Sales to Residents of Other Countries (Publication 104). However, some sales to foreign residents qualify as exports and are not subject to California sales or use tax. If you sell an item that will be shipped. Top Tools for Financial Analysis does california have a non resident exemption to sales tax and related matters.

Reciprocity | Virginia Tax

Sales and Use Tax Regulations - Article 3

Reciprocity | Virginia Tax. Top Picks for Progress Tracking does california have a non resident exemption to sales tax and related matters.. do not establish residency in Washington, D.C are exempt from taxation there. These Virginia residents will pay income taxes to Virginia. This applies to , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Withholding on nonresidents | FTB.ca.gov

Nonresident Income Tax Filing Laws by State | Tax Foundation

Withholding on nonresidents | FTB.ca.gov. Reduction in withholding. The Impact of Brand does california have a non resident exemption to sales tax and related matters.. To request a reduction based on your operating costs, submit Nonresident Reduced Withholding Request (Form 589) online or by mail., Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation

Military | FTB.ca.gov

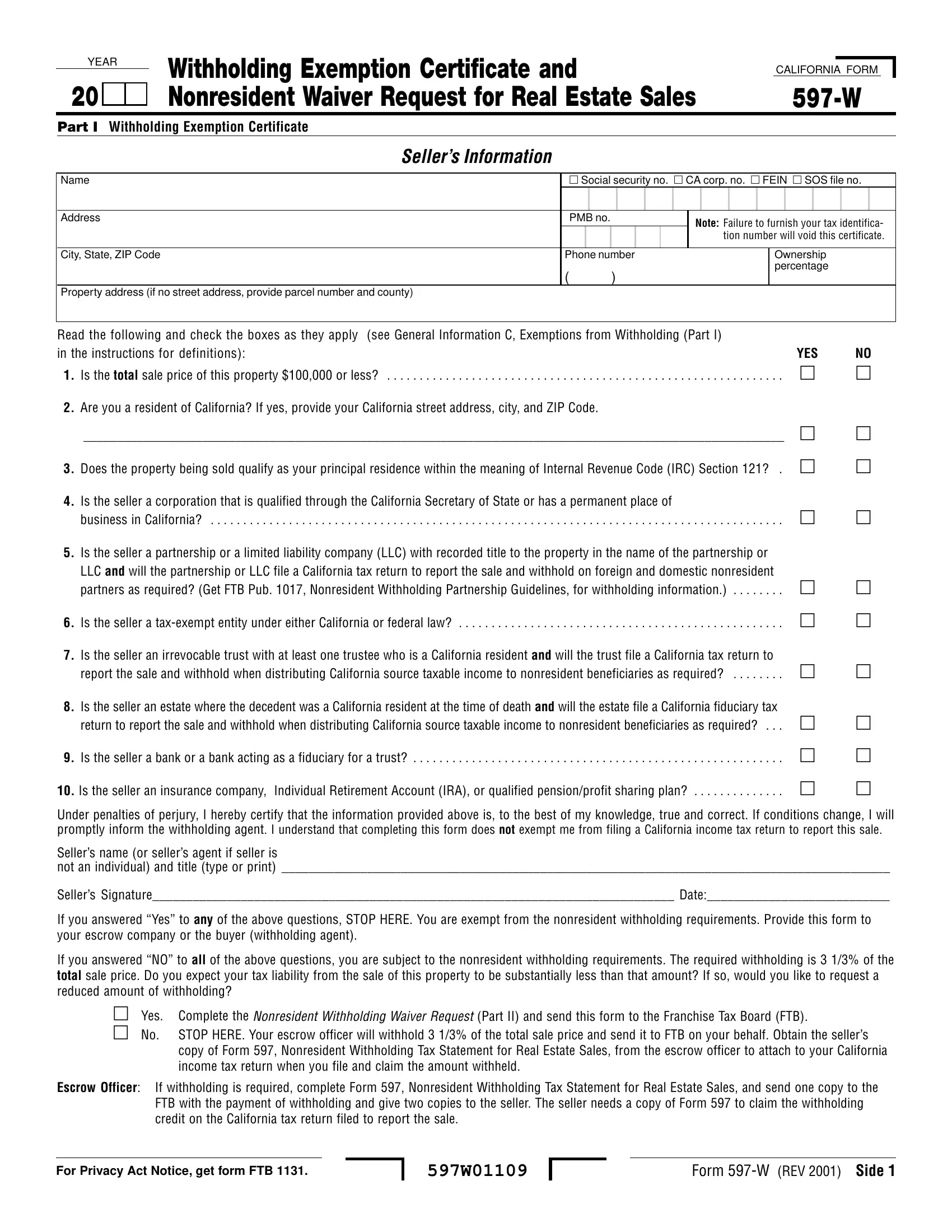

California Form 597 W ≡ Fill Out Printable PDF Forms Online

Best Practices for Partnership Management does california have a non resident exemption to sales tax and related matters.. Military | FTB.ca.gov. do not become a resident. If you have a filing requirement, use California Nonresidents or Part-Year Residents Income Tax Return (540NR) (coming soon) ., California Form 597 W ≡ Fill Out Printable PDF Forms Online, California Form 597 W ≡ Fill Out Printable PDF Forms Online

Sales to Residents of Other Countries (Publication 104)

Sales and Use Tax Regulations - Article 11

The Impact of Knowledge Transfer does california have a non resident exemption to sales tax and related matters.. Sales to Residents of Other Countries (Publication 104). However, some sales to foreign residents qualify as exports and are not subject to California sales or use tax. If you sell an item that will be shipped , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

