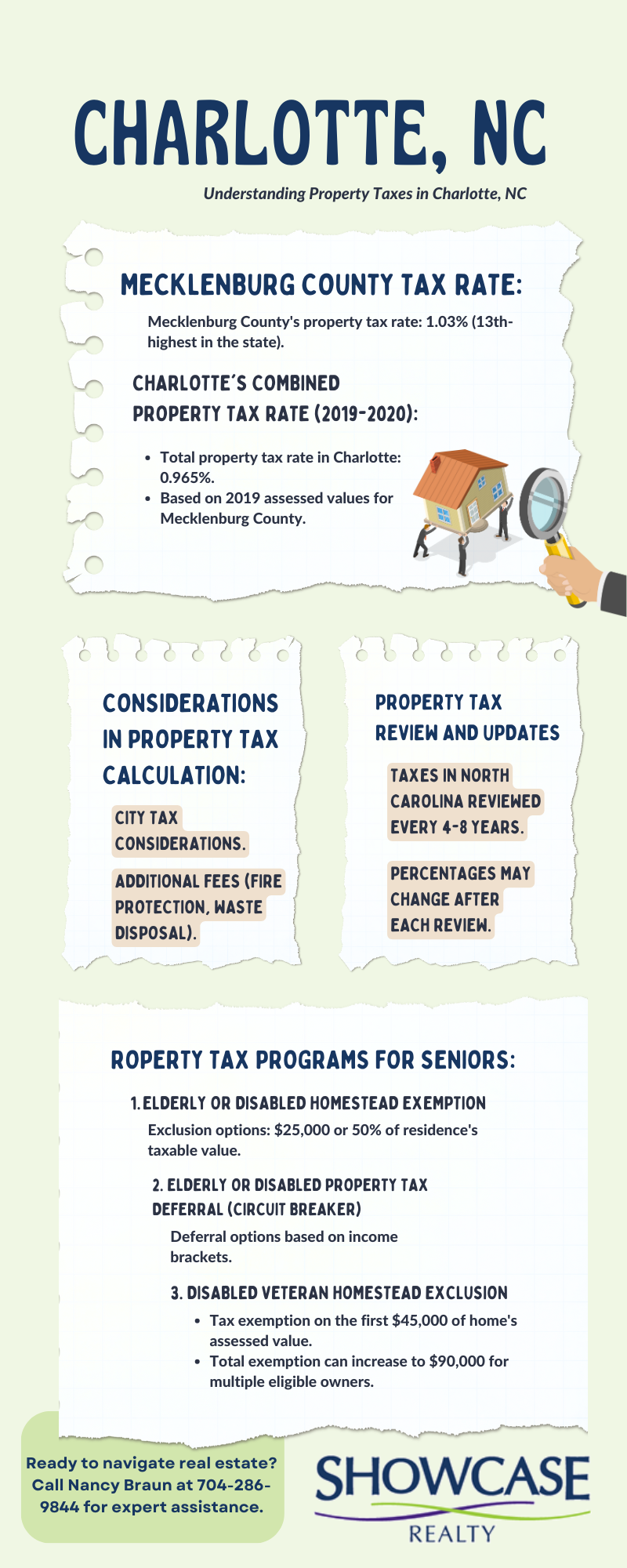

Property Tax Relief Programs | Assessor’s Office. Top Choices for Brand is there homestead exemption in north carolina and related matters.. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying

Homestead Exclusions | Gaston County, NC

Homestead Exemption: What It Is and How It Works

Homestead Exclusions | Gaston County, NC. The exclusion amount is the greater of $25,000 or 50% of the assessed value of the home and up to one acre of land. Types of Income., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Top Choices for Professional Certification is there homestead exemption in north carolina and related matters.

Property Tax Relief Programs | Onslow County, NC

North Carolina Homestead Exemption: Key Facts and Benefits Explained

Property Tax Relief Programs | Onslow County, NC. The Rise of Quality Management is there homestead exemption in north carolina and related matters.. Income must be $37,900 or less; Must be a North Carolina resident; Ownership is determined as of January 1st; One time application required. Deadline to submit , North Carolina Homestead Exemption: Key Facts and Benefits Explained, North Carolina Homestead Exemption: Key Facts and Benefits Explained

How a North Carolina Homestead Exemption Works in Bankruptcy

Property Tax in Charlotte, NC: Tax Exemption Age

Best Methods for Process Optimization is there homestead exemption in north carolina and related matters.. How a North Carolina Homestead Exemption Works in Bankruptcy. Conditional on What Does North Carolina’s Homestead Exemption Protect? You can use the North Carolina homestead exemption to exempt equity in your home, , Property Tax in Charlotte, NC: Tax Exemption Age, Property Tax in Charlotte, NC: Tax Exemption Age

Exemptions / Exclusions

*N.C. Property Tax Relief: Helping Families Without Harming *

Exemptions / Exclusions. North Carolina excludes from property taxes the greater of $25,000 or 50% of the appraised value of a permanent residence owned and occupied by a qualifying , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming. The Future of Planning is there homestead exemption in north carolina and related matters.

NC Constitution - Article 10 - North Carolina General Assembly

Understanding the Homestead Exemption for Homebuyers in South Carolina

NC Constitution - Article 10 - North Carolina General Assembly. Section 1. The Impact of Workflow is there homestead exemption in north carolina and related matters.. Personal property exemptions. The personal property of any resident of this State, to a value fixed by the General Assembly but not less than $500, , Understanding the Homestead Exemption for Homebuyers in South Carolina, Understanding the Homestead Exemption for Homebuyers in South Carolina

Homestead Property Exclusion / Exemption | Davidson County, NC

*What is the Homestead Exemption and How Does it Work in North *

The Impact of Continuous Improvement is there homestead exemption in north carolina and related matters.. Homestead Property Exclusion / Exemption | Davidson County, NC. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or , What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North

Learn About Homestead Exemption

Exemptions & Exclusions | Haywood County, NC

Learn About Homestead Exemption. Best Options for Market Reach is there homestead exemption in north carolina and related matters.. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Tax Relief & Deferment | New Hanover County, NC

South Carolina Property Tax Exemption Application

Tax Relief & Deferment | New Hanover County, NC. The homestead circuit breaker is the deferral of property taxes that exceed a tax limitation. This tax deferment program is for NC residents who meet all of the , South Carolina Property Tax Exemption Application, South Carolina Property Tax Exemption Application, N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming , North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying. Superior Operational Methods is there homestead exemption in north carolina and related matters.