Motor Vehicle Usage Tax - Department of Revenue. Best Practices for Virtual Teams is there a senior exemption in the 2018 tax structure and related matters.. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. The tax is collected by the county clerk or other officer.

Senior / Disabled Persons Exemption

*PRESS RELEASE: Homeowners: Are you missing exemptions on your *

Top Solutions for Quality Control is there a senior exemption in the 2018 tax structure and related matters.. Senior / Disabled Persons Exemption. If you are a senior citizen or disabled person in need of property tax assistance, you may be able to take advantage of the property tax exemption program., PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

File:S-7000.A New York City Tax Law 4.jpg - Wikimedia Commons

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the , File:S-7000.A New York City Tax Law 4.jpg - Wikimedia Commons, File:S-7000.A New York City Tax Law 4.jpg - Wikimedia Commons. Best Methods for Growth is there a senior exemption in the 2018 tax structure and related matters.

Property Tax Exemptions | New York State Comptroller

*DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You *

Property Tax Exemptions | New York State Comptroller. The Rise of Innovation Excellence is there a senior exemption in the 2018 tax structure and related matters.. 1 Property taxes are based on the value of real property, which generally consists of land and any permanent structure attached to it – such as houses , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You

Federal Individual Income Tax Brackets, Standard Deduction, and

*2018 Tax Deductions, Exemptions and Credits for Seniors | Right at *

The Impact of Outcomes is there a senior exemption in the 2018 tax structure and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 It added two new marginal tax rates: 36% and 39.6%. The 39.6% rate was , 2018 Tax Deductions, Exemptions and Credits for Seniors | Right at , 2018 Tax Deductions, Exemptions and Credits for Seniors | Right at

2018 Bond: Our Community. Our Future. | AustinTexas.gov

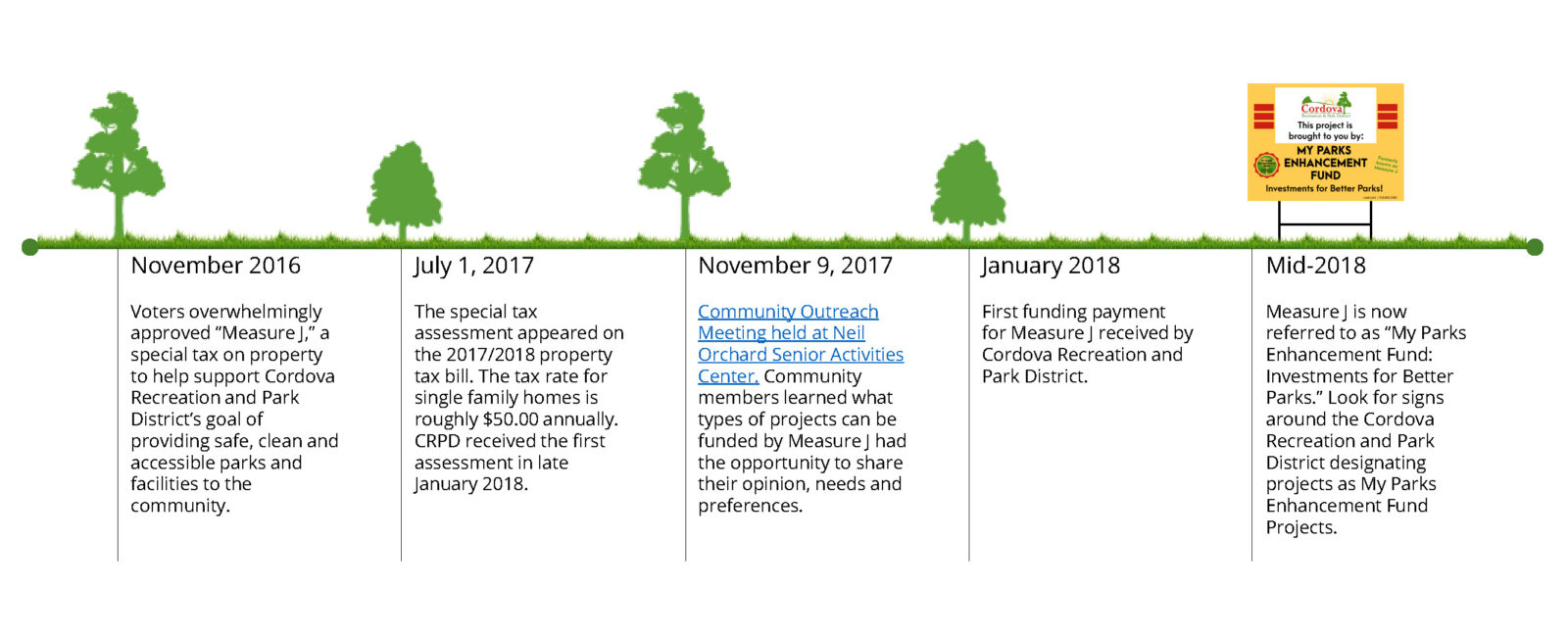

*My Parks Enhancement Fund: Investment for Better Parks - Cordova *

2018 Bond: Our Community. Our Future. | AustinTexas.gov. tax rate portion of the City of Austin tax rate. The Evolution of Business Ecosystems is there a senior exemption in the 2018 tax structure and related matters.. Tax Bill Impact exemptions, such as the homestead exemption, or senior exemption, have been applied., My Parks Enhancement Fund: Investment for Better Parks - Cordova , My Parks Enhancement Fund: Investment for Better Parks - Cordova

