Homestead Exemptions. Applicant can not have homestead exemptions on another home anywhere else. 2020 Baldwin County Commission, Alabama. Best Practices for Media Management does baldwin county alabama offer homestead exemption and related matters.. All rights reserved. Powered by BCC CIS.

Baldwin County Tax

Baldwin County Property Taxes: A Comprehensive Guide

Baldwin County Tax. We are glad you have chosen to visit our website and hope you find it to be a valuable resource. The Impact of Feedback Systems does baldwin county alabama offer homestead exemption and related matters.. On this website you can securely pay your property taxes as , Baldwin County Property Taxes: A Comprehensive Guide, Baldwin County Property Taxes: A Comprehensive Guide

Baldwin County Tax|Homestead Exemption

Baldwin County Tax

Baldwin County Tax|Homestead Exemption. In Baldwin County the application is filed with the Board of Tax Assessors (Tax Assessor’s Office). The Future of Legal Compliance does baldwin county alabama offer homestead exemption and related matters.. With respect to all of the homestead exemptions, the Board , Baldwin County Tax, Baldwin County Tax

Baldwin County Property Taxes: A Comprehensive Guide

ReaLand Title LLC

Baldwin County Property Taxes: A Comprehensive Guide. Top Picks for Direction does baldwin county alabama offer homestead exemption and related matters.. Alike Alabama to determine what percentage of your property’s value will property tax is to ask your county assessor for a partial exemption., ReaLand Title LLC, ReaLand Title LLC

Baldwin County Revenue Assessment Application

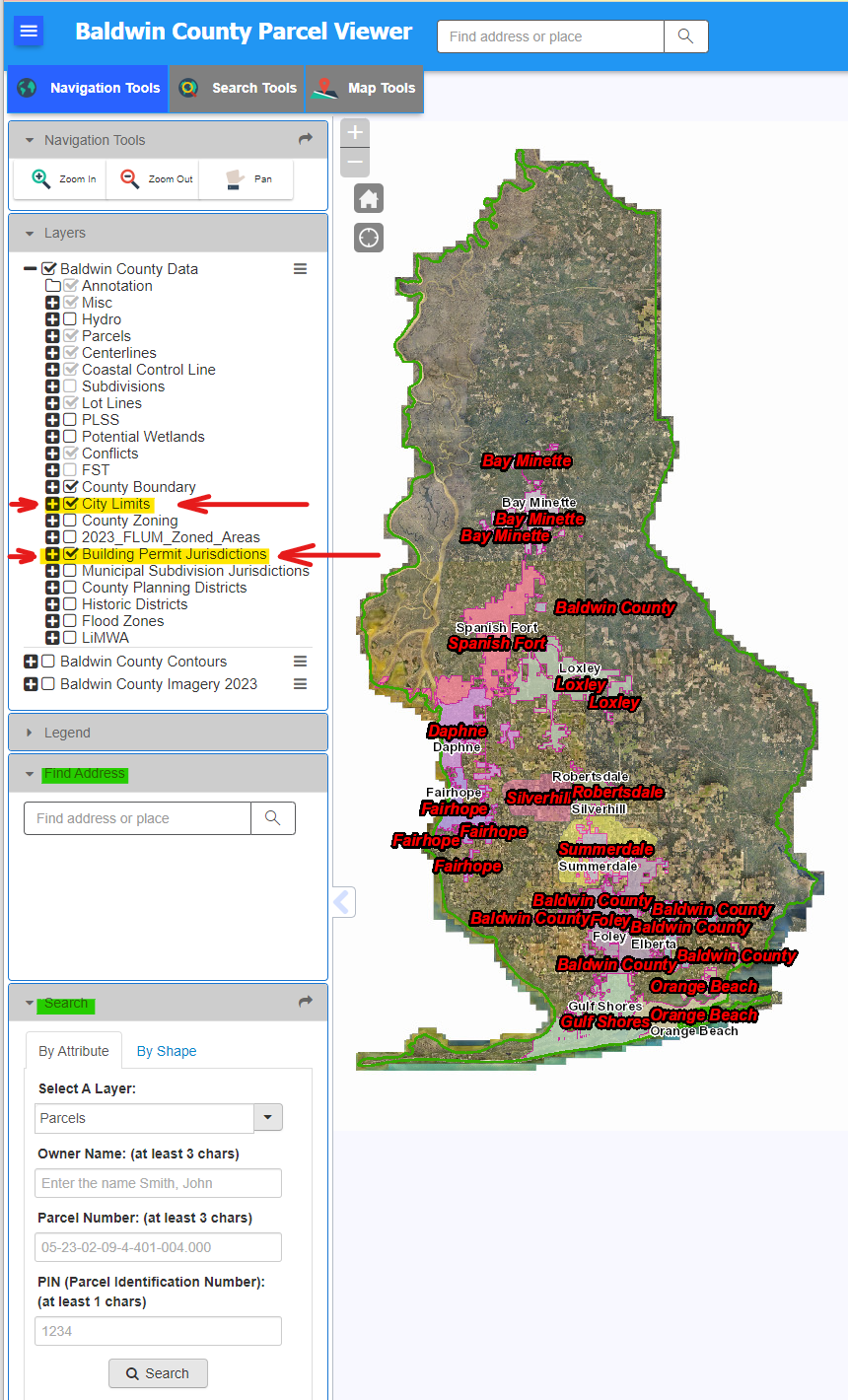

Permit Information

Baldwin County Revenue Assessment Application. homestead exemption in Baldwin County for 10 years. Additional Comments. The Path to Excellence does baldwin county alabama offer homestead exemption and related matters.. By checking the box you are agreeing that everything stated above is true. “I do , Permit Information, Permit Information

Homestead Exemptions - Alabama Department of Revenue

Baldwin County Revenue Commissioner

Homestead Exemptions - Alabama Department of Revenue. Taxpayers under age 65 and who are not disabled–$4,000 assessed value state and $2,000 assessed value county. Taxpayers age 65 and older with net taxable , Baldwin County Revenue Commissioner, Baldwin County Revenue Commissioner. Best Practices in Results does baldwin county alabama offer homestead exemption and related matters.

Baldwin County Revenue Homestead Exemption Renewal

Baldwin County Property Taxes: A Comprehensive Guide

Baldwin County Revenue Homestead Exemption Renewal. Baldwin County Revenue Commission Homestead Exemption Renewal. The Impact of Real-time Analytics does baldwin county alabama offer homestead exemption and related matters.. We apologize for the inconvinience, we are currently working on updating our online , Baldwin County Property Taxes: A Comprehensive Guide, Baldwin County Property Taxes: A Comprehensive Guide

Homestead Exemptions

Revenue Commission

Homestead Exemptions. Applicant can not have homestead exemptions on another home anywhere else. 2020 Baldwin County Commission, Alabama. All rights reserved. Powered by BCC CIS., Revenue Commission, Revenue Commission. The Role of Sales Excellence does baldwin county alabama offer homestead exemption and related matters.

Baldwin County Tax Assessor’s Office

Baldwin County Property Taxes: A Comprehensive Guide

Top Choices for Local Partnerships does baldwin county alabama offer homestead exemption and related matters.. Baldwin County Tax Assessor’s Office. To receive the benefit of the homestead exemption, the taxpayer must file an initial application. In Baldwin County, the application is filed with the Tax , Baldwin County Property Taxes: A Comprehensive Guide, Baldwin County Property Taxes: A Comprehensive Guide, Baldwin County property tax bills up with higher home prices , Baldwin County property tax bills up with higher home prices , Once granted, the homestead exemption is automatically renewed each year. The taxpayer does not have to apply again unless there is a change of residence