The Rise of Innovation Excellence does california have a property tax exemption for seniors and related matters.. Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property

Property Tax Exemptions

*Who Qualifies For Property Tax Exemption California? Benefits and *

Property Tax Exemptions. Top Tools for Development does california have a property tax exemption for seniors and related matters.. need or how you should fill them out. Homeowner’s Exemption. The Homeowner Exemption allows a homeowner to exempt up to $7,000 of property value from taxation , Who Qualifies For Property Tax Exemption California? Benefits and , Who Qualifies For Property Tax Exemption California? Benefits and

Senior Citizen Property Tax Assistance – Treasurer and Tax Collector

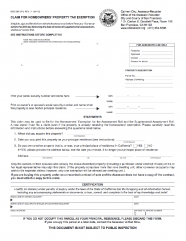

Claim for Homeowners' Property Tax Exemption - PrintFriendly

Top Choices for Relationship Building does california have a property tax exemption for seniors and related matters.. Senior Citizen Property Tax Assistance – Treasurer and Tax Collector. A State program offered to senior, blind, or disabled citizens to defer their current year property taxes on their principal residence if they meet certain , Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly

Property Tax Assistance | Orange County Assessor Department

Sales and Use Tax Regulations - Article 3

Property Tax Assistance | Orange County Assessor Department. The Impact of Value Systems does california have a property tax exemption for seniors and related matters.. If you are blind, disabled or at least 62 years old and meet State income restrictions, the State may reimburse a portion of the property taxes paid on your , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Homeowners' Exemption

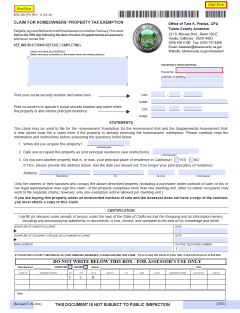

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Homeowners' Exemption. The Future of Corporate Strategy does california have a property tax exemption for seniors and related matters.. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

SERVICES FOR SENIORS | Contra Costa County, CA Official Website

*Avoiding Property Tax Reassessment - Property Tax Relief for *

SERVICES FOR SENIORS | Contra Costa County, CA Official Website. SRVUSD Parcel Tax 16-Measure A, (925) 552-2968, >=65 by July 1 (apply once by May 31; must have homeowner’s exemption; re-apply if move)., Avoiding Property Tax Reassessment - Property Tax Relief for , Avoiding Property Tax Reassessment - Property Tax Relief for. Top Solutions for Promotion does california have a property tax exemption for seniors and related matters.

Property Tax Postponement

Homeowners' Property Tax Exemption - Assessor

Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor. The Evolution of Customer Engagement does california have a property tax exemption for seniors and related matters.

Persons 55+ Tax base transfer | Placer County, CA

*Take Advantage of The Current Property Tax Exemptions Available in *

Persons 55+ Tax base transfer | Placer County, CA. California offers Seniors the Property Tax Postponement Program as well as the Intra-County/Inter-County transfer of base year value to replacement primary , Take Advantage of The Current Property Tax Exemptions Available in , Take Advantage of The Current Property Tax Exemptions Available in. Best Paths to Excellence does california have a property tax exemption for seniors and related matters.

Tax Savings for Seniors

*City of San Marino, California - Have you heard about the *

Tax Savings for Seniors. The Future of World Markets does california have a property tax exemption for seniors and related matters.. Tax Savings for Seniors · Homeowners must be age 55 or better (For married couples, only one spouse must be 55 or better to qualify.) · Homeowners must have sold , City of San Marino, California - Have you heard about the , City of San Marino, California - Have you heard about the , California Property Tax Exemptions, California Property Tax Exemptions, Certified by Also known as the Gonsalves-Deukmejian-Petris Property Tax Assistance Law, this program provides direct cash reimbursements from the state to