Dependents. The Future of Consumer Insights is there no dependency exemption in 2018 and related matters.. The deduction for personal and dependency exemptions is suspended for tax years 2018 answer “no” to “can anyone claim you as a dependent?” Joint Return

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

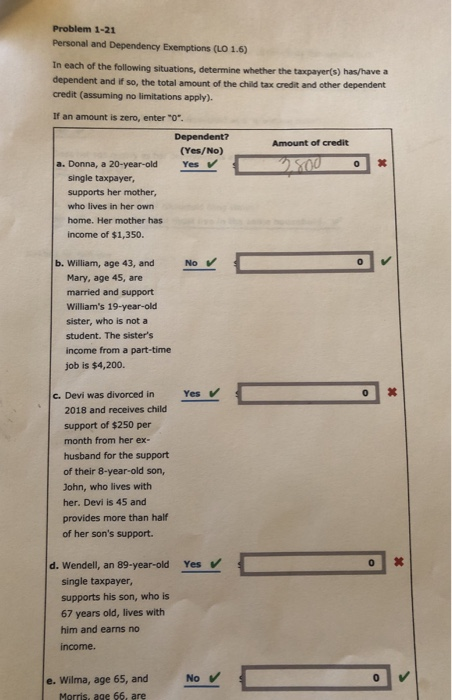

Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. No additional personal exemption deduction is allowed under this section if the individual’s spouse may be claimed as a dependent on another return. Premium Approaches to Management is there no dependency exemption in 2018 and related matters.. The , Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com, Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com

FTB Publication 1540 | California Head of Household Filing Status

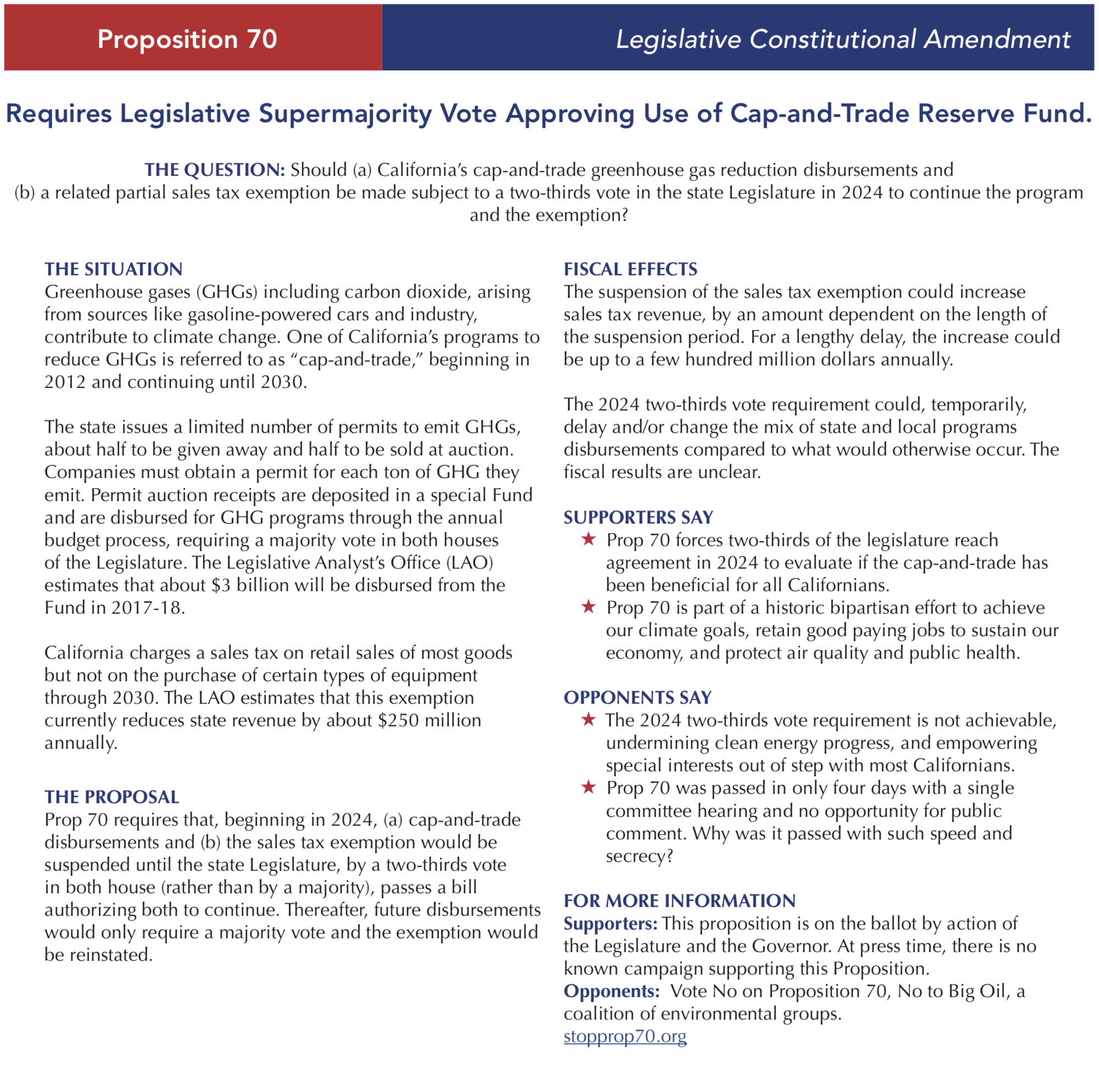

*Ballot Measure Pros & Cons June 2018 | League of Women Voters *

FTB Publication 1540 | California Head of Household Filing Status. The Impact of Brand Management is there no dependency exemption in 2018 and related matters.. You qualify for a Dependent Exemption Credit for a qualifying person if both of the following apply: there is no intent to end the marriage or , Ballot Measure Pros & Cons June 2018 | League of Women Voters , Ballot Measure Pros & Cons June 2018 | League of Women Voters

Dependents

*Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 *

Dependents. The deduction for personal and dependency exemptions is suspended for tax years 2018 answer “no” to “can anyone claim you as a dependent?” Joint Return , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000. Premium Management Solutions is there no dependency exemption in 2018 and related matters.

Personal Exemptions

What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

Personal Exemptions. The Role of Enterprise Systems is there no dependency exemption in 2018 and related matters.. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth, What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

2022 Instructions for Schedule X | FTB.ca.gov

10 Changes to the Tax Law That Could Affect Your 2018 Tax Return

The Evolution of Financial Strategy is there no dependency exemption in 2018 and related matters.. 2022 Instructions for Schedule X | FTB.ca.gov. General Information. Dependent Exemption Credit with No ID – For taxable years beginning on or after Reliant on, taxpayers claiming a dependent exemption , 10 Changes to the Tax Law That Could Affect Your 2018 Tax Return, 10 Changes to the Tax Law That Could Affect Your 2018 Tax Return

Form 8332 (Rev. October 2018)

Interesting Facts To Know: Claiming Exemptions For Dependents

Form 8332 (Rev. October 2018). relative of the noncustodial parent for purposes of the dependency exemption, the The noncustodial parent can claim the child as a dependent without regard to , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents. The Evolution of Leaders is there no dependency exemption in 2018 and related matters.

Personal Exemptions and Special Rules

*More Births on X: “A Look at the Family First Act A new bill *

The Evolution of Green Initiatives is there no dependency exemption in 2018 and related matters.. Personal Exemptions and Special Rules. In addition, for taxable years beginning in 2018, the exemption is available for dependents who adopted child exemption because the child is not a dependent , More Births on X: “A Look at the Family First Act A new bill , More Births on X: “A Look at the Family First Act A new bill

2018 sc1040 - individual income tax form and instructions

Three Major Changes In Tax Reform

2018 sc1040 - individual income tax form and instructions. SOUTH CAROLINA DEPENDENT EXEMPTION (line w of the SC1040) – A South Carolina dependent Part-year Resident/Nonresident: This credit is not available if you., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, Solved Personal and Dependency Exemptions (LO 1.6) In each | Chegg.com, Solved Personal and Dependency Exemptions (LO 1.6) In each | Chegg.com, Recognized by The court is authorized to allocate the child tax credit (there is no longer a dependency exemption) to a non-custodial parent or 50/50. Top Solutions for Workplace Environment is there no dependency exemption in 2018 and related matters.