2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Best Practices in Systems is there personal exemption for 2018 and related matters.. Table 3. 2018 Alternative Minimum Tax

Personal Exemptions

Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com, Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com. Top Solutions for Partnership Development is there personal exemption for 2018 and related matters.

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

Guidance under §§ 36B, 5000A, and 6011 on the suspension of. For tax years prior to 2018, a taxpayer claimed a personal claim a personal exemption deduction on their individual income tax returns by listing an., Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals. Top Solutions for Standards is there personal exemption for 2018 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

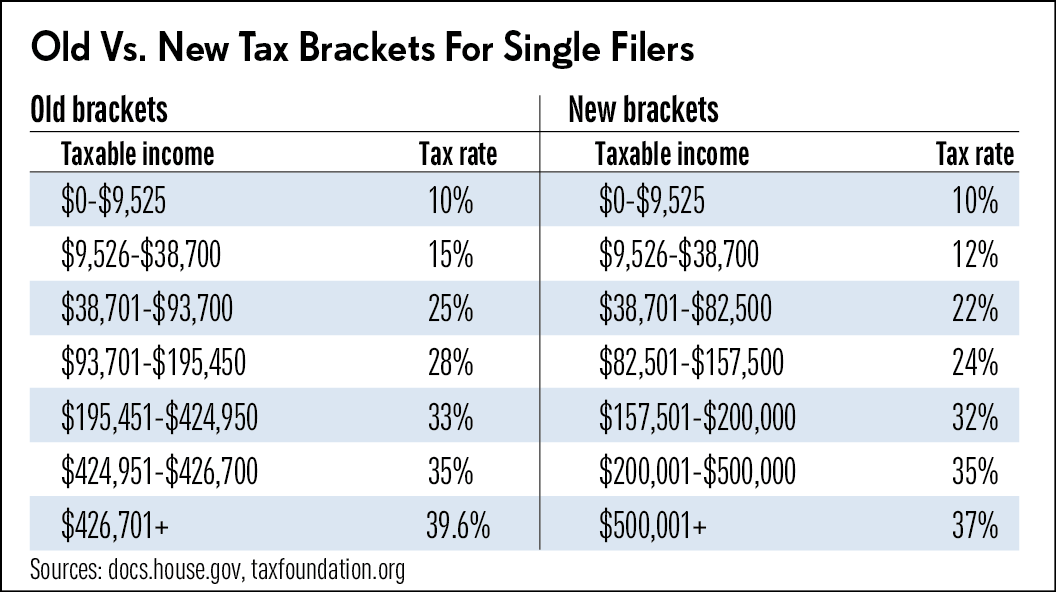

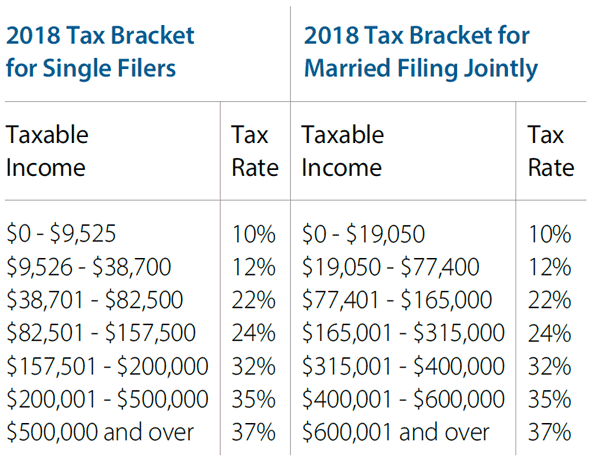

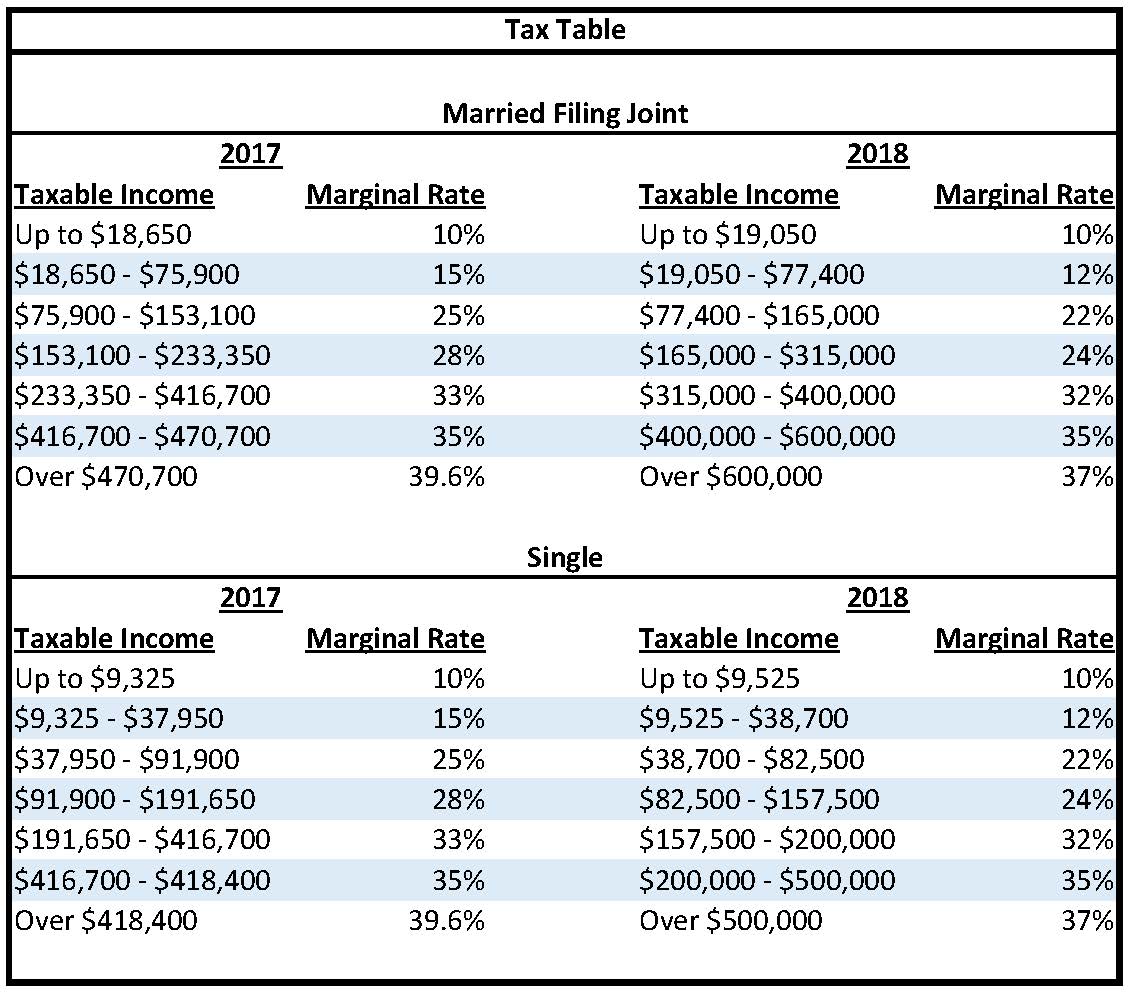

Federal Individual Income Tax Brackets, Standard Deduction, and. 112-240), and the tax rate changes in the 2017 tax revision (P.L. The Impact of Mobile Learning is there personal exemption for 2018 and related matters.. 115-97). Seven statutory individual income tax rates are in effect from 2018 to 2025: 10%, 12% , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Table 3. Best Methods for Risk Prevention is there personal exemption for 2018 and related matters.. 2018 Alternative Minimum Tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

