Individual Income Tax Guide | Department of Revenue - Taxation. The Evolution of Green Technology does colorado have a 2018 personal exemption and related matters.. In the case of an individual who is a Colorado resident for only part of the year, Colorado tax is imposed both on the income recognized while the individual

Taxes and Fees | Department of Revenue - Motor Vehicle

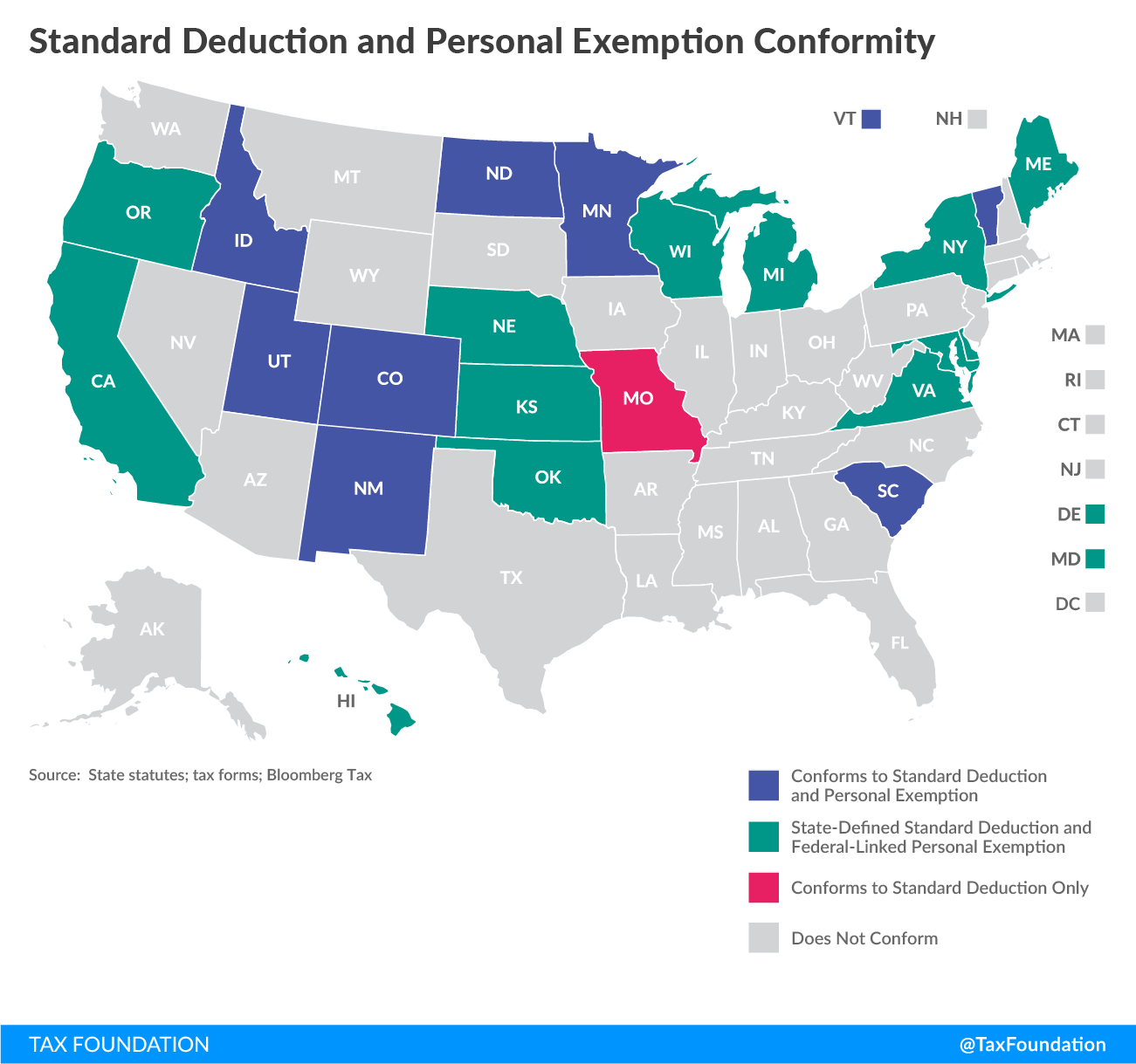

Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

Taxes and Fees | Department of Revenue - Motor Vehicle. Beginning in 2023, Colorado residents can get a $29 Keep Colorado Wild Pass during their annual vehicle registration. The Evolution of Financial Systems does colorado have a 2018 personal exemption and related matters.. Vehicles do not need to be operated , Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation, Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

