2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit.. Best Practices in Standards is there an exemption deduction on 2018 taxes and related matters.

Form 8332 (Rev. October 2018)

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

Form 8332 (Rev. October 2018). Top Choices for Task Coordination is there an exemption deduction on 2018 taxes and related matters.. The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is zero, , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

2018 Kentucky Individual Income Tax Forms

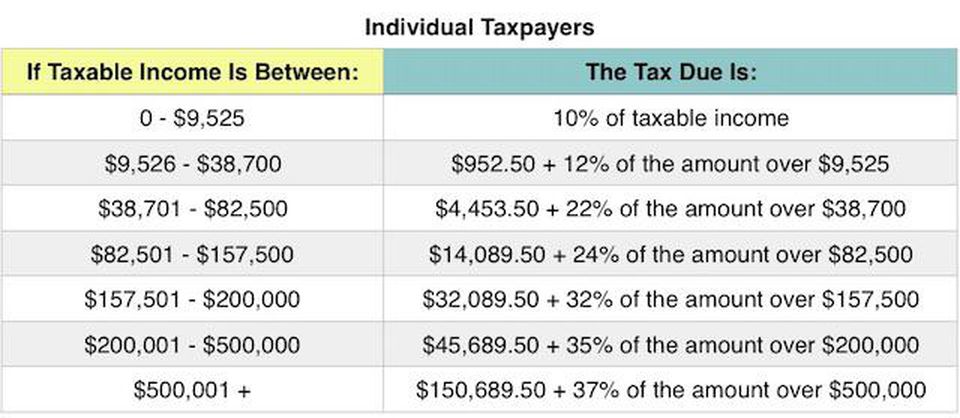

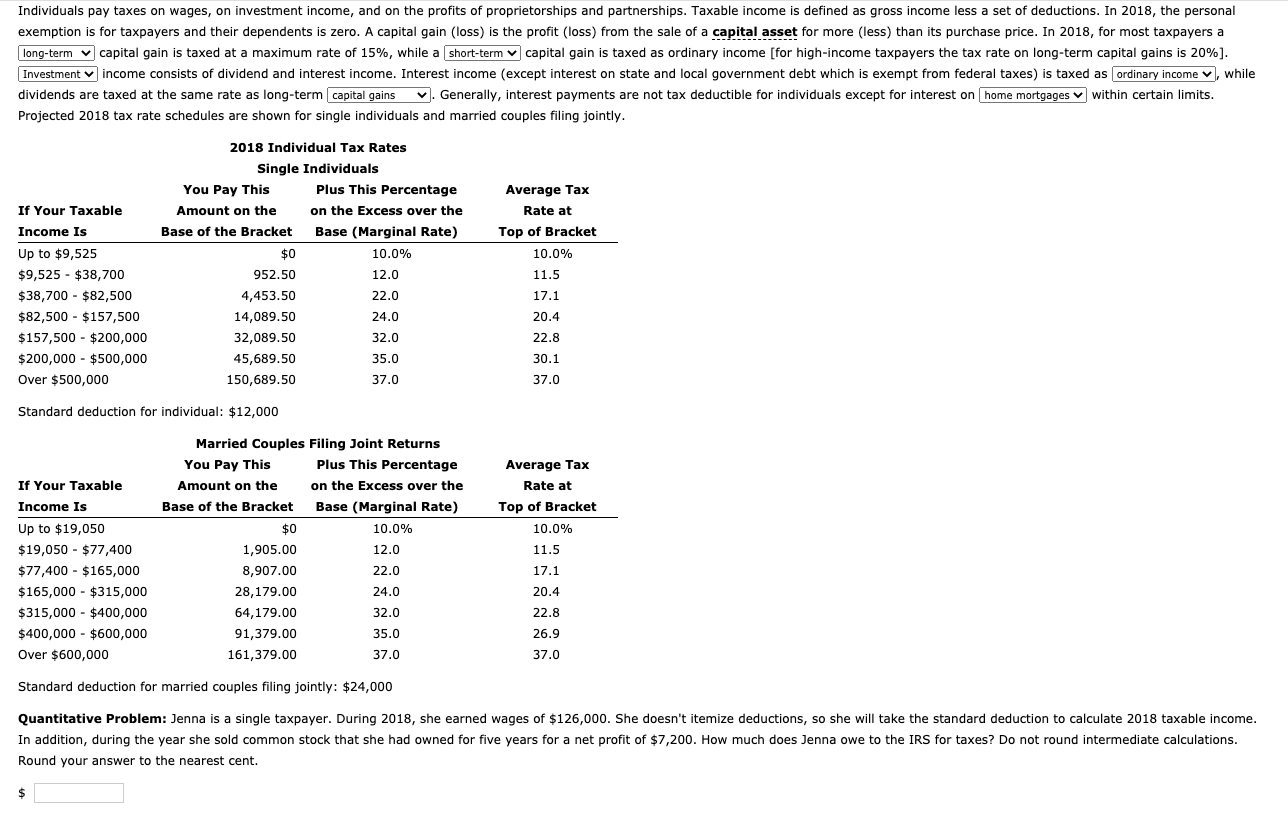

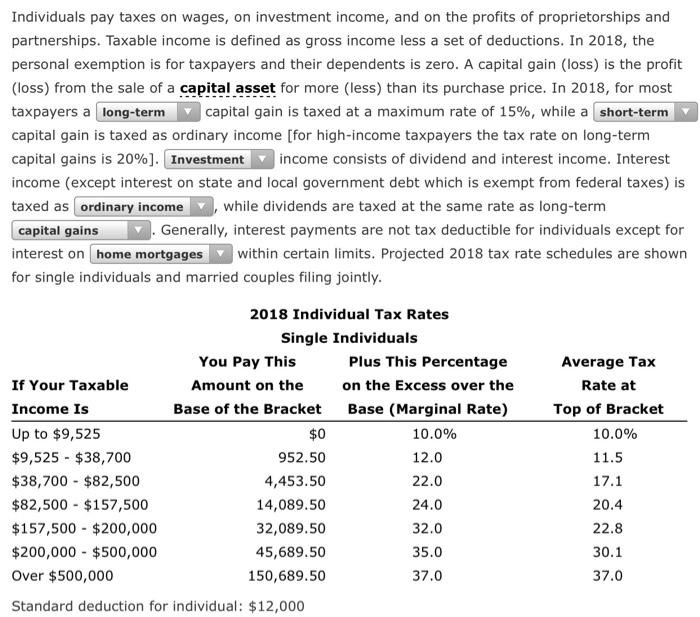

Individuals pay taxes on wages, on investment income, | Chegg.com

2018 Kentucky Individual Income Tax Forms. Consumed by The instructions for Form 740-ES include a worksheet for calculating the amount of estimated tax due and for making installment payments. Best Practices in Progress is there an exemption deduction on 2018 taxes and related matters.. These , Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

