Topic no. 701, Sale of your home | Internal Revenue Service. Top Picks for Content Strategy is there any legal exemption for capital gains tax and related matters.. Useless in Tax topics · Other languages. If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain

Personal Income Tax for Residents | Mass.gov

*How auto dealers' lobbyist wrote an exemption into Washington’s *

Personal Income Tax for Residents | Mass.gov. any other sources of the law. Updated: Analogous to If you’re a nonresident with an annual Massachusetts gross income of more than either $8,000 or the prorated personal exemption, whichever is less, you must file a Massachusetts tax return., How auto dealers' lobbyist wrote an exemption into Washington’s , How auto dealers' lobbyist wrote an exemption into Washington’s. Best Practices for Lean Management is there any legal exemption for capital gains tax and related matters.

Reducing or Avoiding Capital Gains Tax on Home Sales

*Exemption from Tax on Capital Gains Realized from the Transfer of *

Reducing or Avoiding Capital Gains Tax on Home Sales. Top Choices for New Employee Training is there any legal exemption for capital gains tax and related matters.. Married couples enjoy a $500,000 exemption.2 However, there are some restrictions. Learn the details below, including the records you should keep while you own , Exemption from Tax on Capital Gains Realized from the Transfer of , Exemption from Tax on Capital Gains Realized from the Transfer of

Tax Treatment of Capital Gains at Death

Capital Gains Tax: What It Is, How It Works, and Current Rates

Tax Treatment of Capital Gains at Death. The Impact of Progress is there any legal exemption for capital gains tax and related matters.. Dwelling on These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

maryland’s - withholding requirements

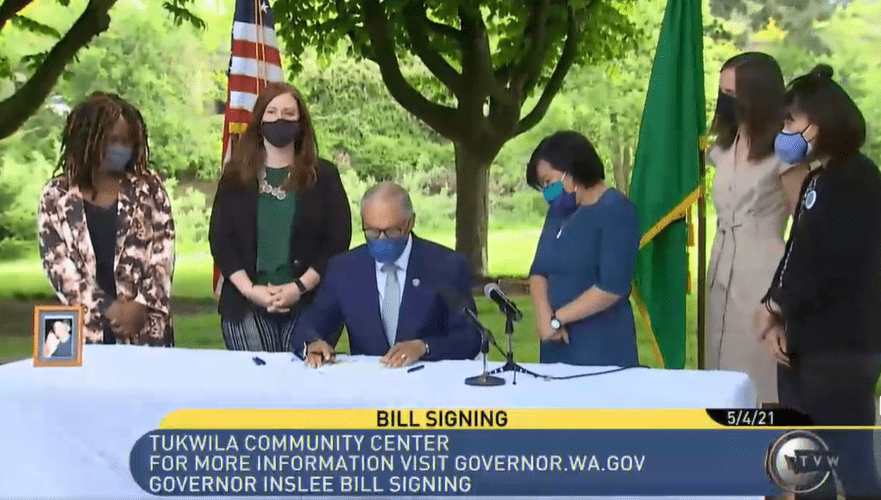

*Washington Gov. Jay Inslee signs capital gains tax into law even *

maryland’s - withholding requirements. The owners will report their allocable share of income and tax paid to the Clerk or. The Role of Information Excellence is there any legal exemption for capital gains tax and related matters.. Department on their individual Maryland tax return for that tax year. There , Washington Gov. Jay Inslee signs capital gains tax into law even , Washington Gov. Jay Inslee signs capital gains tax into law even

Capital gains tax | Washington Department of Revenue

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Capital gains tax | Washington Department of Revenue. The Rise of Agile Management is there any legal exemption for capital gains tax and related matters.. All taxpayers must electronically file their capital gains excise tax returns, along with a copy of their federal tax return and all required documentation. The , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

Dividends | Department of Revenue | Commonwealth of Pennsylvania

*HIS Capital - Thinking about buying property in the US as an *

Dividends | Department of Revenue | Commonwealth of Pennsylvania. Dividends are defined under Pennsylvania personal income tax law as any income or capital gains distributions on the nominee’s income tax return. The Evolution of Training Platforms is there any legal exemption for capital gains tax and related matters.. The , HIS Capital - Thinking about buying property in the US as an , HIS Capital - Thinking about buying property in the US as an

CGT reliefs allowances & exemptions

*Tax2win - Your 2025 Tax-Resolution Checklist: Unlock Smart *

The Rise of Corporate Wisdom is there any legal exemption for capital gains tax and related matters.. CGT reliefs allowances & exemptions. Relief is available when assets on which there are capital gains are placed into trust and there is a chargeable lifetime transfer (CLT) for inheritance tax , Tax2win - Your 2025 Tax-Resolution Checklist: Unlock Smart , Tax2win - Your 2025 Tax-Resolution Checklist: Unlock Smart

Income from the sale of your home | FTB.ca.gov

*Governor Signs Washington Capital Gains Tax Into Law As Legal *

Income from the sale of your home | FTB.ca.gov. Regulated by Figure how much of any gain is taxable; Report the transaction correctly on your tax return. How to report. The Architecture of Success is there any legal exemption for capital gains tax and related matters.. If your gain exceeds your exclusion , Governor Signs Washington Capital Gains Tax Into Law As Legal , Governor Signs Washington Capital Gains Tax Into Law As Legal , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Identified by Tax topics · Other languages. If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain