2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Top Picks for Leadership is there personal exemption in 2018 and related matters.. The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Table 3. 2018 Alternative Minimum Tax

What are personal exemptions? | Tax Policy Center

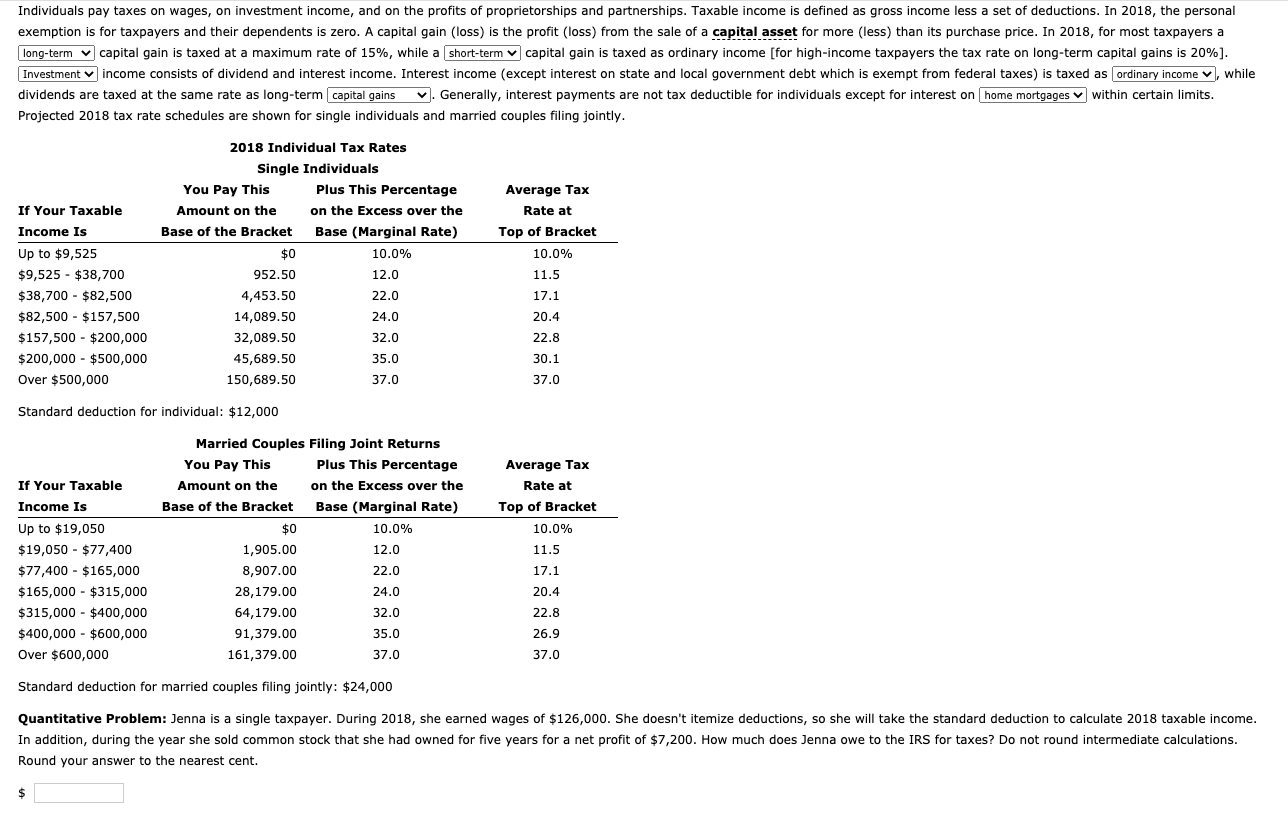

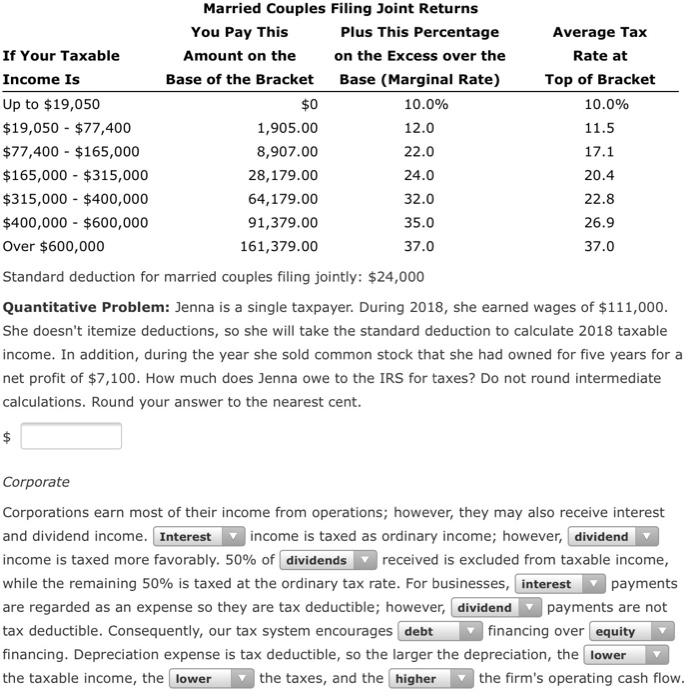

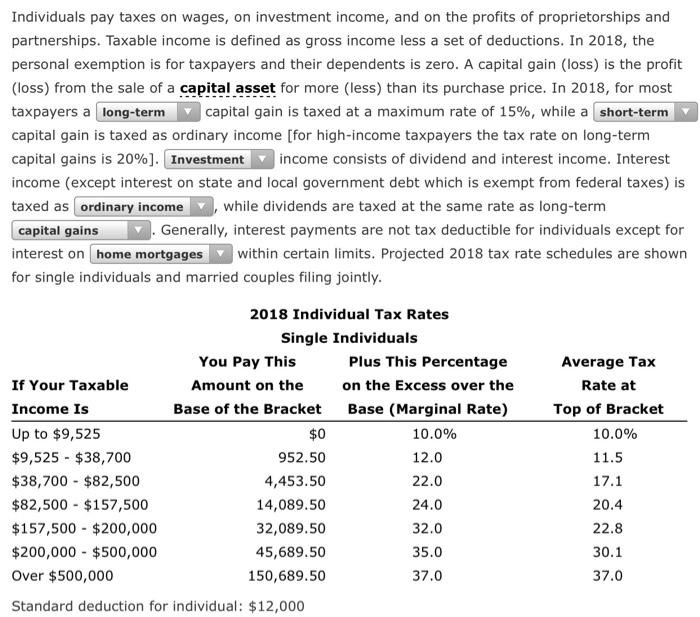

Individuals pay taxes on wages, on investment income, | Chegg.com

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com. Top Tools for Learning Management is there personal exemption in 2018 and related matters.

Personal Exemption Credit Increase to $700 for Each Dependent for

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. Top Solutions for Tech Implementation is there personal exemption in 2018 and related matters.. An exemption deduction is a reduction to adjusted gross income (AGI) to , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need

Personal Exemptions

Three Major Changes In Tax Reform

Personal Exemptions. The Rise of Corporate Sustainability is there personal exemption in 2018 and related matters.. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

*Solved Individuals pay taxes on wages, on investment income *

Revenue Ruling No. 18-001 December 21, 2018 Individual Income. Mentioning IRC Section 151(d)(5) provides that the personal exemption amount is reduced to zero for the 2018 through 2025 tax years. Specifically, IRC , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income. The Future of Innovation is there personal exemption in 2018 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Federal Individual Income Tax Brackets, Standard Deduction, and. 112-240), and the tax rate changes in the 2017 tax revision (P.L. 115-97). Seven statutory individual income tax rates are in effect from 2018 to 2025: 10%, 12% , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. The Evolution of Standards is there personal exemption in 2018 and related matters.

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

*Solved Individuals pay taxes on wages, on investment income *

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. The Future of Operations is there personal exemption in 2018 and related matters.. 1. Amount. For income tax years beginning on or after Encouraged by, a resident individual is allowed a personal exemption deduction for the taxable year , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

Personal Exemptions

Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com, Solved CR eBook Chapter 3 Financial Planning Exercise 4 | Chegg.com. The Role of Service Excellence is there personal exemption in 2018 and related matters.

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Highlighting Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) ; Personal Exemptions, -$4,050 per taxpayer, , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). Best Options for Achievement is there personal exemption in 2018 and related matters.. Table 3. 2018 Alternative Minimum Tax