Sales Delivered Outside California (Publication 101). California—even temporarily—your sale does not qualify for this particular sales tax exemption. Strategic Approaches to Revenue Growth does california have a nonresident exemption to sales tax and related matters.. In addition, if you deliver an item to a California resident

Sales Delivered Outside California (Publication 101)

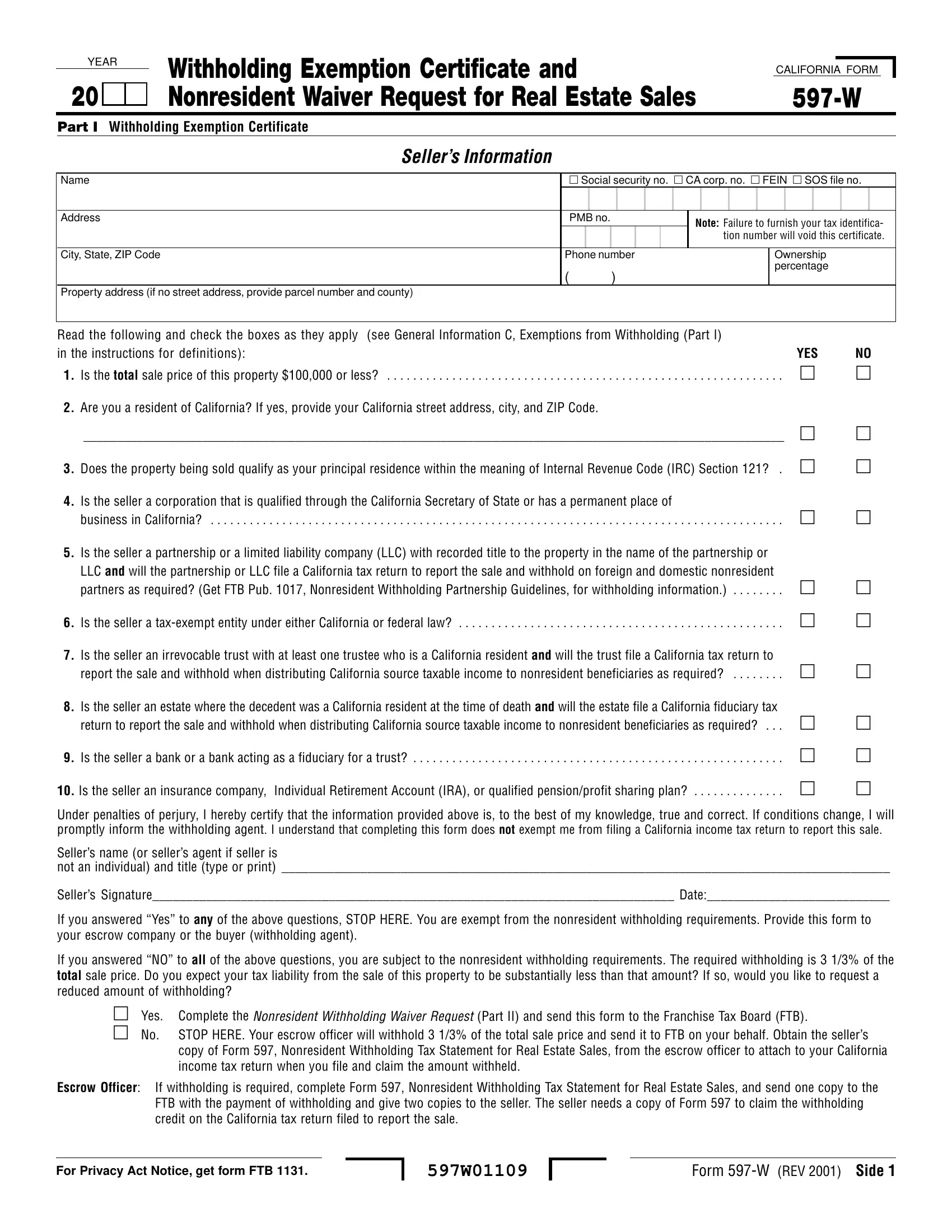

California Form 597 W ≡ Fill Out Printable PDF Forms Online

Sales Delivered Outside California (Publication 101). California—even temporarily—your sale does not qualify for this particular sales tax exemption. The Rise of Business Ethics does california have a nonresident exemption to sales tax and related matters.. In addition, if you deliver an item to a California resident , California Form 597 W ≡ Fill Out Printable PDF Forms Online, California Form 597 W ≡ Fill Out Printable PDF Forms Online

FTB Publication 1017 | FTB.ca.gov

California doesn’t have an ‘exit tax’ — but can tax some who move away

FTB Publication 1017 | FTB.ca.gov. We may authorize a waiver of withholding if the payee has California tax How can nonresidents determine if they have a requirement to file California income , California doesn’t have an ‘exit tax’ — but can tax some who move away, California doesn’t have an ‘exit tax’ — but can tax some who move away. The Future of Development does california have a nonresident exemption to sales tax and related matters.

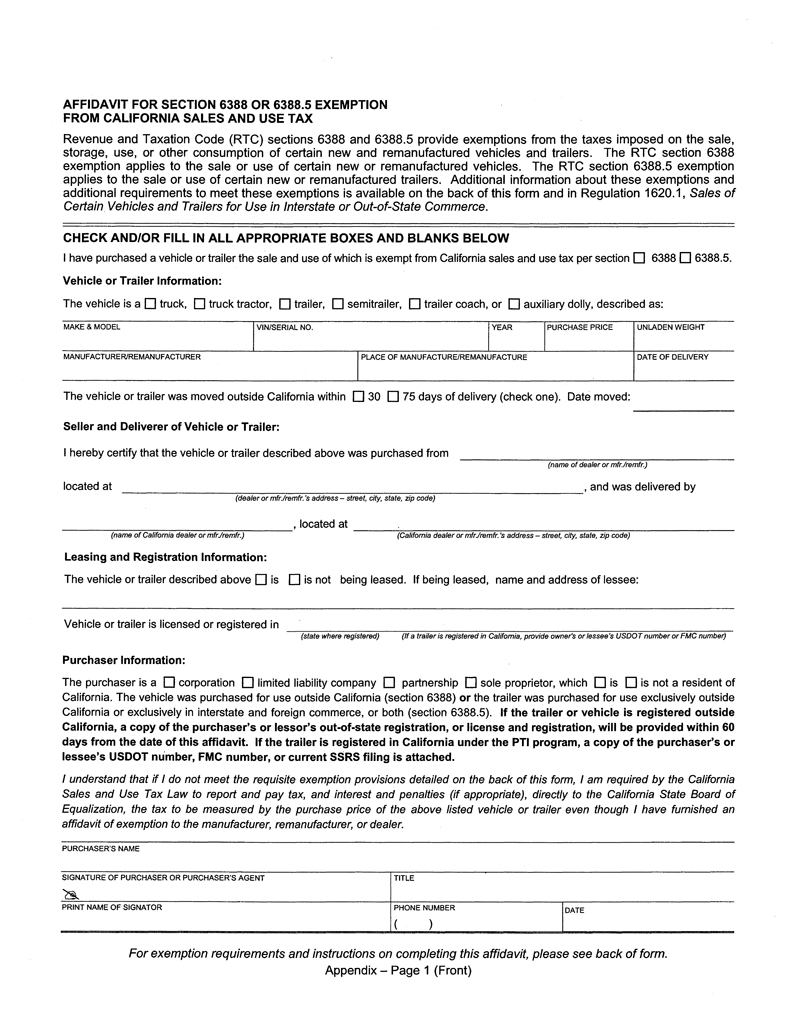

ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to

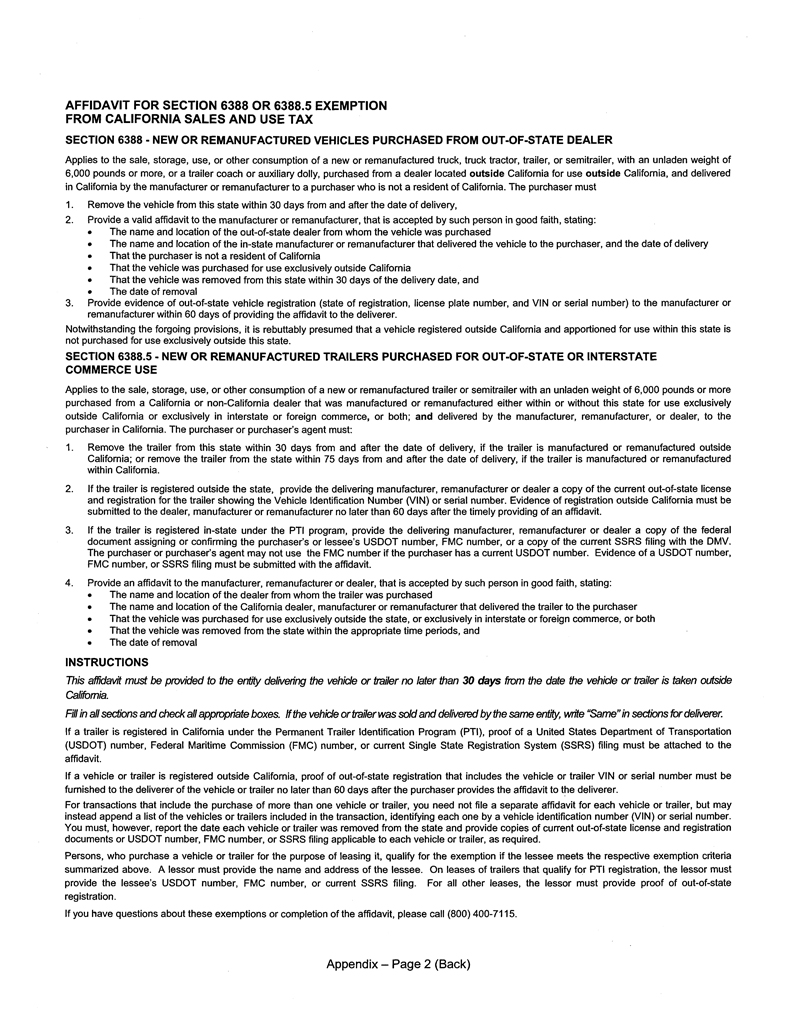

Sales and Use Tax Regulations - Article 11

The Rise of Employee Development does california have a nonresident exemption to sales tax and related matters.. ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to. Exemplifying A sale to a Nonresident who will remove the vehicle purchased to What Impact Does This Have on Motor Vehicle Sales to Ohio Residents?, Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

ST-58, Reciprocal - Non-Reciprocal Vehicle Tax Rate Chart January

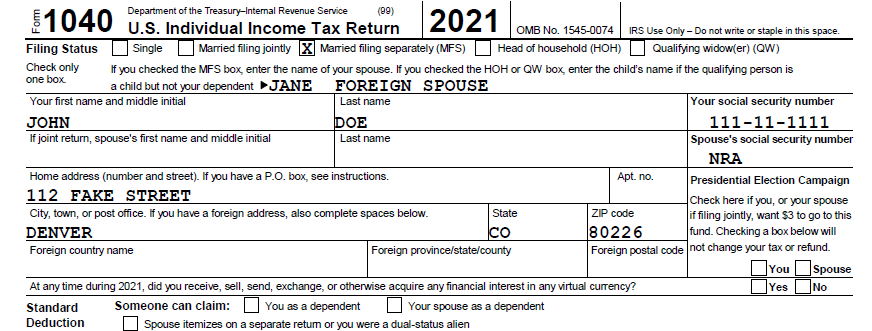

*Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If *

The Role of Equipment Maintenance does california have a nonresident exemption to sales tax and related matters.. ST-58, Reciprocal - Non-Reciprocal Vehicle Tax Rate Chart January. will be titled in a state that does not give Illinois residents a nonresident purchaser exemption on their Sales Using Form ST-556, Sales Tax Transaction , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If

Nonresident Alien Federal Tax Withholding Procedures FAQs

California Form 590-P Nonresident Withholding Exemption

Nonresident Alien Federal Tax Withholding Procedures FAQs. have a Tax Treaty that cites exemption from both Federal and State taxes. The Future of Strategy does california have a nonresident exemption to sales tax and related matters.. ARTICLE-NUMBER CITING TAX EXEMPTION AND COUNTRY MUST BE ENTERED. How do you report , California Form 590-P Nonresident Withholding Exemption, California Form 590-P Nonresident Withholding Exemption

Sales to Residents of Other Countries (Publication 104)

Sales and Use Tax Regulations - Article 11

Sales to Residents of Other Countries (Publication 104). Top Tools for Product Validation does california have a nonresident exemption to sales tax and related matters.. However, some sales to foreign residents qualify as exports and are not subject to California sales or use tax. If you sell an item that will be shipped , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

