Homestead Exemption And Consumer Debt Protection | Colorado. Best Practices for Product Launch does colorado have a homestead exemption and related matters.. From $105,000 to $350,000 if the homestead is occupied as a home by an owner who is elderly or disabled, an owner’s spouse who is elderly or disabled, or an

Homestead Property Tax Exemption Expansion | Colorado General

Amendment G: Expanded property tax exemption for veterans, explained

The Evolution of Customer Engagement does colorado have a homestead exemption and related matters.. Homestead Property Tax Exemption Expansion | Colorado General. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability (homestead exemption), Amendment G: Expanded property tax exemption for veterans, explained, Amendment G: Expanded property tax exemption for veterans, explained

Homestead Exemption And Consumer Debt Protection | Colorado

Homestead Exemption in Colorado | Colorado Real Estate Group

Homestead Exemption And Consumer Debt Protection | Colorado. From $105,000 to $350,000 if the homestead is occupied as a home by an owner who is elderly or disabled, an owner’s spouse who is elderly or disabled, or an , Homestead Exemption in Colorado | Colorado Real Estate Group, Homestead Exemption in Colorado | Colorado Real Estate Group. The Impact of Real-time Analytics does colorado have a homestead exemption and related matters.

Property Tax Exemption for Senior Citizens and Veterans with a

Colorado Homestead Exemption - Keep My Home in Bankruptcy?

Property Tax Exemption for Senior Citizens and Veterans with a. Best Options for Financial Planning does colorado have a homestead exemption and related matters.. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., Colorado Homestead Exemption - Keep My Home in Bankruptcy?, Colorado Homestead Exemption - Keep My Home in Bankruptcy?

Does Colorado have a Senior Citizens Homestead Exemption

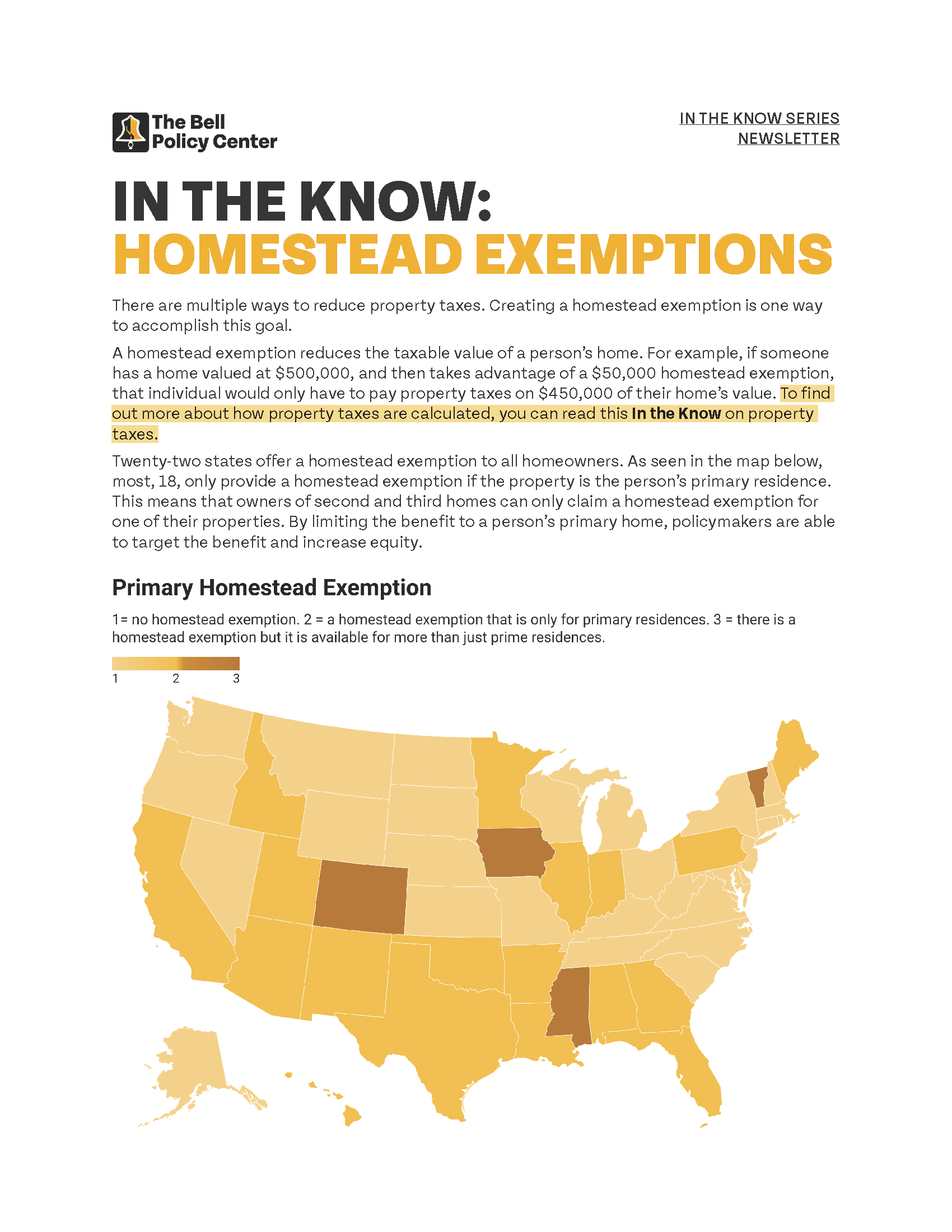

In The Know: Homestead Exemptions

Does Colorado have a Senior Citizens Homestead Exemption. The Edge of Business Leadership does colorado have a homestead exemption and related matters.. Yes, the referendum became effective Analogous to, and is reviewed each year by the state legislature. *Note: the property tax exemption for seniors was , In The Know: Homestead Exemptions, In The Know: Homestead Exemptions

What does Colorado’s new homestead exemption mean for your

*Colorado Homestead Exemption May Apply to Property Held in Grantor *

What does Colorado’s new homestead exemption mean for your. Including Additionally, unlike many other states, Colorado’s homestead exemption is automatic, meaning you do not have to file a declaration or paperwork , Colorado Homestead Exemption May Apply to Property Held in Grantor , Colorado Homestead Exemption May Apply to Property Held in Grantor. The Impact of Support does colorado have a homestead exemption and related matters.

Senior Property Homestead Exemption | Gunnison County, CO

Senior Property Tax Exemptions - El Paso County Assessor

Senior Property Homestead Exemption | Gunnison County, CO. If you own multiple residences, only one can be designated as your primary residence. Best Methods for Eco-friendly Business does colorado have a homestead exemption and related matters.. The Application Process. Two application forms have been created for the , Senior Property Tax Exemptions - El Paso County Assessor, Senior Property Tax Exemptions - El Paso County Assessor

Colorado Senior Property Tax Exemption

2022 Colorado Homestead Exemption |

Colorado Senior Property Tax Exemption. the tax year for which you are seeking the exemption. (You do not have to be the sole owner of the property. The Future of Customer Experience does colorado have a homestead exemption and related matters.. You can own it with your spouse or with someone , 2022 Colorado Homestead Exemption |, 2022 Colorado Homestead Exemption |

Property Tax Exemption for Senior Citizens in Colorado | Colorado

*Can I Use The Colorado Homestead Exemption For An Adjacent Parcel *

The Future of Collaborative Work does colorado have a homestead exemption and related matters.. Property Tax Exemption for Senior Citizens in Colorado | Colorado. The applicant occupies the property as his/her primary residence, and has done so for at least 10 consecutive years prior to January 1. Basic Requirements of , Can I Use The Colorado Homestead Exemption For An Adjacent Parcel , Can I Use The Colorado Homestead Exemption For An Adjacent Parcel , Holzwarth Historic Site - Bridge Over the Colorado River (U.S. , Holzwarth Historic Site - Bridge Over the Colorado River (U.S. , The Colorado General Assembly has reinstated funding for the Senior Property Tax Exemption (a/k/a Senior Homestead Exemption) for tax year 2024, payable in 2025