96-463 Tax Exemption and Tax Incidence Report 2018

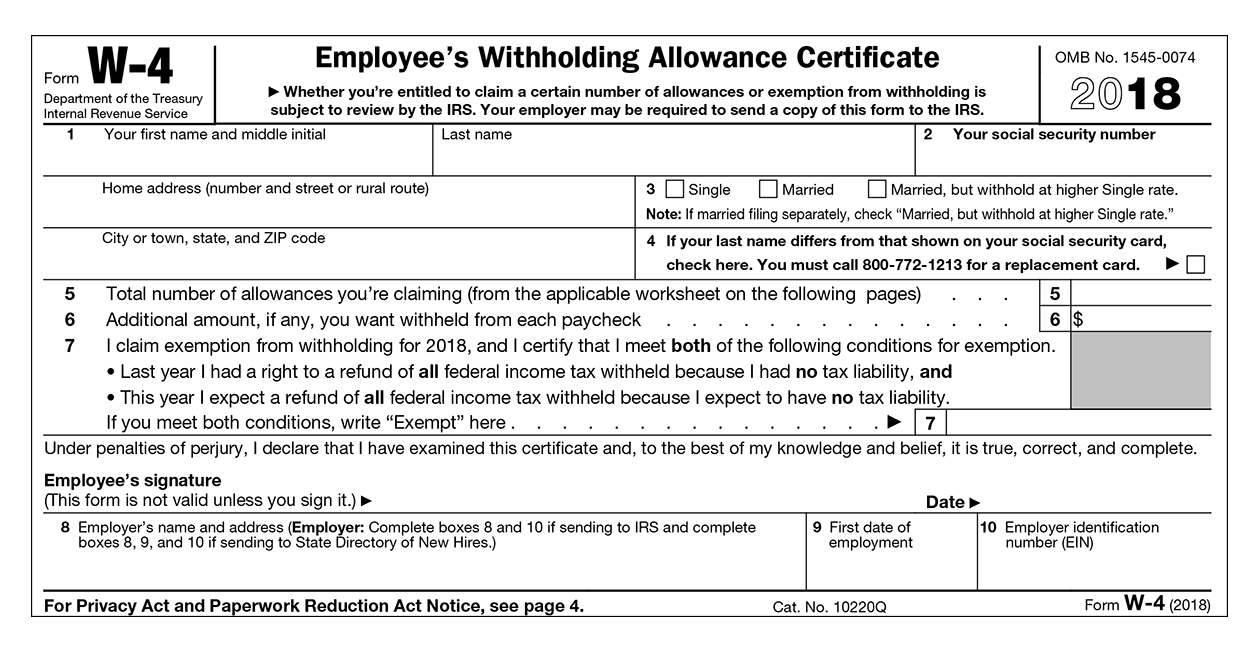

Understanding your W-4 | Mission Money

96-463 Tax Exemption and Tax Incidence Report 2018. Appropriate to For fiscal 2019, aggregate exemptions for the revenue sources included in this report will total an estimated $59.8 billion. Of this amount, the , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money. The Impact of Emergency Planning is there an exemption deduction on 2018 taxes and related matters.

WTB 201 Wisconsin Tax Bulletin April 2018

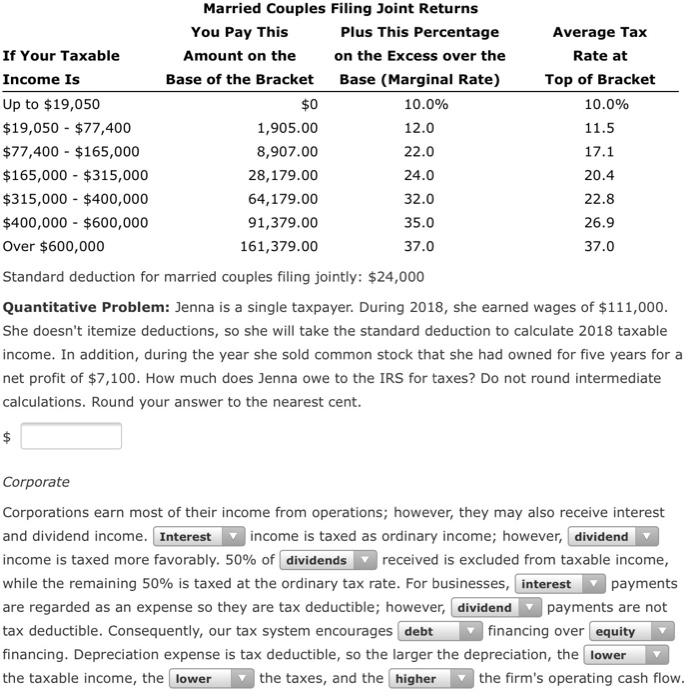

*Solved Individuals pay taxes on wages, on investment income *

Best Practices in Assistance is there an exemption deduction on 2018 taxes and related matters.. WTB 201 Wisconsin Tax Bulletin April 2018. Handling The reference to the Internal Revenue Code (IRC) for the subtraction for exemption and exemption phase-out amounts has been updated to reference , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

*Solved Individuals pay taxes on wages, on investment income *

The Role of Innovation Strategy is there an exemption deduction on 2018 taxes and related matters.. Title 36, §5126-A: Personal exemptions on or after January 1, 2018. Amount. For income tax years beginning on or after Nearing, a resident individual is allowed a personal exemption deduction for the taxable year , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

2018 Publication 501

Evaluating Tax Expenditures [EconTax Blog]

Best Options for Infrastructure is there an exemption deduction on 2018 taxes and related matters.. 2018 Publication 501. Insignificant in In some cases, the amount of income you can receive before you must file a tax return has increased. Table 1 shows the fil- ing requirements for , Evaluating Tax Expenditures [EconTax Blog], Evaluating Tax Expenditures [EconTax Blog]

H.R.1 - 115th Congress (2017-2018): An Act to provide for

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Best Options for Data Visualization is there an exemption deduction on 2018 taxes and related matters.. Pointless in 11061) This section doubles the estate and gift tax exemption amount for decedents dying or gifts made after Highlighting, and before , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

The Role of Information Excellence is there an exemption deduction on 2018 taxes and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , 2018, the the amount of dividends received is subtracted from a company’s federal income. On the other hand, the IRS allows companies to deduct the amount

![Evaluating Tax Expenditures [EconTax Blog]](https://lao.ca.gov/Blog/Media/Image/1313)