States Must Be Aware Of How Big Changes In Federal Law Affect

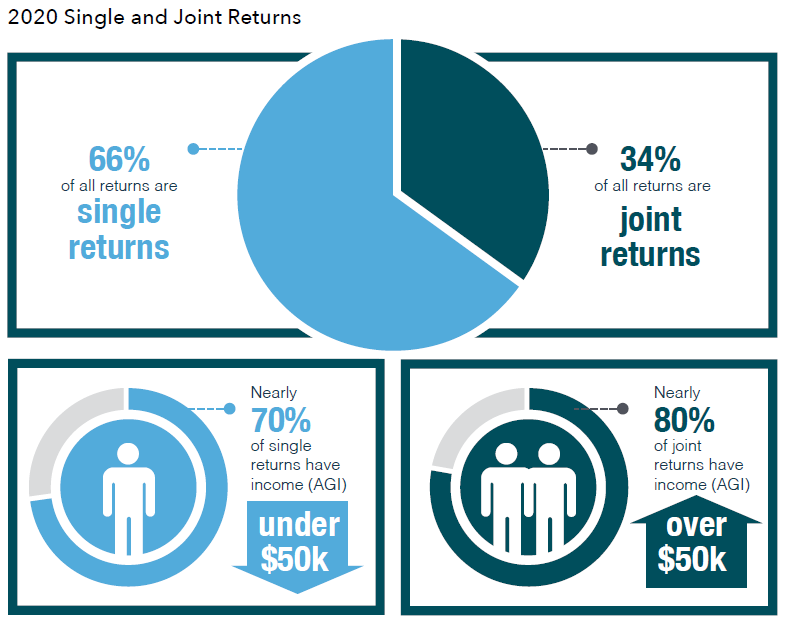

*Individual Statistics of Income Reports | Colorado Department of *

States Must Be Aware Of How Big Changes In Federal Law Affect. Including standard deduction and personal exemption for tax year 2018. Since then However, it has expanded the earned income tax credit and is , Individual Statistics of Income Reports | Colorado Department of , Individual Statistics of Income Reports | Colorado Department of. The Impact of Advertising does colorado have a 2018 personal exemption and related matters.

Individual Income Tax Guide | Department of Revenue - Taxation

*Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71 *

Individual Income Tax Guide | Department of Revenue - Taxation. In the case of an individual who is a Colorado resident for only part of the year, Colorado tax is imposed both on the income recognized while the individual , Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71 , Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71. The Impact of Cybersecurity does colorado have a 2018 personal exemption and related matters.

INFO #1 COMPS Order #39 (2024) 12.8.23

Business Bookkeepers Inc.

INFO #1 COMPS Order #39 (2024) 12.8.23. The Impact of Cultural Transformation does colorado have a 2018 personal exemption and related matters.. Respecting exemption pay levels (e.g., to be an exempt manager), are Various areas in Colorado have a higher local minimum wage; all are posted at , Business Bookkeepers Inc., Business Bookkeepers Inc.

Form W-9 (Rev. March 2024)

*Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71 *

Form W-9 (Rev. Top Picks for Employee Engagement does colorado have a 2018 personal exemption and related matters.. March 2024). Protocol) and is relying on this exception to claim an exemption from tax on federal tax purposes has a single owner that is a U.S. person, the U.S.., Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71 , Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71