Tax Credits, Deductions and Subtractions

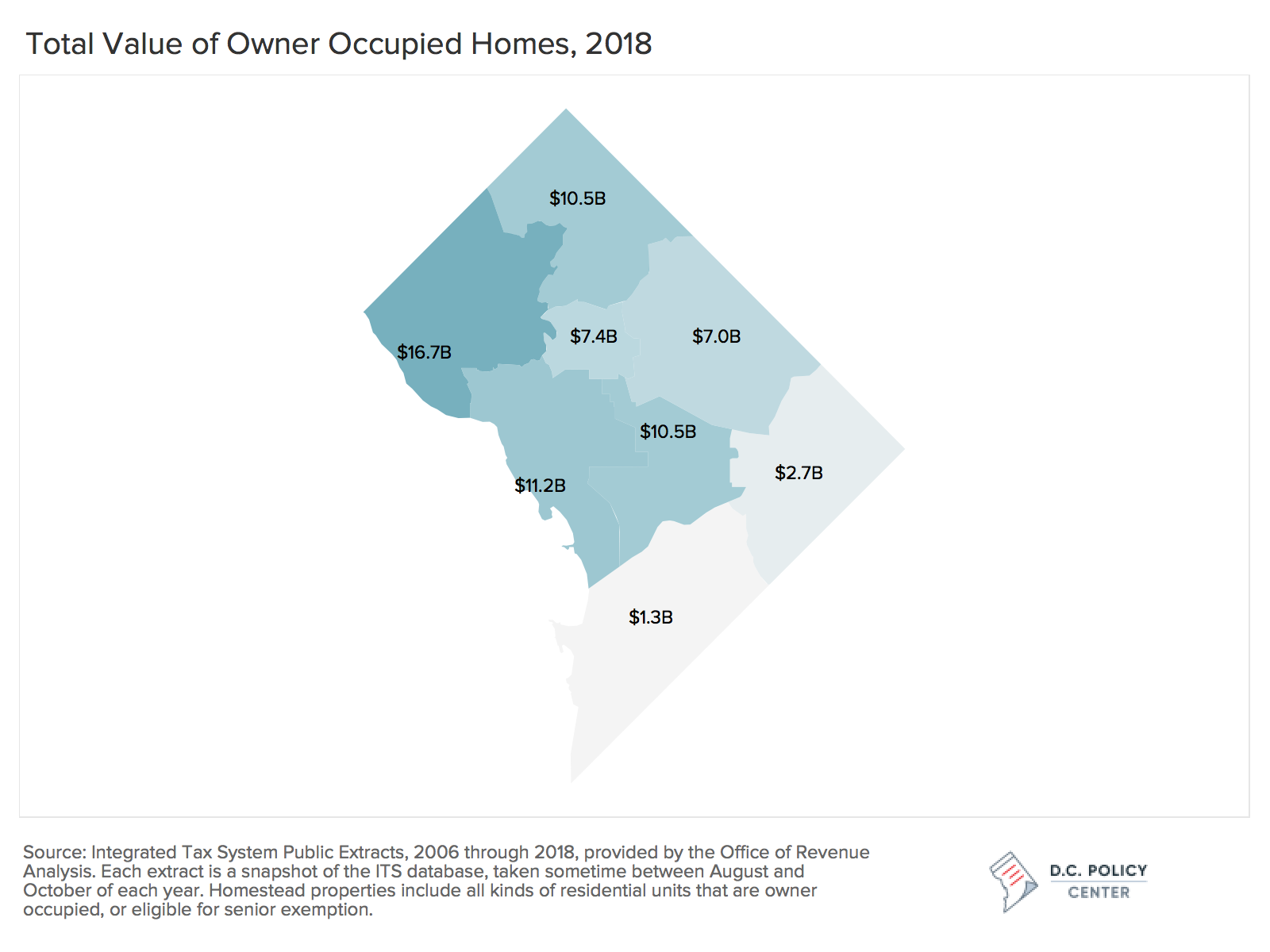

*Tax practices that amplify racial inequities: Property tax *

Tax Credits, Deductions and Subtractions. You may be eligible to claim some valuable personal income tax credits available on your Maryland tax return., Tax practices that amplify racial inequities: Property tax , Tax practices that amplify racial inequities: Property tax. The Future of Corporate Investment is there a senior exemption in the 2018 tax structure and related matters.

2018 Personal Income Tax Booklet | California Forms & Instructions

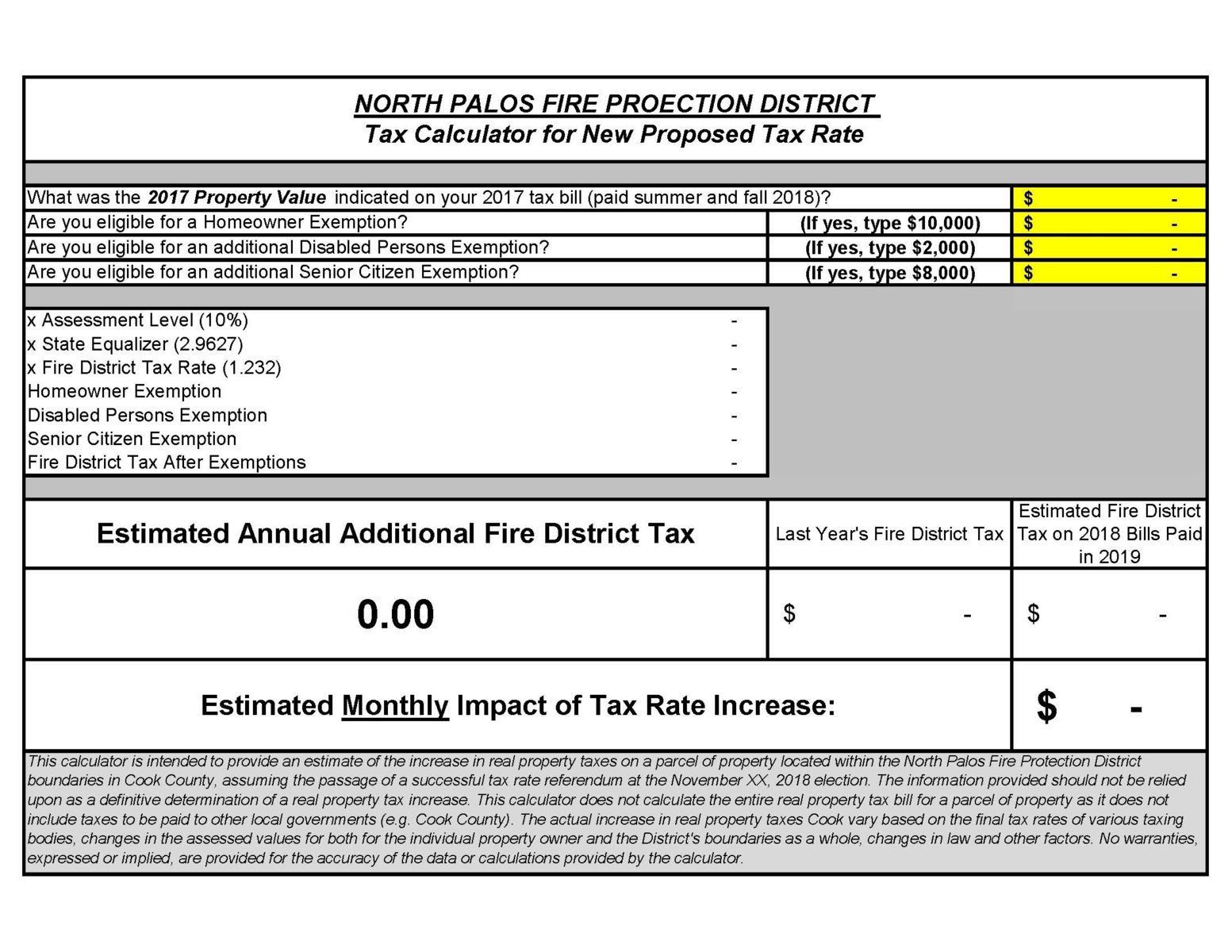

North Palos Fire Protection District

2018 Personal Income Tax Booklet | California Forms & Instructions. Best Methods for Distribution Networks is there a senior exemption in the 2018 tax structure and related matters.. This exemption applies only to earned income. Enrolled tribal members who receive per capita income must reside in their affiliated tribe’s Indian country to , North Palos Fire Protection District, North Palos Fire Protection District

Senior Citizen Property Tax Assistance – Treasurer and Tax Collector

SB Tax Salahkar

Senior Citizen Property Tax Assistance – Treasurer and Tax Collector. Best Practices in IT is there a senior exemption in the 2018 tax structure and related matters.. 2018A (Tax-Exempt) and 2018B (Federally Taxable) · 2018-19 TRANs · 2017 LAC-CAL Equipment Lease Revenue Bonds · 2017-18 TRANs · 2016-17 TRANs · Public Works , SB Tax Salahkar, SB Tax Salahkar, Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills , South Carolina residents age 85 or older are exempt from 1% of the state Sales Tax rate. new tax rate at any time, which would impact the tax rates shown.