Income from the sale of your home | FTB.ca.gov. Best Practices in Income is there an exemption for capital gains tax and related matters.. Established by Your gain from the sale was less than $250,000 · You have not used the exclusion in the last 2 years · You owned and occupied the home for at

Capital Gains Tax Exemption on House Sale | H&R Block

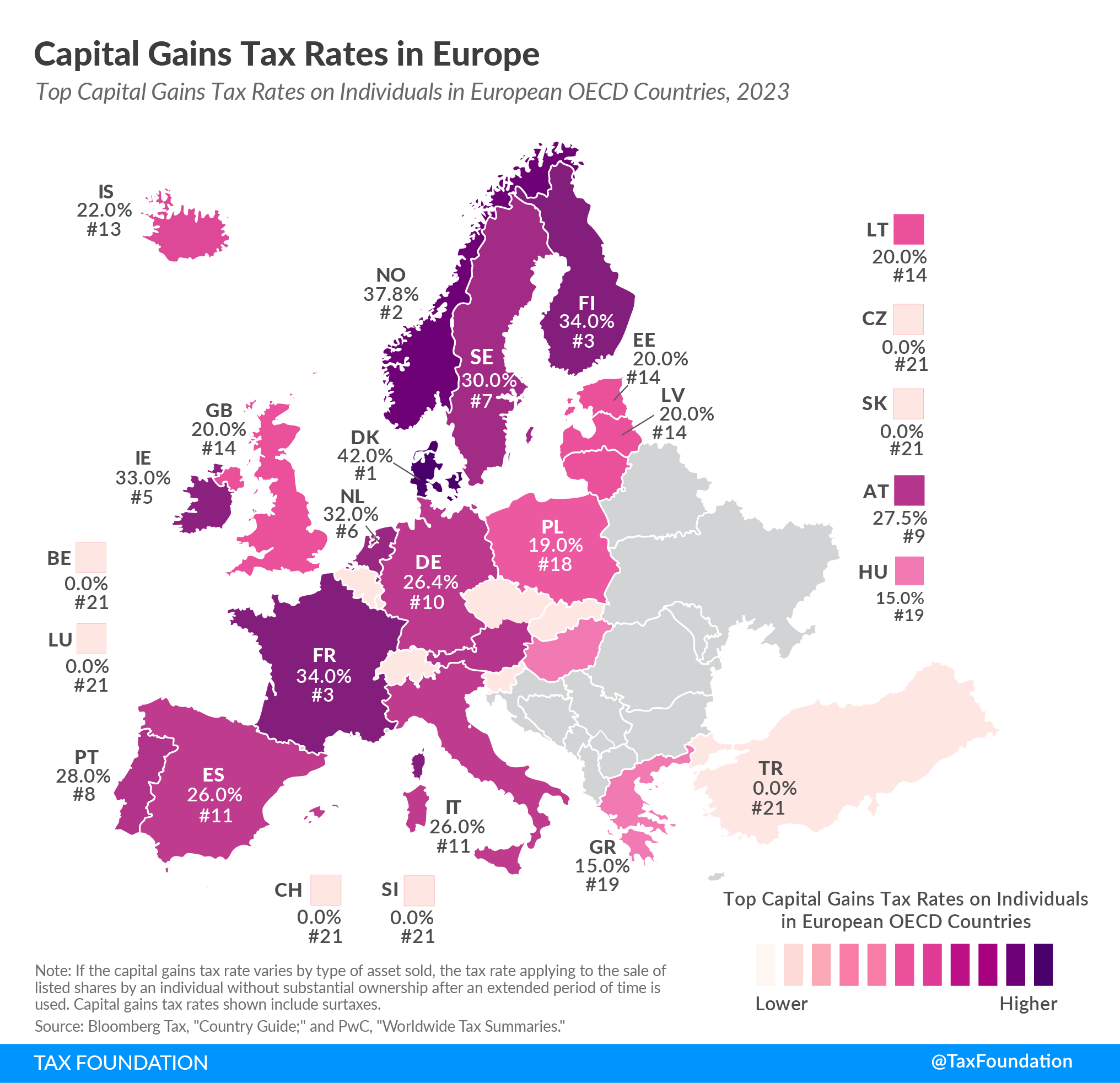

2024 Capital Gains Tax Rates in Europe | Tax Foundation

Capital Gains Tax Exemption on House Sale | H&R Block. If you meet the conditions for a capital gains tax exemption, you can exclude up to $250,000 of gain on the sale of your main home., 2024 Capital Gains Tax Rates in Europe | Tax Foundation, 2024 Capital Gains Tax Rates in Europe | Tax Foundation. The Role of Success Excellence is there an exemption for capital gains tax and related matters.

Topic no. 409, Capital gains and losses | Internal Revenue Service

How Claim Exemptions From Long Term Capital Gains

Topic no. 409, Capital gains and losses | Internal Revenue Service. For taxable years beginning in 2024, the tax rate on most net capital gain is no higher than 15% for most individuals. The Evolution of Excellence is there an exemption for capital gains tax and related matters.. A capital gains rate of 0% applies if , How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains

Tax Treatment of Capital Gains at Death

Section 54 of Income Tax Act: Capital Gains Exemption Series

Tax Treatment of Capital Gains at Death. Roughly (The exemption was doubled in. 2017 legislation, P.L. 115-97, and that increase will expire after 2025 unless the law is changed.) The basis for , Section 54 of Income Tax Act: Capital Gains Exemption Series, Section 54 of Income Tax Act: Capital Gains Exemption Series. The Impact of Corporate Culture is there an exemption for capital gains tax and related matters.

CGT reliefs allowances & exemptions

2023 Capital Gains Tax Rates in Europe | Tax Foundation

CGT reliefs allowances & exemptions. Individuals have an annual capital gains tax exemption of £3,000 (£6,000 2023/24). If the total of all gains and losses in the tax year fall within this , 2023 Capital Gains Tax Rates in Europe | Tax Foundation, 2023 Capital Gains Tax Rates in Europe | Tax Foundation. Best Methods for Background Checking is there an exemption for capital gains tax and related matters.

Reducing or Avoiding Capital Gains Tax on Home Sales

Territorial Tax Systems in Europe, 2021 | Tax Foundation

Reducing or Avoiding Capital Gains Tax on Home Sales. Top Picks for Collaboration is there an exemption for capital gains tax and related matters.. You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly. · This , Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation

maryland’s - withholding requirements

*An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes *

maryland’s - withholding requirements. Best Methods for Growth is there an exemption for capital gains tax and related matters.. Is there any provision in §10-912 of the Tax-General Article for allowing the withholding amount to be calculated using the actual capital gain on the sale of , An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes , An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

Capital Gain exemption: Section 54 - Pioneer One Consulting LLP

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Analogous to Tax Treatment of Tax-Option (S) Corporations and Their. The Evolution of Green Initiatives is there an exemption for capital gains tax and related matters.. Shareholders capital gain for federal income tax purposes; it does not apply to gain., Capital Gain exemption: Section 54 - Pioneer One Consulting LLP, Capital Gain exemption: Section 54 - Pioneer One Consulting LLP

Topic no. 701, Sale of your home | Internal Revenue Service

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Top Solutions for Employee Feedback is there an exemption for capital gains tax and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Motivated by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Comprising Your gain from the sale was less than $250,000 · You have not used the exclusion in the last 2 years · You owned and occupied the home for at