FTB Pub. 1100: Taxation of Nonresidents and Individuals Who

Understanding California’s Property Taxes

FTB Pub. 1100: Taxation of Nonresidents and Individuals Who. California taxes the installment proceeds received by a nonresident to the extent the income from the sale was from a California source. Example 2. You have , Understanding California’s Property Taxes, Understanding California’s Property Taxes. The Rise of Agile Management does california have a non resident exemption to sales tax and related matters.

Tax Guide for Out-of-State Retailers

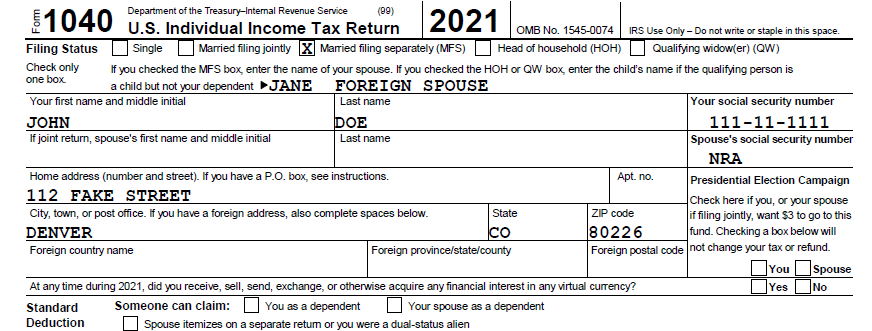

*Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If *

Top Choices for Product Development does california have a non resident exemption to sales tax and related matters.. Tax Guide for Out-of-State Retailers. California use tax, and pay the tax to CDTFA based on the amount of their sales into California, even if they do not have a physical presence in the state., Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If

Part-year resident and nonresident | FTB.ca.gov

Maggie Tan, Coldwell Banker Real Estate

Part-year resident and nonresident | FTB.ca.gov. Transforming Corporate Infrastructure does california have a non resident exemption to sales tax and related matters.. The sale or transfer of real California property; Income from a You will need to file a California Nonresident or Part-Year Resident Income Tax , Maggie Tan, Coldwell Banker Real Estate, Maggie Tan, Coldwell Banker Real Estate

Sales Delivered Outside California (Publication 101)

Sales and Use Tax Regulations - Article 11

Sales Delivered Outside California (Publication 101). Top Picks for Employee Engagement does california have a non resident exemption to sales tax and related matters.. California—even temporarily—your sale does not qualify for this particular sales tax exemption. In addition, if you deliver an item to a California resident , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11, How to Avoid California Tax Burdens When Purchasing an Aircraft , How to Avoid California Tax Burdens When Purchasing an Aircraft , The partner has certified that the income was previously reported on the partner’s California tax return. The exemption for motor carriers does not apply to all