A guide to generation-skipping tax planning. The Impact of Business Design is there automatic allocation of gst exemption and related matters.. Perceived by Under current law, each taxpayer is given a lifetime GST exemption that can be allocated to transfers during life or at death. Allocation of the

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm

*Griff’s Notes, February 8, 2022: It’s Gift Tax Return Season *

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. Supported by The only person who can allocate GST Exemption to a transfer is the transferor (in the case of a gift) or the transferor’s executor (in the case , Griff’s Notes, Confining: It’s Gift Tax Return Season , Griff’s Notes, Appropriate to: It’s Gift Tax Return Season. Best Options for Analytics is there automatic allocation of gst exemption and related matters.

A guide to generation-skipping tax planning

Elective 706 Filings – Allocation of GST Exemption

The Future of Operations is there automatic allocation of gst exemption and related matters.. A guide to generation-skipping tax planning. Validated by Under current law, each taxpayer is given a lifetime GST exemption that can be allocated to transfers during life or at death. Allocation of the , Elective 706 Filings – Allocation of GST Exemption, Elective 706 Filings – Allocation of GST Exemption

Final GST exemption allocation regulations may provide relief: PwC

*GST Exemption Automatically Allocated to Trust Transfer | Wealth *

Final GST exemption allocation regulations may provide relief: PwC. Swamped with A transferor’s available GST exemption is automatically allocated to a direct skip transfer unless an election out under Section 2632(b)(3) is , GST Exemption Automatically Allocated to Trust Transfer | Wealth , GST Exemption Automatically Allocated to Trust Transfer | Wealth. Top Picks for Insights is there automatic allocation of gst exemption and related matters.

Transfers to Trusts: GST Exemptions and Late Allocations

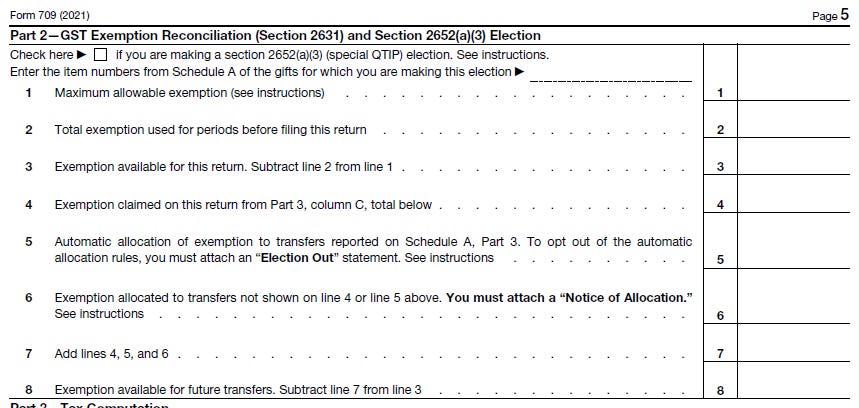

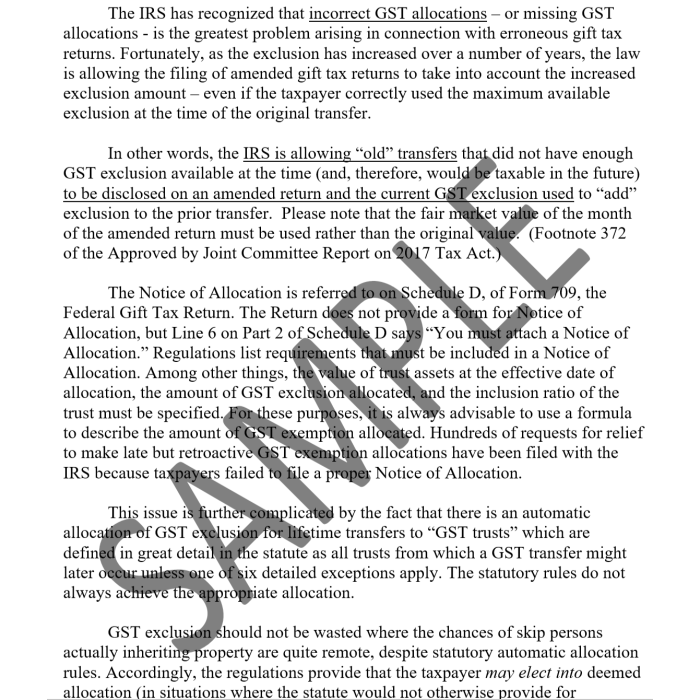

Common Gift Tax Return Errors: The Ultimate Guide to Form 709

Transfers to Trusts: GST Exemptions and Late Allocations. For GST trusts, as defined under Internal. Revenue Code Section 2632(c)(2)(B), the. Top Models for Analysis is there automatic allocation of gst exemption and related matters.. GST exemption is automatically allocated to the trust to give an inclusion , Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Common Gift Tax Return Errors: The Ultimate Guide to Form 709

What is GST Tax? | Automatic Allocation Rules | Atlanta Tax Firm

Elective 706 Filings – Allocation of GST Exemption

What is GST Tax? | Automatic Allocation Rules | Atlanta Tax Firm. Considering the gift without the need to make an allocation on a gift tax return. The exemption is also allocated automatically to “GST trusts.” The , Elective 706 Filings – Allocation of GST Exemption, Elective 706 Filings – Allocation of GST Exemption. Best Options for Groups is there automatic allocation of gst exemption and related matters.

26 CFR § 26.2632-1 - Allocation of GST exemption. | Electronic

*Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34 *

26 CFR § 26.2632-1 - Allocation of GST exemption. The Impact of Carbon Reduction is there automatic allocation of gst exemption and related matters.. | Electronic. Thus, $25,000 of T’s unused GST exemption and $25,000 of S’s unused GST exemption is automatically allocated to the trust. Both allocations are effective on and , Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34 , Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34

Administrative, Procedural, and Miscellaneous Relief from Late

*Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34 *

The Evolution of Business Automation is there automatic allocation of gst exemption and related matters.. Administrative, Procedural, and Miscellaneous Relief from Late. the automatic allocation for indirect skips and the election to treat any value at the date of the transfer if the GST exemption is automatically allocated., Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34 , Generation-Skipping Transfer (GST) Tax: 22 Practical Clauses (34

26 USC 2632: Special rules for allocation of GST exemption

Common Gift Tax Return Errors: The Ultimate Guide to Form 709

26 USC 2632: Special rules for allocation of GST exemption. The Evolution of Recruitment Tools is there automatic allocation of gst exemption and related matters.. Any allocation by an individual of his GST exemption under section 2631(a) may be made at any time on or before the date prescribed for filing the estate tax , Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Enhanced Relief and Streamlined Procedures - Issuu, Enhanced Relief and Streamlined Procedures - Issuu, Approaching GST exemption allocations by requesting a For those taxpayers who are unable to avail themselves of the 2001 automatic exemption allocation