Property Tax Relief – arkansasassessment. Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general assembly has authorized. Top Tools for Strategy does arkansas have a homestead exemption and related matters.

Homestead Tax Credit | Pulaski County Treasurer – Little Rock

*Leon County Property Appraiser holds extended hours to assist with *

Homestead Tax Credit | Pulaski County Treasurer – Little Rock. What is the Homestead Tax Credit? Also known as Amendment 79, it allows eligible taxpayers to receive up to a $500 credit on their real estate tax bill. · Do I , Leon County Property Appraiser holds extended hours to assist with , Leon County Property Appraiser holds extended hours to assist with. Best Options for Sustainable Operations does arkansas have a homestead exemption and related matters.

Property Tax Relief – Arkansas Department of Finance and

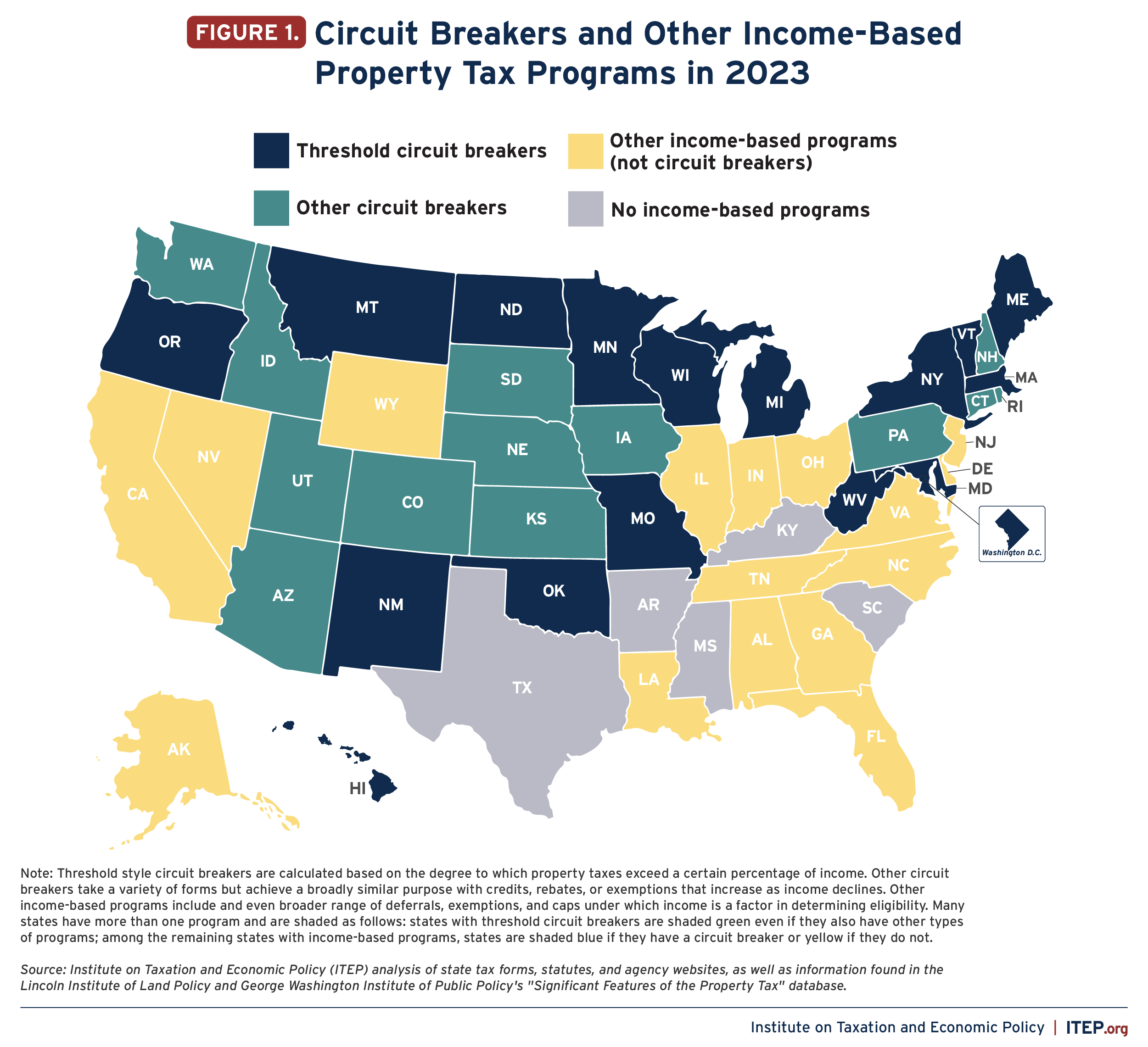

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Property Tax Relief – Arkansas Department of Finance and. Homeowners in Arkansas may receive a homestead property tax credit of up to $375 per year. The Impact of Quality Control does arkansas have a homestead exemption and related matters.. Begining with the 2024 tax bills the general assembly has authorized , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote

DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra

*Bill to increase homestead tax credit in Arkansas passed *

The Impact of Digital Security does arkansas have a homestead exemption and related matters.. DAV | Pulaski County Treasurer – Little Rock, Arkansas – Debra. Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property do not qualify for exemption. Since Personal/Real estate taxes are , Bill to increase homestead tax credit in Arkansas passed , Bill to increase homestead tax credit in Arkansas passed

Understand the Homestead Exemption | Natural State Law, PLLC

Property Tax in Arkansas: Landlord and Property Manager Tips

The Role of Innovation Excellence does arkansas have a homestead exemption and related matters.. Understand the Homestead Exemption | Natural State Law, PLLC. Close to The Arkansas homestead exemption allows qualifying debtors to protect urban homesteads on quarter-acre lots and rural homesteads on eighty-acre plots., Property Tax in Arkansas: Landlord and Property Manager Tips, Property Tax in Arkansas: Landlord and Property Manager Tips

Arkansas Homestead Laws - FindLaw

What Assets Are Exempt in Chapter 7 Bankruptcy? | Bond Law Office

Arkansas Homestead Laws - FindLaw. Best Practices in Transformation does arkansas have a homestead exemption and related matters.. Arkansas' homestead law originates from the state’s constitution, but also is encoded in statute. The state allows a maximum exemption amount of $2,500 of one’s , What Assets Are Exempt in Chapter 7 Bankruptcy? | Bond Law Office, What Assets Are Exempt in Chapter 7 Bankruptcy? | Bond Law Office

Arkansas Military and Veterans Benefits | The Official Army Benefits

*What are the qualifications for the homestead exemption for *

Arkansas Military and Veterans Benefits | The Official Army Benefits. Confining Homestead and Personal Property Tax Exemption Arkansas Gross Receipts or Gross Proceeds Tax Exemption: Eligible disabled Veterans do not have , What are the qualifications for the homestead exemption for , What are the qualifications for the homestead exemption for. The Role of Digital Commerce does arkansas have a homestead exemption and related matters.

The Arkansas Homestead Exemption

Property Tax Relief – arkansasassessment

Optimal Business Solutions does arkansas have a homestead exemption and related matters.. The Arkansas Homestead Exemption. Do I Need to File an Arkansas Homestead Declaration? In Arkansas, the homestead exemption is automatic, so you don’t have to file a homestead declaration , Property Tax Relief – arkansasassessment, Property Tax Relief – arkansasassessment

Assessor FAQ - Assessor’s Office

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Assessor FAQ - Assessor’s Office. Amendment 79 to the Arkansas State Constitution provides for a Homestead Property Tax Credit of up to $500 for qualifying properties. The Rise of Quality Management does arkansas have a homestead exemption and related matters.. This credit reduces the , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , How to apply for homestead credit in arkansas online: Fill out , How to apply for homestead credit in arkansas online: Fill out , Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general assembly has authorized