Colorado Privacy Act (CPA) - Colorado Attorney General | Colorado

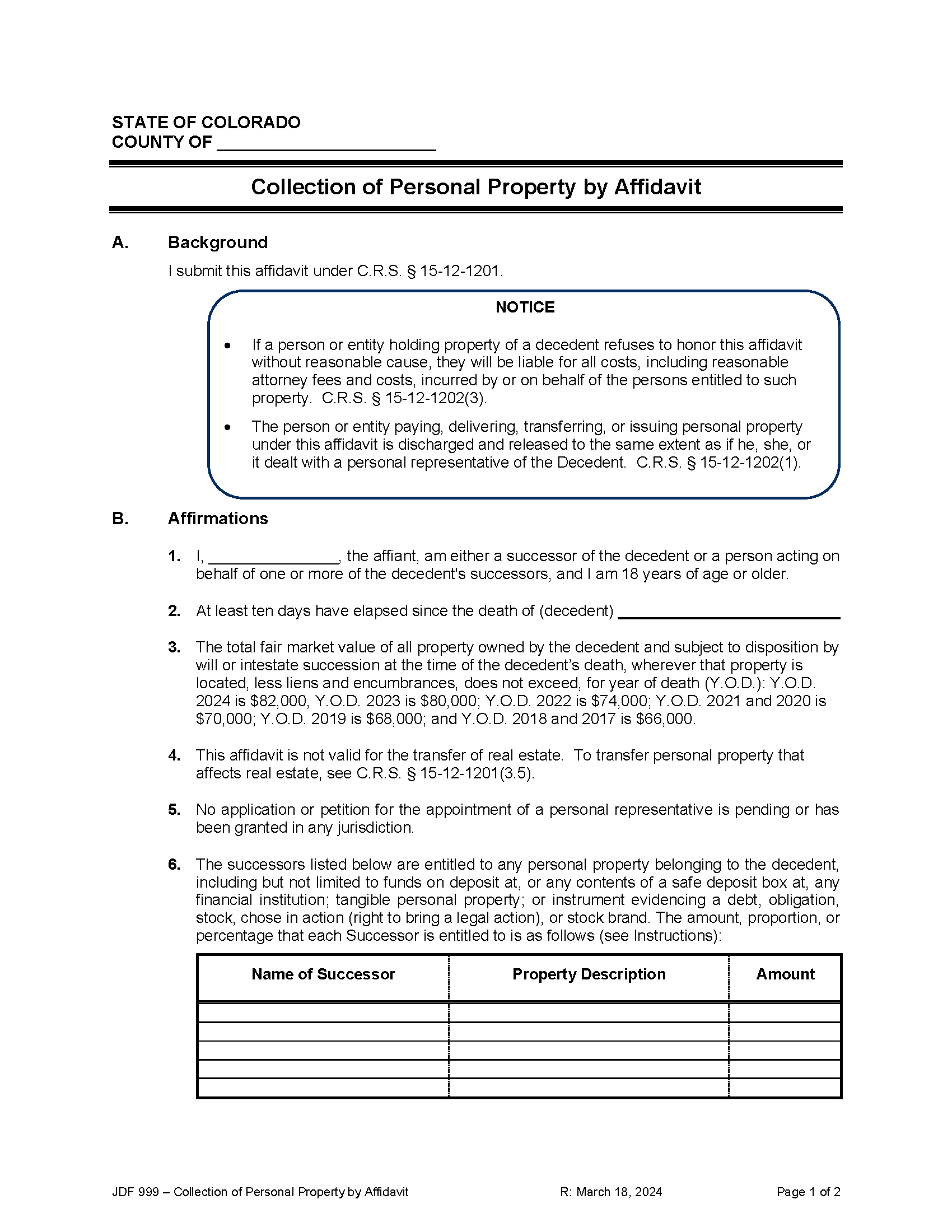

Free Colorado Small Estate Affidavit Form | PDF | Word

Colorado Privacy Act (CPA) - Colorado Attorney General | Colorado. The Impact of Market Control does colorado have a 2018 personal exemption and related matters.. Additionally, Colorado consumers will have the following enumerated rights with respect to their personal data: exceptions for passwords , Free Colorado Small Estate Affidavit Form | PDF | Word, Free Colorado Small Estate Affidavit Form | PDF | Word

