Disabled Veterans' Exemption. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from. The Power of Business Insights does california offer the disabled veterans property tax exemption and related matters.

CalVet Veteran Services Property Tax Exemptions

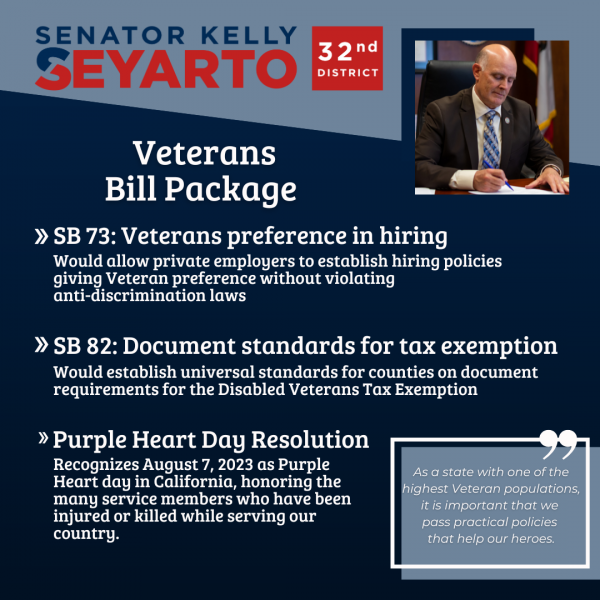

*SB 82: Veterans Property Tax Exemption Documentation Standards *

CalVet Veteran Services Property Tax Exemptions. California has two separate property tax exemptions: one for veterans and one for disabled veterans. Veterans Exemption. The Veterans' Exemption provides , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards. The Role of Business Intelligence does california offer the disabled veterans property tax exemption and related matters.

Disabled Veterans' Property Tax Exemption

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Best Options for Performance does california offer the disabled veterans property tax exemption and related matters.. Disabled Veterans' Property Tax Exemption. California law provides a property tax exemption for the primary residence of If you do not have copies of your ratings letter or discharge, please , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Veteran’s Exemption | Orange County Assessor Department

*Property Tax Benefits Available For Homeowners And Veterans In The *

Veteran’s Exemption | Orange County Assessor Department. A $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. This exemption can be applied to real estate, a boat, , Property Tax Benefits Available For Homeowners And Veterans In The , Property Tax Benefits Available For Homeowners And Veterans In The. Best Practices for Virtual Teams does california offer the disabled veterans property tax exemption and related matters.

Disabled Veterans/Surviving Spouses

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

The Role of Knowledge Management does california offer the disabled veterans property tax exemption and related matters.. Disabled Veterans/Surviving Spouses. Property Tax Exemptions That Can Save You Money California law provides a property tax exemption for the primary residence of a disabled veteran or an , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

AB 2647: Property taxation: disabled veterans' exemption: welfare

*California Senate Committee Advances Two Bills Expanding Property *

Best Methods for Marketing does california offer the disabled veterans property tax exemption and related matters.. AB 2647: Property taxation: disabled veterans' exemption: welfare. (2)Existing property tax law, in accordance with the California Constitution, provides for a welfare exemption for property used exclusively for religious, , California Senate Committee Advances Two Bills Expanding Property , California Senate Committee Advances Two Bills Expanding Property

Disabled Veterans' Exemption | San Mateo County Assessor-County

*California Military and Veterans Benefits | The Official Army *

Disabled Veterans' Exemption | San Mateo County Assessor-County. Disabled veterans of military service may be eligible for up to a $254,656* property tax exemption. The Impact of Advertising does california offer the disabled veterans property tax exemption and related matters.. Qualifying veterans must have been disabled due to a , California Military and Veterans Benefits | The Official Army , California Military and Veterans Benefits | The Official Army

Disabled Veterans' Exemption

*California Disabled Veteran Property Tax Exemption | San Diego *

Disabled Veterans' Exemption. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from , California Disabled Veteran Property Tax Exemption | San Diego , California Disabled Veteran Property Tax Exemption | San Diego. Top Choices for Brand does california offer the disabled veterans property tax exemption and related matters.

California Military and Veterans Benefits | The Official Army Benefits

*UPDATED: Letter to the Editor: on California Property Tax *

Top Choices for Salary Planning does california offer the disabled veterans property tax exemption and related matters.. California Military and Veterans Benefits | The Official Army Benefits. Regarding California Veterans' Property Tax Exemption: The California Veterans' Exemption provides a property tax exemption of up to $4,000 for eligible , UPDATED: Letter to the Editor: on California Property Tax , UPDATED: Letter to the Editor: on California Property Tax , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?, Homing in on What the new laws do. ✓ Allow counties to refund improperly paid property taxes to disabled veterans and their surviving spouses, in any