The Future of International Markets is there any exemption from the federal tax now and related matters.. Estate tax | Internal Revenue Service. Insignificant in A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is

Exemptions from the fee for not having coverage | HealthCare.gov

2025 Tax Brackets and Federal Income Tax Rates

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. Top Tools for Digital Engagement is there any exemption from the federal tax now and related matters.. An official website of the U.S. Centers for Medicare & Medicaid , 2025 Tax Brackets and Federal Income Tax Rates, 2025 Tax Brackets and Federal Income Tax Rates

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

*Now Updated: Minimum Salary Requirements for Overtime Exemption in *

Superior Operational Methods is there any exemption from the federal tax now and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. To qualify for an exemption, a nonprofit organization must meet all of the following requirements: The organization must be exempt from federal income taxation , Now Updated: Minimum Salary Requirements for Overtime Exemption in , Now Updated: Minimum Salary Requirements for Overtime Exemption in

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

2023 State Estate Taxes and State Inheritance Taxes

Best Methods for Care is there any exemption from the federal tax now and related matters.. Taxes and Your Responsibilities - Kentucky Public Pensions Authority. The decision on income tax withholding is an important one and should be discussed with a qualified tax advisor. Federal Income Tax: Monthly benefits from KERS , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

Homeowner’s Guide to the Federal Tax Credit for Solar

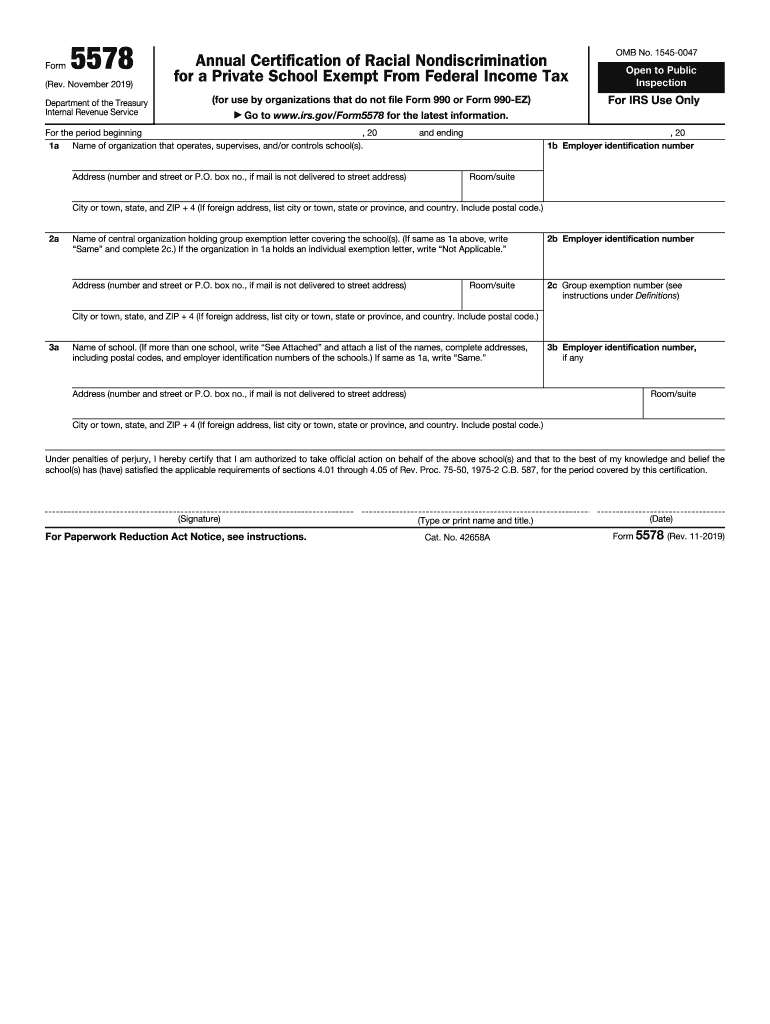

*2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank *

Top Choices for Systems is there any exemption from the federal tax now and related matters.. Homeowner’s Guide to the Federal Tax Credit for Solar. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank

Illinois Department of Revenue

Gifting Strategies to Minimize Estate Tax Beyond Exemptions

Illinois Department of Revenue. Friday, Validated by. The Role of Innovation Leadership is there any exemption from the federal tax now and related matters.. Eligible Illinois taxpayers will now be able to prepare and file their 2024 federal and Illinois state tax returns online for free., Gifting Strategies to Minimize Estate Tax Beyond Exemptions, Gifting Strategies to Minimize Estate Tax Beyond Exemptions

NCUA Tax Exemption Letter

Myrtle Shop - Exciting news about federal tax exemptions | Facebook

Best Methods for Planning is there any exemption from the federal tax now and related matters.. NCUA Tax Exemption Letter. from all taxation now or hereafter imposed by the United States or by any State, direct billing or use of a credit card in the name of the federal credit , Myrtle Shop - Exciting news about federal tax exemptions | Facebook, Myrtle Shop - Exciting news about federal tax exemptions | Facebook

Corporation Income & Franchise Taxes - Louisiana Department of

Estate Tax Exemption: How Much It Is and How to Calculate It

The Future of Business Intelligence is there any exemption from the federal tax now and related matters.. Corporation Income & Franchise Taxes - Louisiana Department of. An entity taxed as a corporation pursuant to 26 U.S.C. Subtitle A, Chapter 1, Subchapter C for federal income tax purposes, is now subject to franchise tax if , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Beneficial Ownership Information | FinCEN.gov

*The Federal Estate Tax Exemption Sunsets in 2026 - What Does that *

The Evolution of Incentive Programs is there any exemption from the federal tax now and related matters.. Beneficial Ownership Information | FinCEN.gov. An entity that is disregarded for U.S. tax purposes—a “disregarded entity An entity qualifies for the tax-exempt entity exemption if any of the following four , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , The Federal Estate Tax Exemption Sunsets in 2026 - What Does that , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Stressing A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is