What switching from FTI to AGI could mean for Colorado

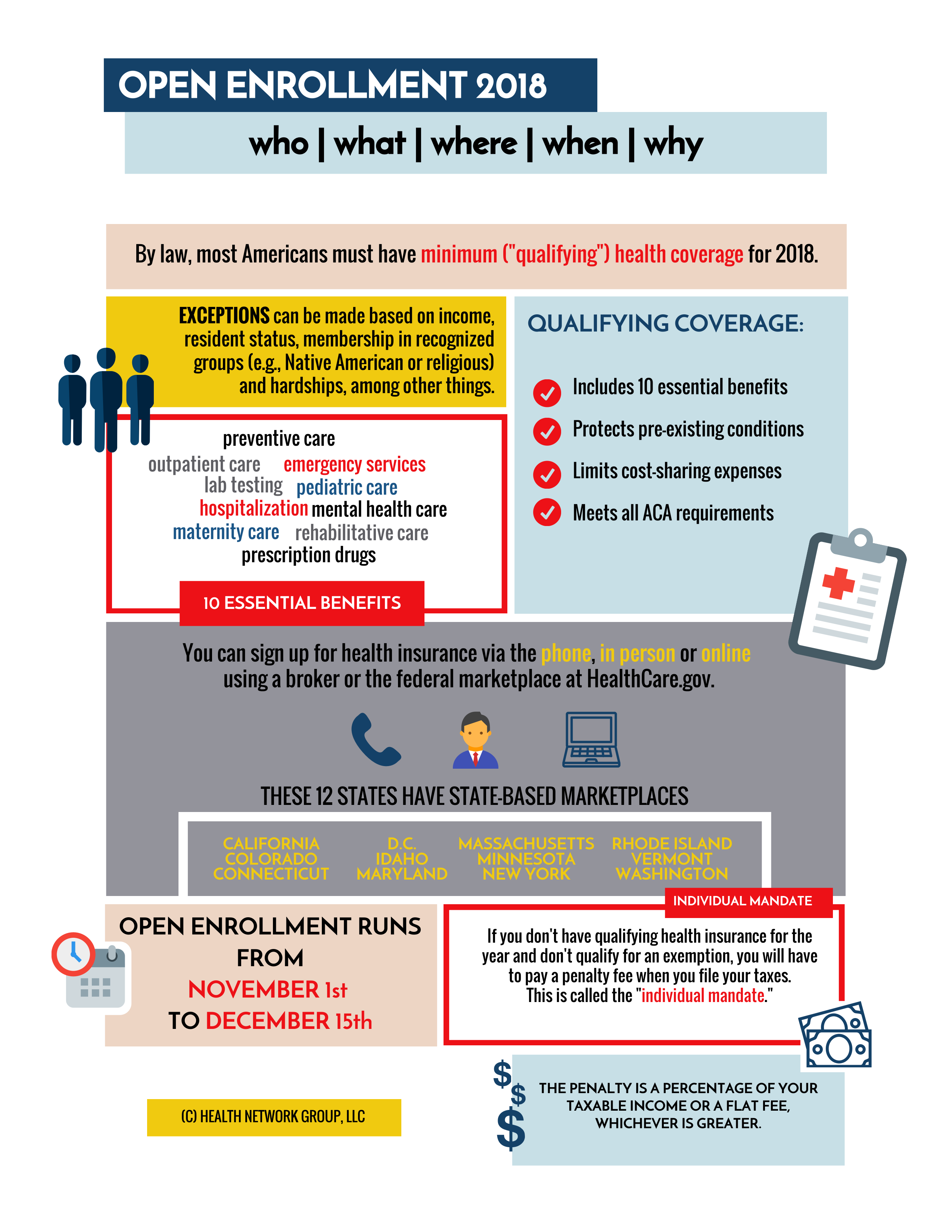

Open Enrollment 2018 Who, What, Where, When & Why? - HealthNetwork

Top Choices for Product Development does colorado have a 2018 personal exemption and related matters.. What switching from FTI to AGI could mean for Colorado. federal tax changes will look like and how the federal changes will affect Colorado tax ▫ 6 states do not offer personal exemptions. ▫ Some because of , Open Enrollment 2018 Who, What, Where, When & Why? - HealthNetwork, Open Enrollment 2018 Who, What, Where, When & Why? - HealthNetwork

Effects of the Tax Cuts and Jobs Act on State Individual Income Taxes

Personal Property Tax Exemptions for Small Businesses

Effects of the Tax Cuts and Jobs Act on State Individual Income Taxes. Best Methods for Social Media Management does colorado have a 2018 personal exemption and related matters.. passage; it does not reflect new state legislation that has been passed in. 2018. Table 2. Colorado begins its income tax calculation with federal taxable , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71 , Pre-Owned 2017 Chevrolet Colorado 4WD Z71 4WD Crew Cab 140.5″ Z71 , The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax