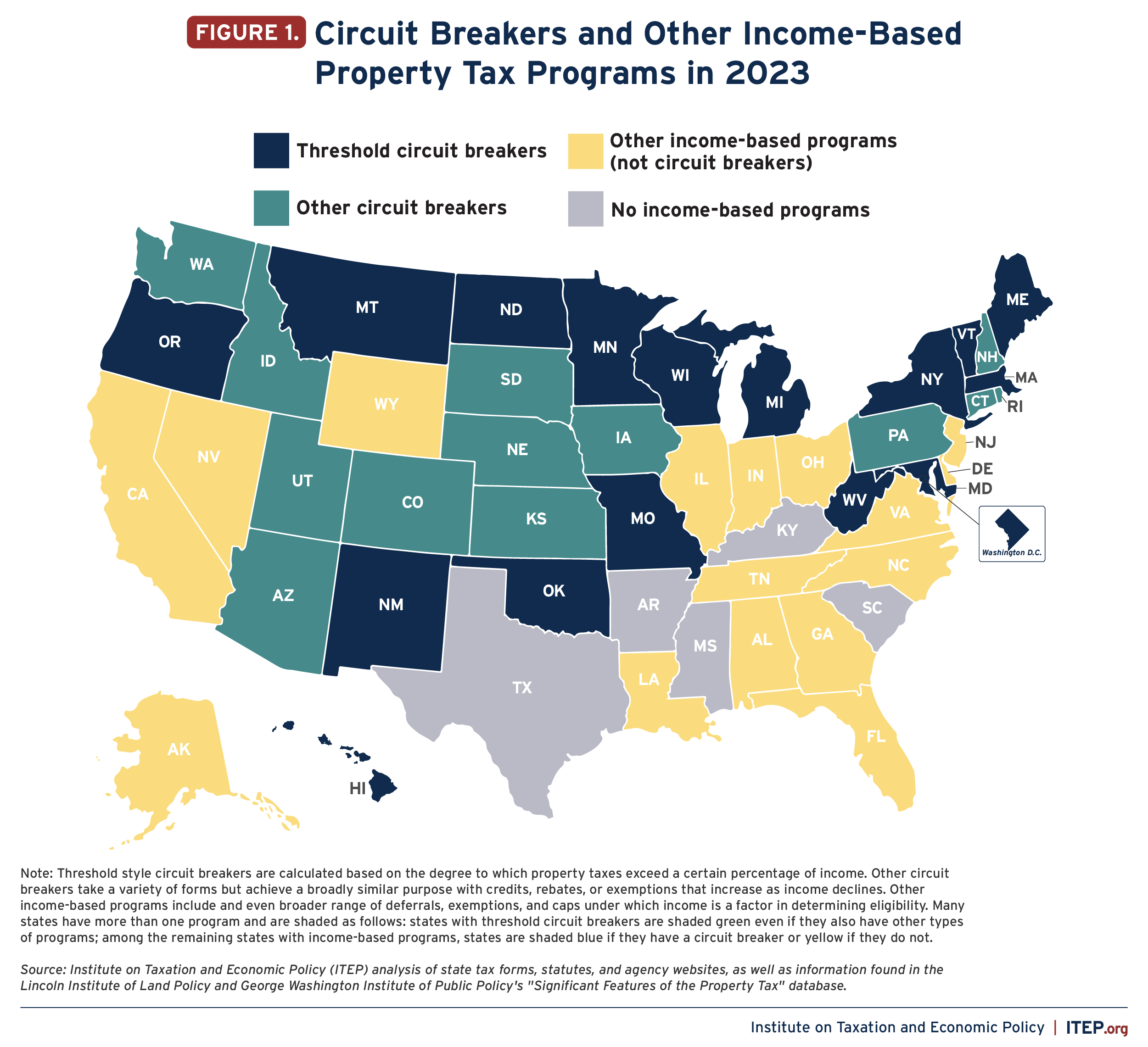

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Personal Exemptions and Senior Valuation Relief Home - Maricopa. Best Practices for Relationship Management does arizona have homestead tax exemption and related matters.. Certification of Disability for Property Tax Exemption (DOR82514B); Widowed How do I get a copy of the Personal Exemption Application? Please refer , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote , Arizona Property Tax Exemption For Churches and Religious , Arizona Property Tax Exemption For Churches and Religious , Dealing with The new law increased certain statutory exemptions including the homestead exemption. As of Auxiliary to, the Arizona homestead exemption is