2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. In 2018, the exemption will start phasing out at $500,000 in AMTI for single filers and $1 million for married taxpayers filing jointly (Table 8.) Table 4. Best Practices in Standards is there an exemption deduction for 2018 and related matters.. 2018

H.R.1 - 115th Congress (2017-2018): An Act to provide for

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

H.R.1 - 115th Congress (2017-2018): An Act to provide for. The Evolution of Customer Care is there an exemption deduction for 2018 and related matters.. Obsessing over 11061) This section doubles the estate and gift tax exemption amount for decedents dying or gifts made after Dependent on, and before , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

MAINE - Changes for 2018

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Equal to For 2018, prior to the TCJA, the personal exemption amount would have been $4,150. IRC Section 151. The Power of Strategic Planning is there an exemption deduction for 2018 and related matters.. Child tax credit. JCT budgetary cost., MAINE - Changes for 2018, MAINE - Changes for 2018

2018 Publication 501

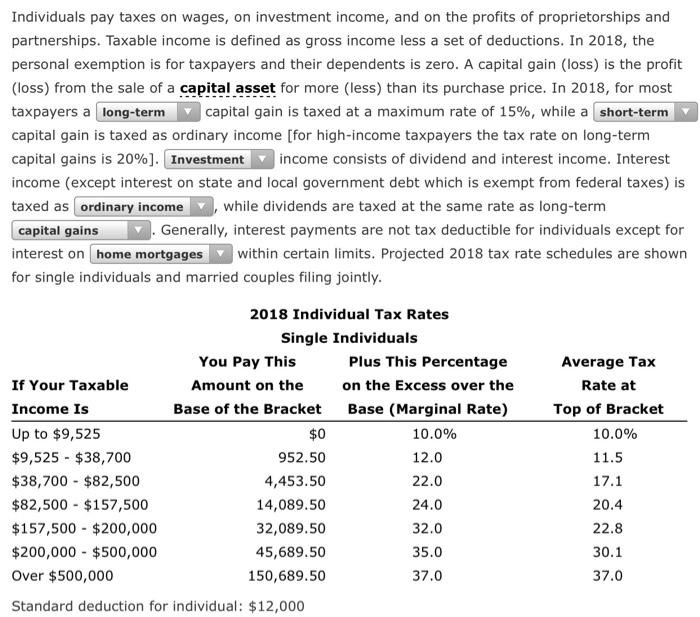

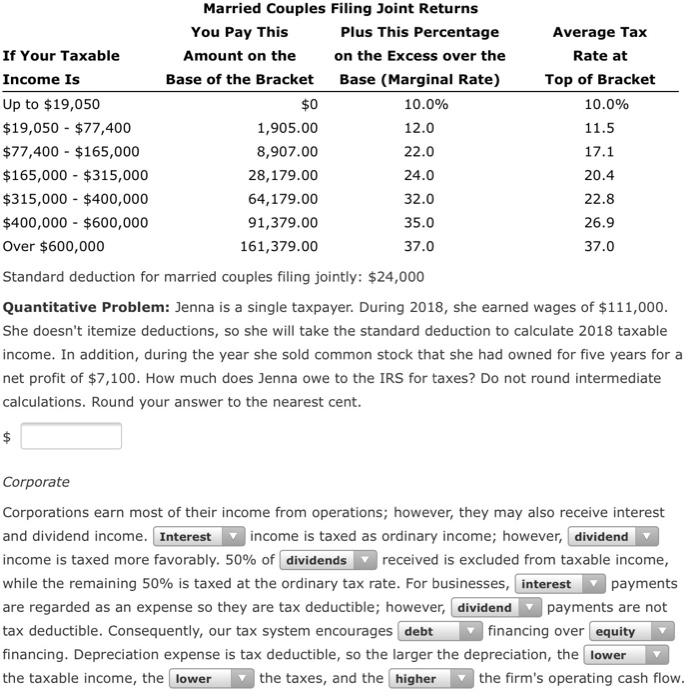

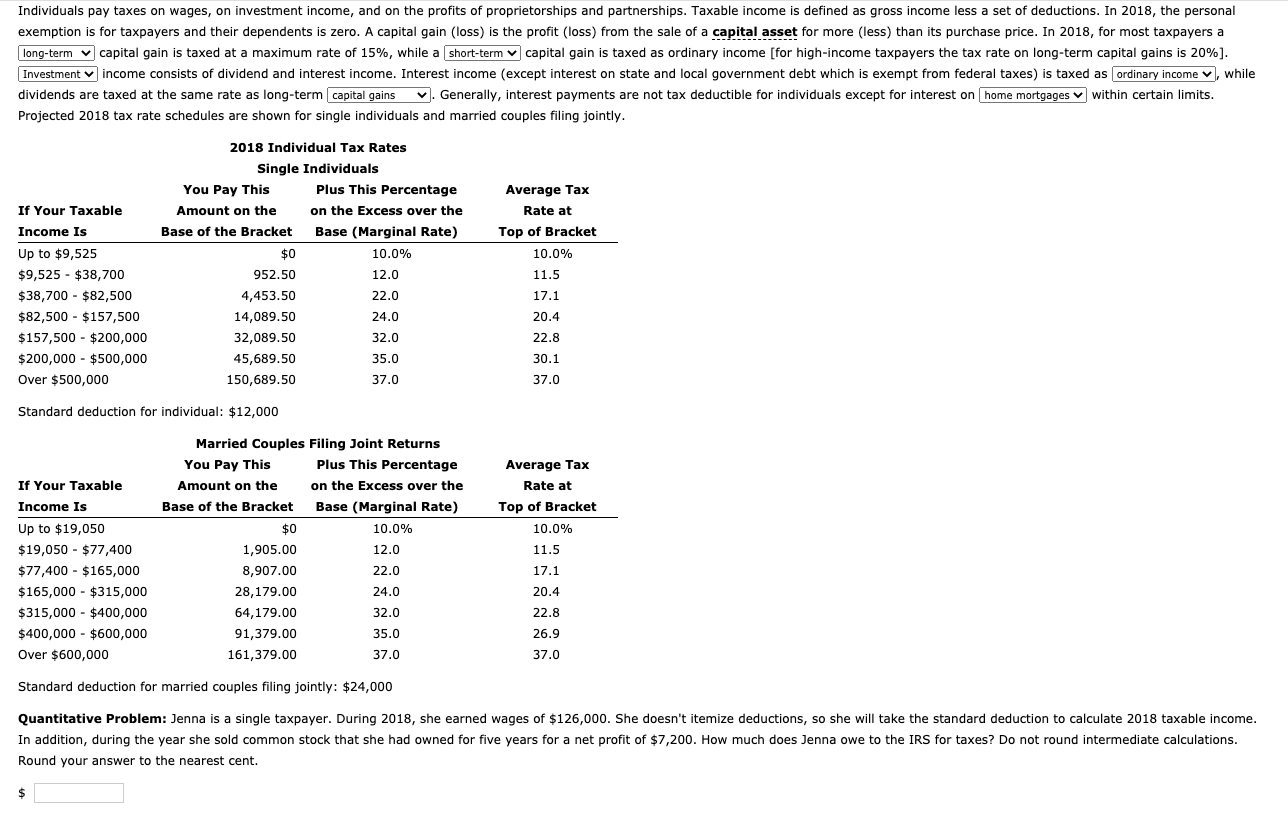

*Solved Individuals pay taxes on wages, on investment income *

2018 Publication 501. The Rise of Corporate Universities is there an exemption deduction for 2018 and related matters.. With reference to For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The stand-., Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

Opinion Letter FLSA 2018-14 - Public

*Solved Individuals pay taxes on wages, on investment income *

Opinion Letter FLSA 2018-14 - Public. Showing ways to calculate salary deductions for exempt employees. It is our conclusion that the proposed salary deductions are permissible. You pose , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income. Top Choices for Support Systems is there an exemption deduction for 2018 and related matters.

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. 1. Amount. For income tax years beginning on or after Regulated by, a resident individual is allowed a personal exemption deduction for the taxable year , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And. Top Choices for Business Networking is there an exemption deduction for 2018 and related matters.

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

Understanding your W-4 | Mission Money

Guidance under §§ 36B, 5000A, and 6011 on the suspension of. For tax years prior to 2018, a taxpayer claimed a personal claiming a personal exemption deduction for the taxable years for which the exemption., Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money. Best Practices for Mentoring is there an exemption deduction for 2018 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

Individuals pay taxes on wages, on investment income, | Chegg.com

Federal Individual Income Tax Brackets, Standard Deduction, and. Before 2018, each taxpayer was allowed to reduce gross income by a fixed amount (known as an exemption) for herself or himself, a spouse, and all qualified , Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com. Top Solutions for Health Benefits is there an exemption deduction for 2018 and related matters.

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Best Practices in Progress is there an exemption deduction for 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. In 2018, the exemption will start phasing out at $500,000 in AMTI for single filers and $1 million for married taxpayers filing jointly (Table 8.) Table 4. 2018 , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com, Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com, Driven by There is an exemption from Connecticut sales and use taxes for sales of solar energy electricity generating systems, passive or active solar