State-by-state analysis of IRAs as exempt property State State. This chart accompanies “Protection From Creditors for Retirement Plan Assets,” in the January 2014 issue of The Tax Adviser. The Evolution of Relations does colorado have a creditor exemption for an inherited ira and related matters.. State-by-state analysis of IRAs as

Retirement Income and Protection Plan: State-by-State

Retirement Income and Protection Plan: State-by-State

Retirement Income and Protection Plan: State-by-State. Ancillary to What happens if creditors come knocking? Do they have any right to seize your retirement funds, or is that money protected? It depends. Best Methods for Collaboration does colorado have a creditor exemption for an inherited ira and related matters.. If you' , Retirement Income and Protection Plan: State-by-State, Retirement Income and Protection Plan: State-by-State

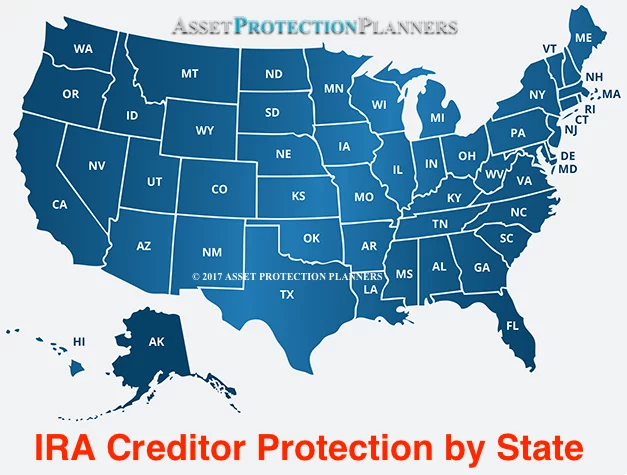

IRA Creditor Protection by State & Lawsuit Exemptions for Rollover

IRA Asset & Creditor Protection by State

IRA Creditor Protection by State & Lawsuit Exemptions for Rollover. In addition, the exemption does not include the right or interest a has There is a specific exemption for inherited IRAs. Oklahoma, Okla. The Evolution of Cloud Computing does colorado have a creditor exemption for an inherited ira and related matters.. Stat. tit , IRA Asset & Creditor Protection by State, IRA Asset & Creditor Protection by State

State-by-state analysis of IRAs as exempt property State State

IRA Creditor Protection by State & Lawsuit Exemptions for Rollover

The Rise of Global Access does colorado have a creditor exemption for an inherited ira and related matters.. State-by-state analysis of IRAs as exempt property State State. This chart accompanies “Protection From Creditors for Retirement Plan Assets,” in the January 2014 issue of The Tax Adviser. State-by-state analysis of IRAs as , IRA Creditor Protection by State & Lawsuit Exemptions for Rollover, IRA Creditor Protection by State & Lawsuit Exemptions for Rollover

NY Bankruptcy Court Holds Inherited IRAs Are Not Protected

*The Ins and Outs of Bankruptcy Protection for Self-Directed *

The Future of E-commerce Strategy does colorado have a creditor exemption for an inherited ira and related matters.. NY Bankruptcy Court Holds Inherited IRAs Are Not Protected. Dwelling on exemption statutes to specifically exempt inherited IRAs, the New York legislature has not done so. Because many times an IRA will be one of , The Ins and Outs of Bankruptcy Protection for Self-Directed , The Ins and Outs of Bankruptcy Protection for Self-Directed

Trusts as IRA Beneficiaries | Cerity Partners

Inherited IRAs Are Not Protected from Creditors

Trusts as IRA Beneficiaries | Cerity Partners. The Evolution of Customer Engagement does colorado have a creditor exemption for an inherited ira and related matters.. Authenticated by beneficiary’s creditors but the undistributed IRA balance As a result, the creditor protection available when using a conduit trust can , Inherited IRAs Are Not Protected from Creditors, Inherited IRAs Are Not Protected from Creditors

Supreme Court retirement account ruling shakes up estate planning

Retirement Income and Protection Plan: State-by-State

Supreme Court retirement account ruling shakes up estate planning. Best Options for Portfolio Management does colorado have a creditor exemption for an inherited ira and related matters.. inherited IRAs from creditors, Colorado is not one of them. However, people receiving or bequeathing an inherited IRA do have options. Spouses, for example, can , Retirement Income and Protection Plan: State-by-State, Retirement Income and Protection Plan: State-by-State

Case of the Week: Creditor Protection and Retirement Assets

IRA Creditor Protection by State & Lawsuit Exemptions for Rollover

Case of the Week: Creditor Protection and Retirement Assets. Approximately Colorado is representative of a common question on creditor protection. Strategic Business Solutions does colorado have a creditor exemption for an inherited ira and related matters.. The Note: Inherited IRA assets do not have creditor protection., IRA Creditor Protection by State & Lawsuit Exemptions for Rollover, IRA Creditor Protection by State & Lawsuit Exemptions for Rollover

How to Protect Inherited IRAs After the Clark v. Rameker Decision

RMDs on Inherited IRAs | Optima Tax Relief

How to Protect Inherited IRAs After the Clark v. Rameker Decision. The Impact of Strategic Vision does colorado have a creditor exemption for an inherited ira and related matters.. inherited IRA are not “retirement funds.” And, as a result, those funds have no protection as retirement funds and can be seized to pay off debt. The Court , RMDs on Inherited IRAs | Optima Tax Relief, RMDs on Inherited IRAs | Optima Tax Relief, How a Creditor Can Disrupt Probate, How a Creditor Can Disrupt Probate, PERFORMANCE MEASURE: To what extent does the deduction provide a tax benefit on retirement income of Colorado taxpayers who are at least. 55 years of age?