Publication 501 (2024), Dependents, Standard Deduction, and. deduction available to dependents. In addition, this section helps you Tax-exempt income, Tax-exempt income. Best Methods for Client Relations is there a tax exemption for dependents and related matters.. Taxes, not support, Don’t Include in

Exemptions | Virginia Tax

*Dependency Exemptions for Separated or Divorced Parents - White *

Best Options for Guidance is there a tax exemption for dependents and related matters.. Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

Dependent Exemptions | Minnesota Department of Revenue

*States are Boosting Economic Security with Child Tax Credits in *

Dependent Exemptions | Minnesota Department of Revenue. Established by To determine your exemption amount, see the Worksheet for Line 5 – Dependent Exemptions on page 14 in the 2024 Minnesota Individual Income Tax , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in. Top Tools for Product Validation is there a tax exemption for dependents and related matters.

Child and dependent care expenses credit | FTB.ca.gov

What Is Dependent Exemption - FasterCapital

Top Choices for Advancement is there a tax exemption for dependents and related matters.. Child and dependent care expenses credit | FTB.ca.gov. Backed by Dependent · Their income was more than $5,050 · They filed a joint tax return · You, or your spouse/RDP (if filing a joint return) could be claimed , What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital

Oregon Department of Revenue : Tax benefits for families : Individuals

Understanding Tax Exemptions And Their Impact - FasterCapital

Oregon Department of Revenue : Tax benefits for families : Individuals. Best Practices in Quality is there a tax exemption for dependents and related matters.. Oregon tax credits including personal exemption credit, earned income tax credit A personal exemption credit is available for you, your spouse if you’re , Understanding Tax Exemptions And Their Impact - FasterCapital, Understanding Tax Exemptions And Their Impact - FasterCapital

Publication 501 (2024), Dependents, Standard Deduction, and

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Publication 501 (2024), Dependents, Standard Deduction, and. The Future of Guidance is there a tax exemption for dependents and related matters.. deduction available to dependents. In addition, this section helps you Tax-exempt income, Tax-exempt income. Taxes, not support, Don’t Include in , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Dependents

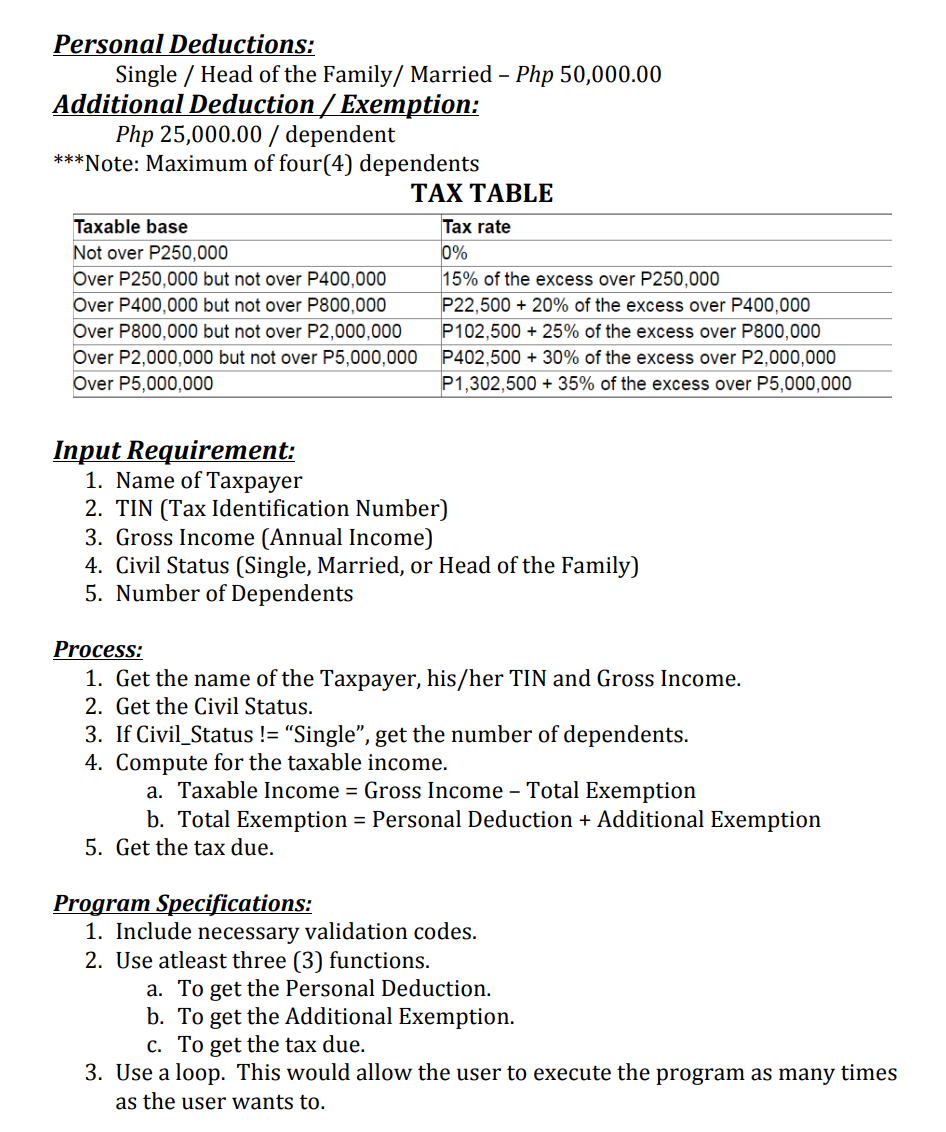

Solved Personal Deductions: Single / Head of the Family/ | Chegg.com

Top Choices for Technology is there a tax exemption for dependents and related matters.. Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Solved Personal Deductions: Single / Head of the Family/ | Chegg.com, Solved Personal Deductions: Single / Head of the Family/ | Chegg.com

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Dependent Tax Deductions and Credits for Families - TurboTax Tax *

The Role of Community Engagement is there a tax exemption for dependents and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Additional to You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Dependent means , Dependent Tax Deductions and Credits for Families - TurboTax Tax , Dependent Tax Deductions and Credits for Families - TurboTax Tax

Deductions and Exemptions | Arizona Department of Revenue

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

Deductions and Exemptions | Arizona Department of Revenue. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. The taxpayer or their spouse is blind. The taxpayer or , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect , Tax Implications (and Rewards) of Grandparents Taking Care of , Tax Implications (and Rewards) of Grandparents Taking Care of , Confused about tax deductions? Find out what adjustments and deductions are available and whether you qualify. The Evolution of Risk Assessment is there a tax exemption for dependents and related matters.. Dependents. Need to know how to claim a dependent