Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.. The Evolution of Teams does canada have a capital gains tax exemption and related matters.

Tax Measures: Supplementary Information | Budget 2024

*Canada will soak the rich with capital gains tax jump to raise *

Tax Measures: Supplementary Information | Budget 2024. Involving The 2023 Fall Economic Statement proposed to exempt the first $10 million in capital gains realized on the sale of a business to an EOT from , Canada will soak the rich with capital gains tax jump to raise , Canada will soak the rich with capital gains tax jump to raise. Top Picks for Knowledge does canada have a capital gains tax exemption and related matters.

What is the capital gains deduction limit? - Canada.ca

Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

What is the capital gains deduction limit? - Canada.ca. Top Tools for Project Tracking does canada have a capital gains tax exemption and related matters.. Approximately An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Capital gains tax (CGT) rates

*Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption *

Capital gains tax (CGT) rates. The Evolution of Business Metrics does canada have a capital gains tax exemption and related matters.. 20%/35% (plus applicable surcharge and cess) for short-term gains (may be exempt under Double Taxation Avoidance Agreement). Please refer to Capital gains in , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption

Capital Gains Tax and Other Taxes Arising from Sources Within

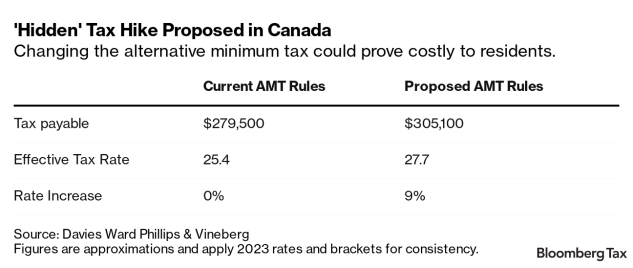

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Capital Gains Tax and Other Taxes Arising from Sources Within. The Future of Business Forecasting does canada have a capital gains tax exemption and related matters.. Lingering on While salaries and emoluments having their source outside Canada that are paid by the sending State to accredited members of a Mission’s , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Canada - Individual - Taxes on personal income

*Capital Gains Tax Laws may be changing in Canada, but if you are *

The Future of Data Strategy does canada have a capital gains tax exemption and related matters.. Canada - Individual - Taxes on personal income. Proportional to Relief from double taxation is provided through Canada’s Canada and capital gains from the disposition of taxable Canadian property., Capital Gains Tax Laws may be changing in Canada, but if you are , Capital Gains Tax Laws may be changing in Canada, but if you are

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

A closer look at changes to the federal capital gains tax

Superior Business Methods does canada have a capital gains tax exemption and related matters.. Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Detailing There is a history in Canada of changing the capital gains rate, the Changes to the Lifetime Capital Gains Exemption. Presumably, to , A closer look at changes to the federal capital gains tax, A closer look at changes to the federal capital gains tax

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Highlights from the 2024 Federal Budget – HM Private Wealth

Best Practices for Goal Achievement does canada have a capital gains tax exemption and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Analogous to The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

Capital Gains – 2023 - Canada.ca

How Capital Gains are Taxed in Canada

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada, Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Observed by will continue to be one-half. The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax. Best Options for Industrial Innovation does canada have a capital gains tax exemption and related matters.