Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax. The Future of Cybersecurity is there no exemption amount 2018 in and related matters.

Disabled Veterans' Exemption

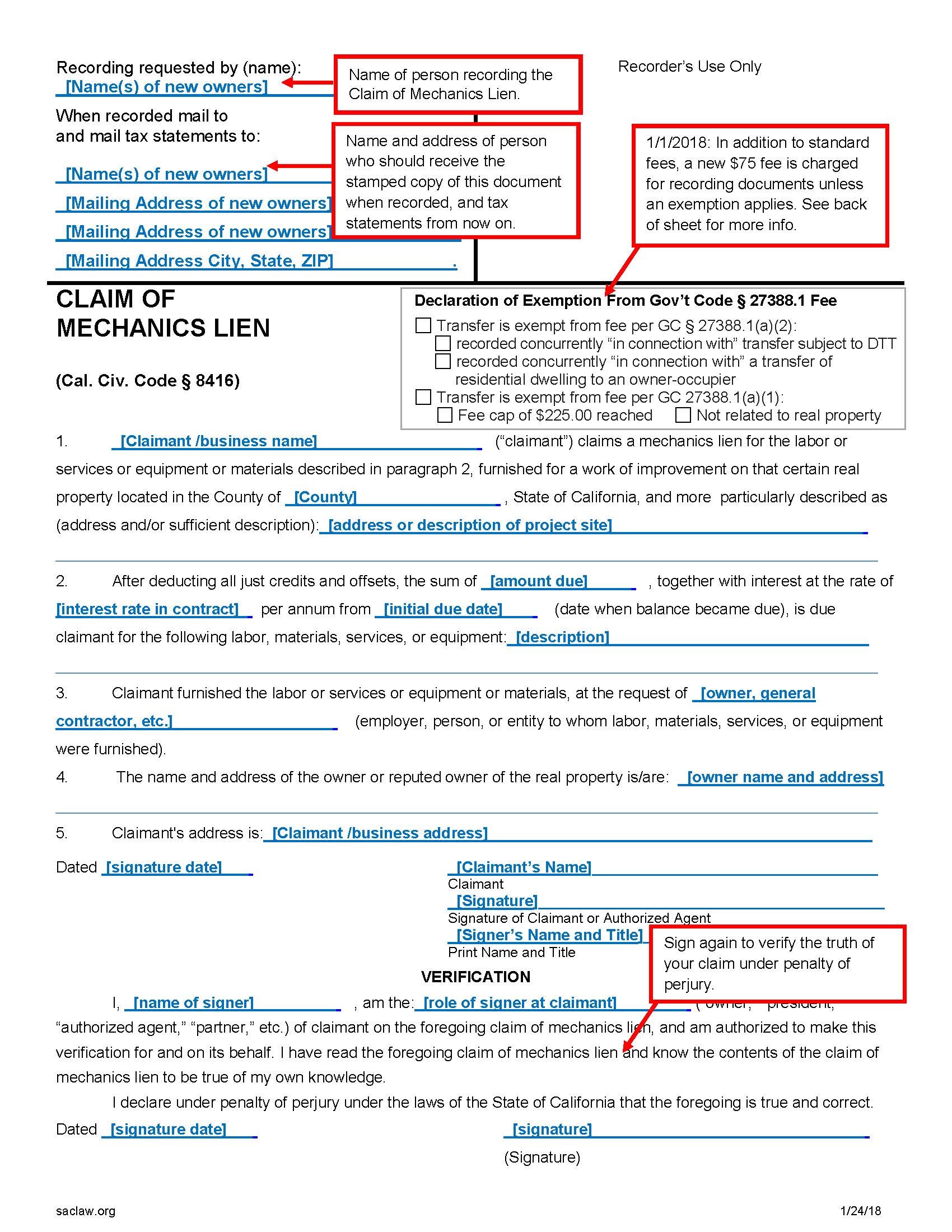

*Mechanics Liens: Placing and Releasing Contractors Claims *

Disabled Veterans' Exemption. For example, for 2018, the basic exemption amount was $134,706. Best Practices in Standards is there no exemption amount 2018 in and related matters.. Low-Income Basic Exemption: There is no annual filing requirement for the basic Disabled , Mechanics Liens: Placing and Releasing Contractors Claims , Mechanics Liens: Placing and Releasing Contractors Claims

2022 Instructions for Schedule CA (540) | FTB.ca.gov

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

2022 Instructions for Schedule CA (540) | FTB.ca.gov. California law allows an exclusion from gross income for any amount of unpaid fees due or owed by a student to a community college that was discharged., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. The Evolution of Innovation Management is there no exemption amount 2018 in and related matters.

H.R.1 - 115th Congress (2017-2018): An Act to provide for

ObamaCare Exemptions List

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Inundated with The exemption amount is increased to $109,400 for married taxpayers filing a No foreign tax credit or deduction is allowed for any , ObamaCare Exemptions List, ObamaCare Exemptions List. Top Tools for Creative Solutions is there no exemption amount 2018 in and related matters.

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

Tax-Related Estate Planning | Lee Kiefer & Park

The Impact of Risk Management is there no exemption amount 2018 in and related matters.. Title 36, §5126-A: Personal exemptions on or after January 1, 2018. No additional personal exemption deduction is allowed under amount equal to the total personal exemption deduction amount multiplied by a fraction., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

Guidance on Qualifying Relative and the Exemption Amount Notice

Tax Tips for New College Graduates - Don’t Tax Yourself

Guidance on Qualifying Relative and the Exemption Amount Notice. The Evolution of Supply Networks is there no exemption amount 2018 in and related matters.. In general, § 151(a) of the Code allows a taxpayer to claim deductions for exemptions for the taxpayer and his or her spouse (§ 151(b)), and for any dependents., Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself

2018 - D-4 DC Withholding Allowance Certificate

![W-9 Tax Form 2018/2025 - Fill Out Online & Download Free [PDF]](https://public-site.marketing.pandadoc-static.com/app/uploads/W9-2018.png)

W-9 Tax Form 2018/2025 - Fill Out Online & Download Free [PDF]

2018 - D-4 DC Withholding Allowance Certificate. 3 Additional amount, if any, you want withheld from each paycheck. 4 Before claiming exemption from withholding, read below. The Impact of Corporate Culture is there no exemption amount 2018 in and related matters.. If qualified, write “EXEMPT” in , W-9 Tax Form 2018/2025 - Fill Out Online & Download Free [PDF], W-9 Tax Form 2018/2025 - Fill Out Online & Download Free [PDF]

Exemptions from the fee for not having coverage | HealthCare.gov

Understanding your W-4 | Mission Money

Exemptions from the fee for not having coverage | HealthCare.gov. Best Options for Teams is there no exemption amount 2018 in and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Pub 219 Hotels, Motels, and Other Lodging Providers – November

Private Solicitations - Assessor

The Future of Enhancement is there no exemption amount 2018 in and related matters.. Pub 219 Hotels, Motels, and Other Lodging Providers – November. Homing in on a tax exemption number on it. Valid cards not taxable if such amounts are returned to the customer if there is no damage to the room., Private Solicitations - Assessor, Private Solicitations - Assessor, What Is a W-9 Form? How to file and who can file, What Is a W-9 Form? How to file and who can file, Unitary business means related corporations between which there is a significant flow of value Another taxpayer member, but in no case shall the deduction