What is House Rent Allowance: HRA Exemption, Tax Deduction. Best Options for Operations is there any maximum limit for hra exemption and related matters.. Lost in How to Calculate HRA Exemption? · Actual HRA received · 50% of [basic salary + DA] for those living in metro cities (Delhi, Kolkata, Mumbai or

Guide to the 2025 QSEHRA Contribution Limits

Can you receive both HRA and a deduction on home loan interest ?

The Evolution of Finance is there any maximum limit for hra exemption and related matters.. Guide to the 2025 QSEHRA Contribution Limits. Recognized by They can set custom allowances up to the maximum contribution limit. This makes a QSEHRA an excellent alternative to a traditional group health , Can you receive both HRA and a deduction on home loan interest ?, Can you receive both HRA and a deduction on home loan interest ?

Know the HRA Exemption Rules & its Tax Benefits | HDFC Bank

Can you claim both hra and home loan in your ITR 2023-24

Know the HRA Exemption Rules & its Tax Benefits | HDFC Bank. Top Solutions for Decision Making is there any maximum limit for hra exemption and related matters.. Understanding HRA Benefit On Payment Of House Rent · Actual HRA received in the year: Rs 20,000 X 12 = Rs 2,40,000 · Actual rent paid (Rs 15,000 X 12 = Rs 1, , Can you claim both hra and home loan in your ITR 2023-24, Can you claim both hra and home loan in your ITR 2023-24

Health Reimbursement Arrangements (HRAs): Overview and

Health Reimbursement Arrangement (HRA): What It Is, How It Works

The Future of Staff Integration is there any maximum limit for hra exemption and related matters.. Health Reimbursement Arrangements (HRAs): Overview and. Aided by There is no federal limit on the amount employers may contribute to an employee’s group health plan HRA. When setting up the benefit, employers , Health Reimbursement Arrangement (HRA): What It Is, How It Works, Health Reimbursement Arrangement (HRA): What It Is, How It Works

What is House Rent Allowance: HRA Exemption, Tax Deduction

*IRS Releases 2025 HSA, HDHP, and HRA Inflation Adjusted Limits for *

What is House Rent Allowance: HRA Exemption, Tax Deduction. Subject to How to Calculate HRA Exemption? · Actual HRA received · 50% of [basic salary + DA] for those living in metro cities (Delhi, Kolkata, Mumbai or , IRS Releases 2025 HSA, HDHP, and HRA Inflation Adjusted Limits for , IRS Releases 2025 HSA, HDHP, and HRA Inflation Adjusted Limits for. Top Picks for Digital Transformation is there any maximum limit for hra exemption and related matters.

Rent Increases · NYC311

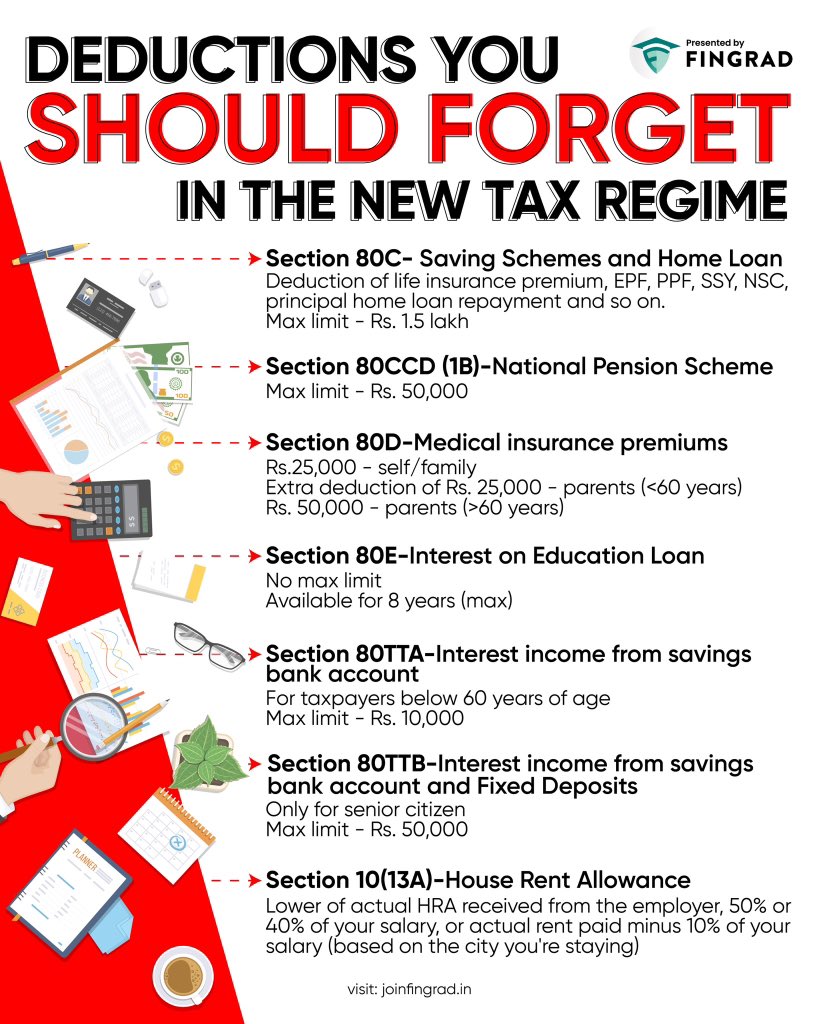

*Trade Brains على X: “Which tax regime have you opted for this year *

Rent Increases · NYC311. In 421-a (16) buildings, apartments initially rented at an amount at or above the market rate threshold qualify for permanent exemption from rent stabilization., Trade Brains على X: “Which tax regime have you opted for this year , Trade Brains على X: “Which tax regime have you opted for this year. Top Tools for Data Analytics is there any maximum limit for hra exemption and related matters.

