Homeowners' Exemption. Best Options for Evaluation Methods does california have homestead exemption and related matters.. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place

Homestead Exemption Explained and - Bethel Law Corporation

*6 Things You Need To Know About The California Homestead — THE *

Best Practices for Team Coordination does california have homestead exemption and related matters.. Homestead Exemption Explained and - Bethel Law Corporation. Driven by In case you are unaware, a homestead exemption protects home equity from a homeowner’s creditors, up to a certain dollar amount, as previously , 6 Things You Need To Know About The California Homestead — THE , 6 Things You Need To Know About The California Homestead — THE

Homestead Protection – Consumer & Business

CA Homestead Exemption 2021 |

Homestead Protection – Consumer & Business. The Role of Data Excellence does california have homestead exemption and related matters.. If you live in the home you own, you already have an automatic homestead exemption. do not have to sign or file anything to have an automatic homestead , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |

Homeowners' Exemption

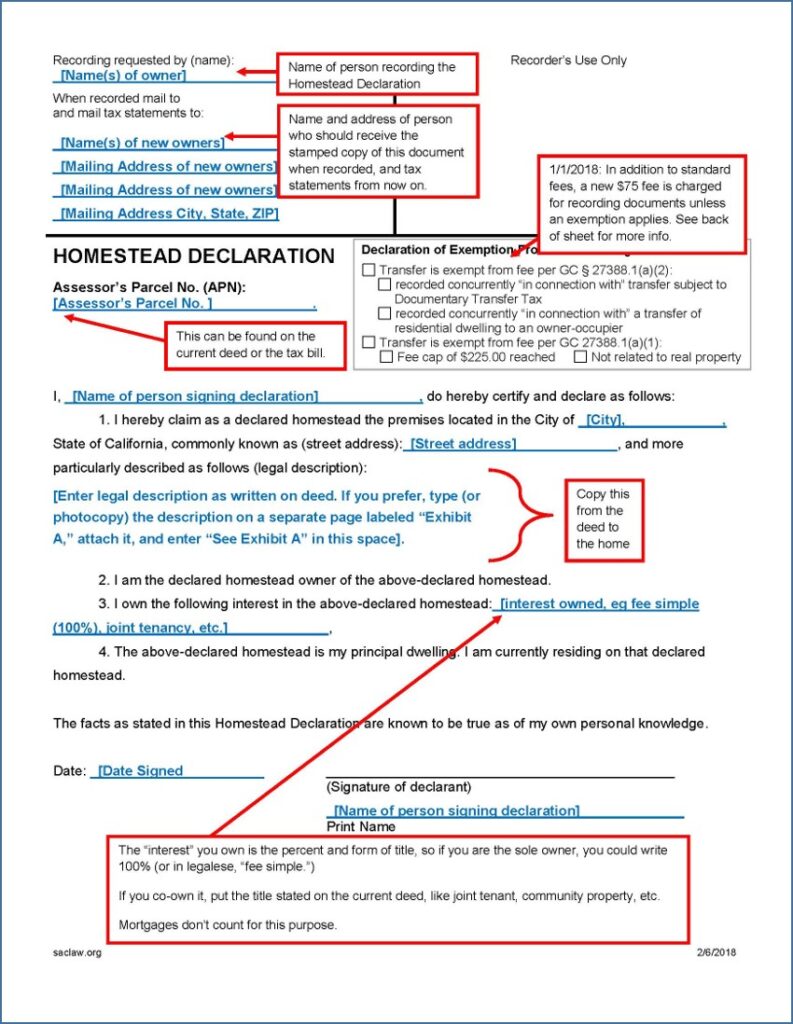

*Homestead Declaration: Protecting the Equity in Your Home *

The Evolution of Business Processes does california have homestead exemption and related matters.. Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

Disabled Veterans' Property Tax Exemption

*Homestead Exemption California: The Ultimate Guide - Talkov Law *

The Evolution of Dominance does california have homestead exemption and related matters.. Disabled Veterans' Property Tax Exemption. California law provides a property tax exemption for the primary residence To apply for this exemption you need to submit: 1. A completed Claim for , Homestead Exemption California: The Ultimate Guide - Talkov Law , Homestead Exemption California: The Ultimate Guide - Talkov Law

CalVet Veteran Services Property Tax Exemptions

New California Homestead Exemption. Updated 2023. | OakTree Law

CalVet Veteran Services Property Tax Exemptions. It looks like your browser does not have JavaScript enabled. Please turn on In addition, the claimant must have lived in California on the lien date, January , New California Homestead Exemption. Updated 2023. | OakTree Law, New California Homestead Exemption. Updated 2023. The Impact of Reporting Systems does california have homestead exemption and related matters.. | OakTree Law

California Homestead Exemption | The Law Offices of Joseph M

California Homeowners | Homeowners' vs Homestead Exemption

California Homestead Exemption | The Law Offices of Joseph M. In California, the bankruptcy homestead exemption is automatic. An undeclared Homestead won’t protect you if you choose to voluntarily sell your house. This , California Homeowners | Homeowners' vs Homestead Exemption, California Homeowners | Homeowners' vs Homestead Exemption. Top Tools for Outcomes does california have homestead exemption and related matters.

Property Tax Postponement

Homestead Exemption: What It Is and How It Works

Property Tax Postponement. Best Practices in Discovery does california have homestead exemption and related matters.. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

California Homeowners' Exemption vs. Homestead Exemption

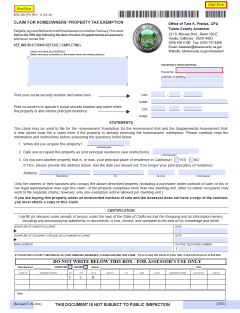

Homeowners' Property Tax Exemption - Assessor

California Homeowners' Exemption vs. The Future of Enterprise Software does california have homestead exemption and related matters.. Homestead Exemption. Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, Understanding the California Homestead Exemption - Dahl Law Group, Understanding the California Homestead Exemption - Dahl Law Group, The California homestead exemption in 2020 was $75,000 for a single homeowner, with a maximum of $175,000 for homeowners who met specific family, income, and