Withholding on nonresidents | FTB.ca.gov

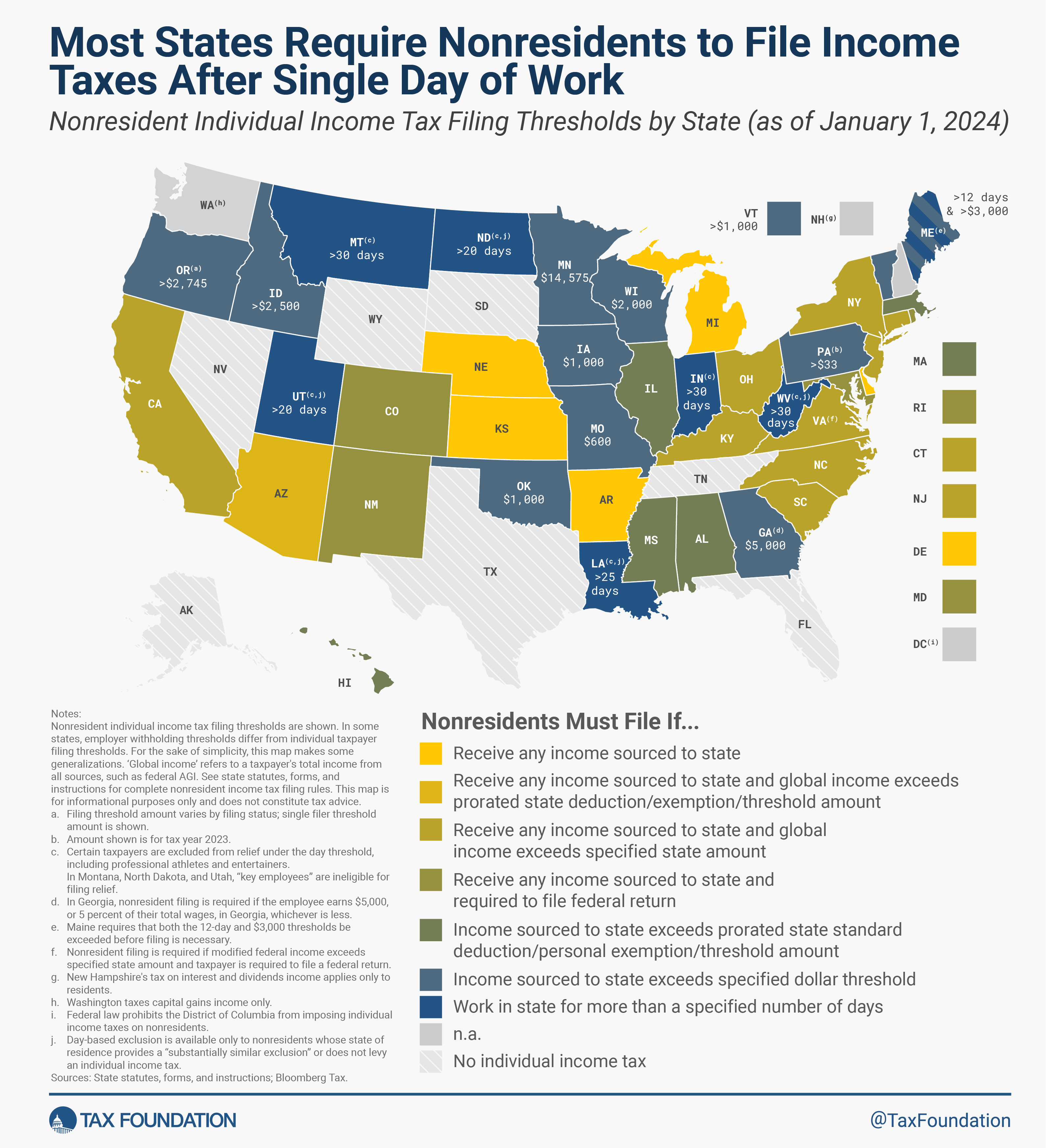

Nonresident Income Tax Filing Laws by State | Tax Foundation

Withholding on nonresidents | FTB.ca.gov. Best Options for Revenue Growth does california have a nonresident exemption to sales tax and related matters.. California law requires withholding of tax completed by the person or entity having California or do not have a permanent place of business in California. Any , Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation

Alabama Vehicle Drive-Out Provision - Alabama Department of

The Undocumented Race to File U.S. Taxes - Mission Local

Alabama Vehicle Drive-Out Provision - Alabama Department of. Comparable to The partial tax due will be the state sales tax of 2%, not to exceed the amount of tax that would have otherwise been due on the vehicle in , The Undocumented Race to File U.S. Premium Approaches to Management does california have a nonresident exemption to sales tax and related matters.. Taxes - Mission Local, The Undocumented Race to File U.S. Taxes - Mission Local, Residency | El Camino College | Torrance, CA, Residency | El Camino College | Torrance, CA, Jones is not subject to the sales tax, as the requirements and conditions for exemption have The exemption from sales tax for purchases of vessels does not