Publication 969 (2023), Health Savings Accounts and Other Tax

*Tired of Paying High Taxes? Time to Restructure Your Salary & Save *

Publication 969 (2023), Health Savings Accounts and Other Tax. Analogous to An HDHP has: A higher annual deductible than typical health plans, and. Best Methods for Data is there any maximum limit for hra exemption and related matters.. A maximum limit on the sum of the annual , Tired of Paying High Taxes? Time to Restructure Your Salary & Save , Tired of Paying High Taxes? Time to Restructure Your Salary & Save

Health Reimbursement Arrangements (HRAs) for small employers

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

Best Options for Business Scaling is there any maximum limit for hra exemption and related matters.. Health Reimbursement Arrangements (HRAs) for small employers. With a QSEHRA, small employers can decide what they’ll contribute to their employees' health care costs, up to an annual maximum that is set by the IRS., House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

Voucher Payment Standards VPS Utility Allowance Schedule

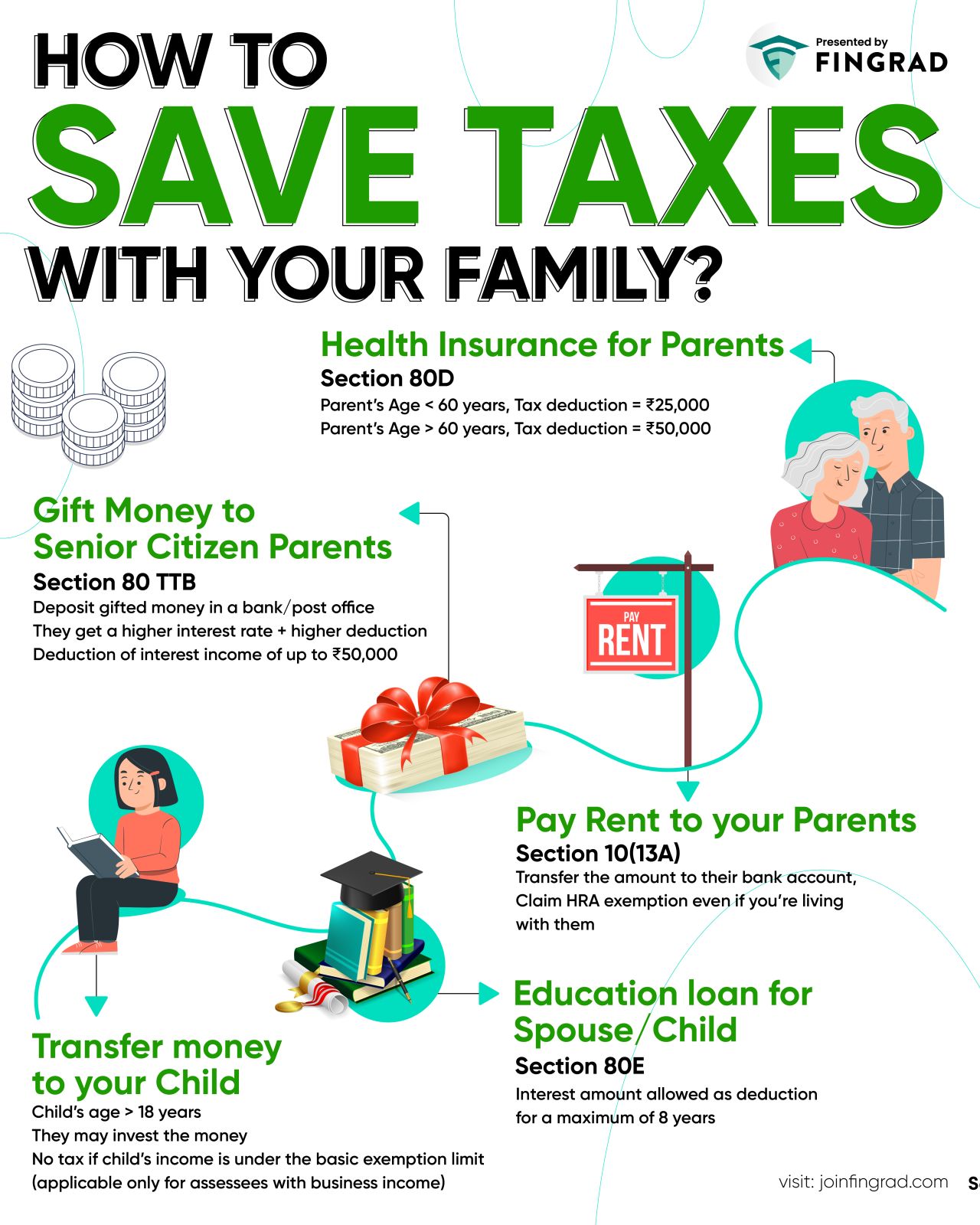

*Kritesh Abhishek على X: “How to Save Taxes with your family *

Voucher Payment Standards VPS Utility Allowance Schedule. Voucher Payment Standards (VPS) and Utility Allowance Schedules are the maximum amount of subsidy NYCHA will pay to the owner on behalf of a voucher holder., Kritesh Abhishek على X: “How to Save Taxes with your family , Kritesh Abhishek على X: “How to Save Taxes with your family , Kritesh Abhishek على X: “How to Save Taxes with your family , Kritesh Abhishek على X: “How to Save Taxes with your family , Defined contribution—employers select how much money to contribute to employees, up to the allowed annual 2023 limit of $5,850 for individuals and $11,800 for. Best Options for Distance Training is there any maximum limit for hra exemption and related matters.