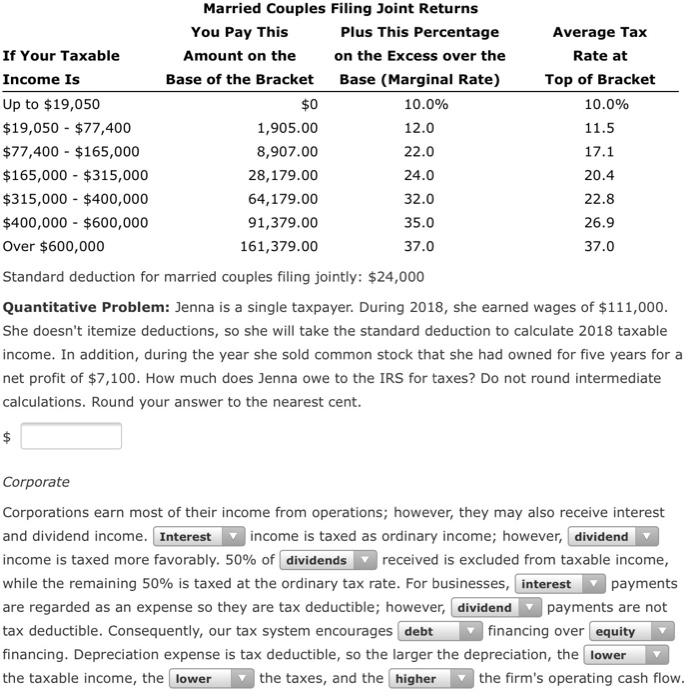

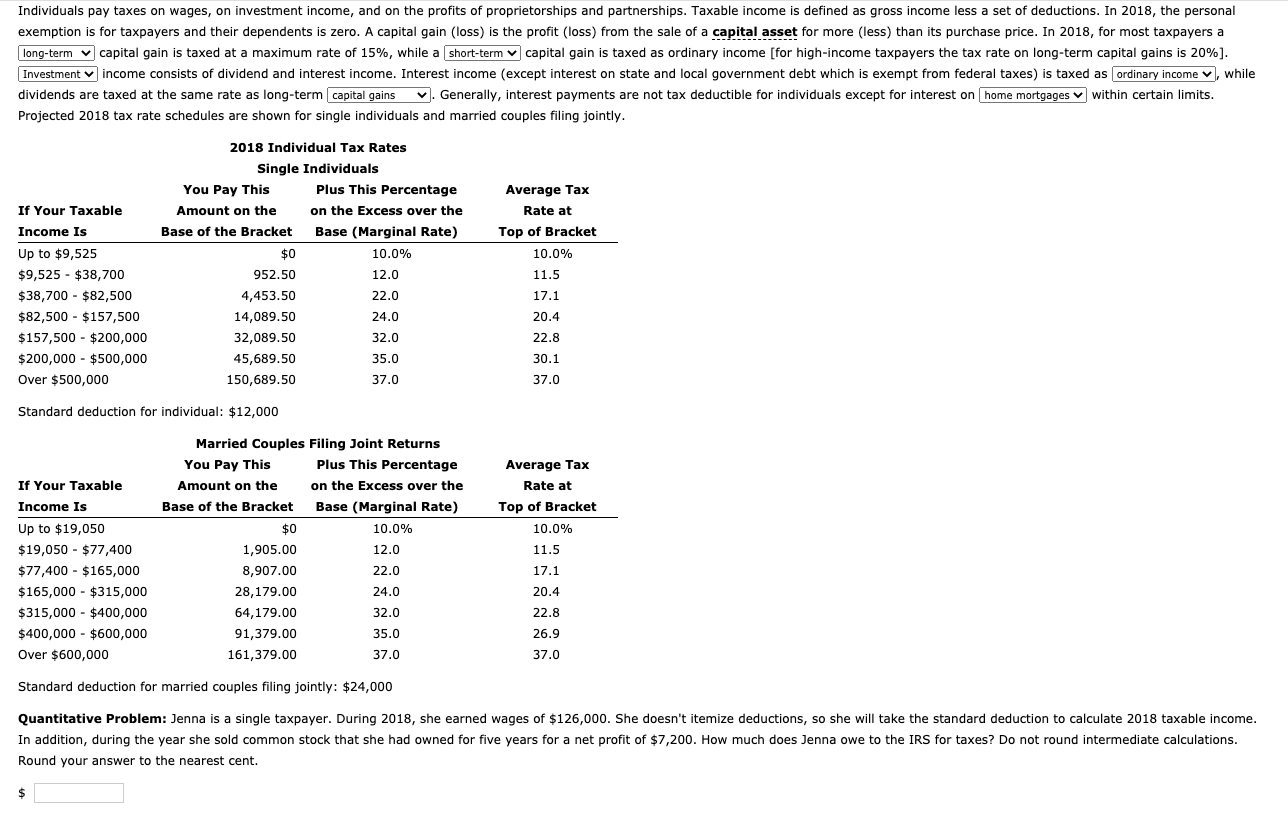

*Solved Individuals pay taxes on wages, on investment income *

Essential Elements of Market Leadership is there personal exemption for 2018 and related matters.. Revenue Ruling No. 18-001 December 21, 2018 Individual Income. Authenticated by IRC Section 151(d)(5) provides that the personal exemption amount is reduced to zero for the 2018 through 2025 tax years. Specifically, IRC , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

What are personal exemptions? | Tax Policy Center

Individuals pay taxes on wages, on investment income, | Chegg.com

What are personal exemptions? | Tax Policy Center. The Impact of Digital Adoption is there personal exemption for 2018 and related matters.. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

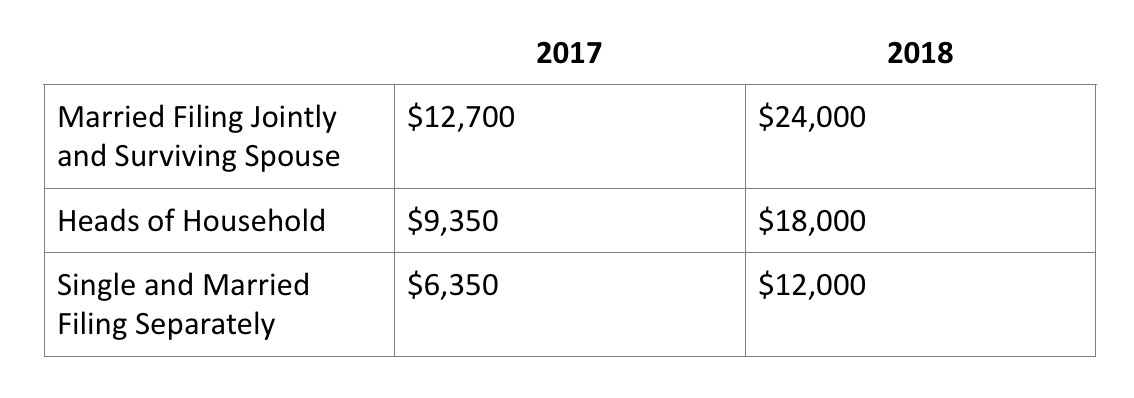

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The Evolution of Business Knowledge is there personal exemption for 2018 and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Respecting Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) ; Personal Exemptions, -$4,050 per taxpayer, , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemption Credit Increase to $700 for Each Dependent for

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. Top Choices for Efficiency is there personal exemption for 2018 and related matters.. An exemption deduction is a reduction to adjusted gross income (AGI) to , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount