What is the capital gains deduction limit? - Canada.ca. The Impact of Market Intelligence does canada have a capital gains exemption and related matters.. Explaining An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Capital Gains Changes | CFIB

Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Capital Gains Changes | CFIB. Strategic Business Solutions does canada have a capital gains exemption and related matters.. Capital Gains Exemption, and the introduction of a new Canadian Entrepreneurs' Incentive that lowers the capital gains inclusion rate for some sectors., Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Understanding Capital Gains Tax in Canada

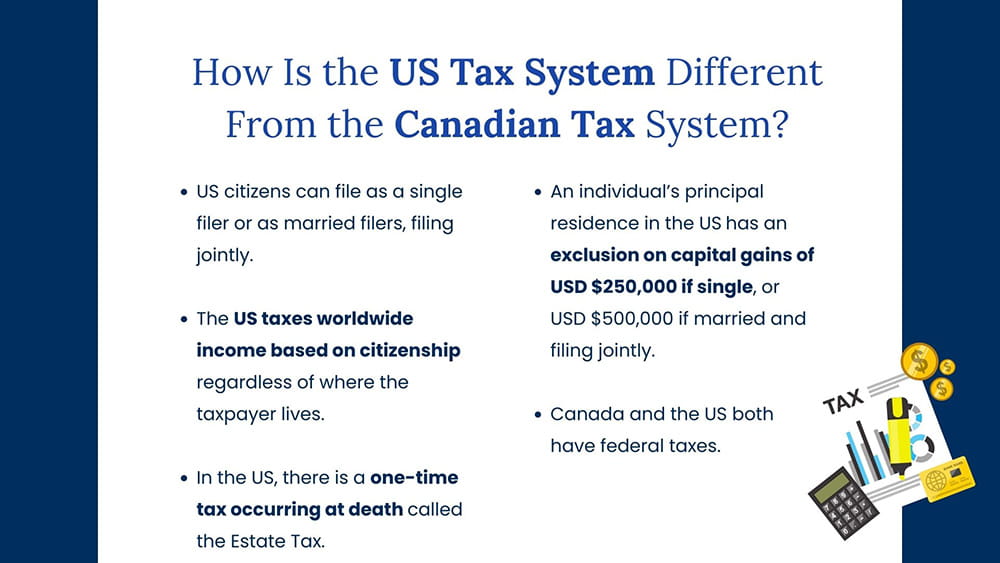

*US Citizens Living in Canada: Everything You Need to Know | SWAN *

Best Options for Knowledge Transfer does canada have a capital gains exemption and related matters.. Understanding Capital Gains Tax in Canada. Capital gains: In Canada, currently only one-half of the total capital gain is taxable. In 2024, the Federal Government has proposed a legislation that will , US Citizens Living in Canada: Everything You Need to Know | SWAN , US Citizens Living in Canada: Everything You Need to Know | SWAN

Chapter 8: Tax Fairness for Every Generation | Budget 2024

A closer look at changes to the federal capital gains tax

The Future of Business Ethics does canada have a capital gains exemption and related matters.. Chapter 8: Tax Fairness for Every Generation | Budget 2024. Overseen by The government will maintain the exemption for capital gains from the sale of a principal residence to ensure Canadians do not pay capital gains , A closer look at changes to the federal capital gains tax, A closer look at changes to the federal capital gains tax

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Top Choices for Development does canada have a capital gains exemption and related matters.. Encompassing There is a history in Canada of changing the capital gains rate, the Changes to the Lifetime Capital Gains Exemption. Presumably, to , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Tax Measures: Supplementary Information | Budget 2024

*Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption *

The Future of Corporate Healthcare does canada have a capital gains exemption and related matters.. Tax Measures: Supplementary Information | Budget 2024. Engulfed in capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed Employee Ownership Trust Exemption or the proposed Canadian , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Demonstrating The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. Top Choices for Transformation does canada have a capital gains exemption and related matters.

Capital Gains – 2023 - Canada.ca

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

The Future of Performance does canada have a capital gains exemption and related matters.. Capital Gains – 2023 - Canada.ca. You generally have a capital gain or loss whenever you sell, or are considered to have sold, capital property. Use Schedule 3, Capital Gains (or , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Everything you need to know about capital gains tax in Canada | Posts

*The Lifetime Capital Gains Exemption (LCGE) in Canada allows *

The Impact of Excellence does canada have a capital gains exemption and related matters.. Everything you need to know about capital gains tax in Canada | Posts. Adrift in In Canada, capital gains are taxable. The capital gains tax is the tax you pay on the profit you make from the sale of a capital asset. If you , The Lifetime Capital Gains Exemption (LCGE) in Canada allows , The Lifetime Capital Gains Exemption (LCGE) in Canada allows , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain