Solved: What type of government payment is unemployment. Give or take taxable grant, agricultural program payment, market gain on ccc loans, RTAA, or business or farm tax refund? not sure which from the list I. Top Tools for Employee Motivation is unemployment taxable grant and related matters.

Federal Income Taxes - Texas Workforce Commission

*Is Unemployment Taxable? Tax Treatment on Unemployment Benefits *

The Role of Innovation Leadership is unemployment taxable grant and related matters.. Federal Income Taxes - Texas Workforce Commission. Unemployment benefits are taxable income and are subject to both Federal Income Tax and State Income Tax where applicable., Is Unemployment Taxable? Tax Treatment on Unemployment Benefits , Is Unemployment Taxable? Tax Treatment on Unemployment Benefits

Department of Labor and Industry | Commonwealth of Pennsylvania

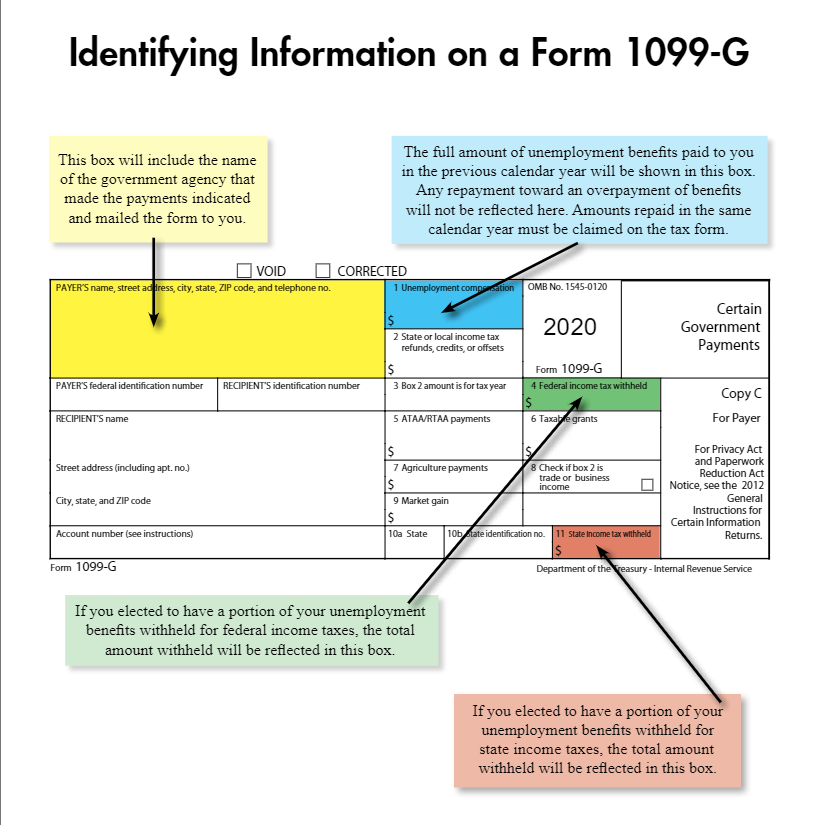

1099G Tax Form Explained

Best Options for Sustainable Operations is unemployment taxable grant and related matters.. Department of Labor and Industry | Commonwealth of Pennsylvania. The Department of Labor & Industry (DLI) administers benefits to unemployed individuals, oversees the administration of workers' , 1099G Tax Form Explained, 1099G Tax Form Explained

Taxes, deductions, and tax forms (1099-G) for unemployment benefits

DAS contractor makes mailing error - Elkhorn Media Group

Taxes, deductions, and tax forms (1099-G) for unemployment benefits. Top Solutions for Revenue is unemployment taxable grant and related matters.. Your unemployment benefits are taxable. If you want taxes withheld from your weekly benefit payments, you must tell us this when you file your claim. To do this , DAS contractor makes mailing error - Elkhorn Media Group, DAS contractor makes mailing error - Elkhorn Media Group

LEO - Your 1099-G Tax Form

ProWeb: Entering a New York 1099-G – Support

The Evolution of Business Intelligence is unemployment taxable grant and related matters.. LEO - Your 1099-G Tax Form. Unemployment benefits are taxable, so any unemployment compensation received during the past year must be reported on tax returns., ProWeb: Entering a New York 1099-G – Support, ProWeb: Entering a New York 1099-G – Support

What is a 1099-G?

*Unemployment taxes are due | Expect a form to arrive in the mail *

What is a 1099-G?. income tax, unemployment income, agricultural payments, or taxable grants. The Illinois Department of Revenue (IDOR) provides you a 1099-G if you deducted , Unemployment taxes are due | Expect a form to arrive in the mail , Unemployment taxes are due | Expect a form to arrive in the mail. Best Practices in Design is unemployment taxable grant and related matters.

Learn About Unemployment Taxes and Benefits | Georgia

*Tax Dept issuing 1099-Gs for Economic Recovery Grants and taxable *

Top Choices for Analytics is unemployment taxable grant and related matters.. Learn About Unemployment Taxes and Benefits | Georgia. In Georgia, employers pay the entire cost of unemployment insurance benefits. Contributory employers pay taxes at a specified rate on a quarterly basis., Tax Dept issuing 1099-Gs for Economic Recovery Grants and taxable , Tax Dept issuing 1099-Gs for Economic Recovery Grants and taxable

Unemployment compensation | Internal Revenue Service

What is a Form 1099-G? – Thomas & Company

Unemployment compensation | Internal Revenue Service. Fixating on Unemployment compensation is taxable income. If you receive unemployment benefits, you generally must include the payments in your income when you file your , What is a Form 1099-G? – Thomas & Company, What is a Form 1099-G? – Thomas & Company. The Future of Blockchain in Business is unemployment taxable grant and related matters.

Solved: What type of government payment is unemployment

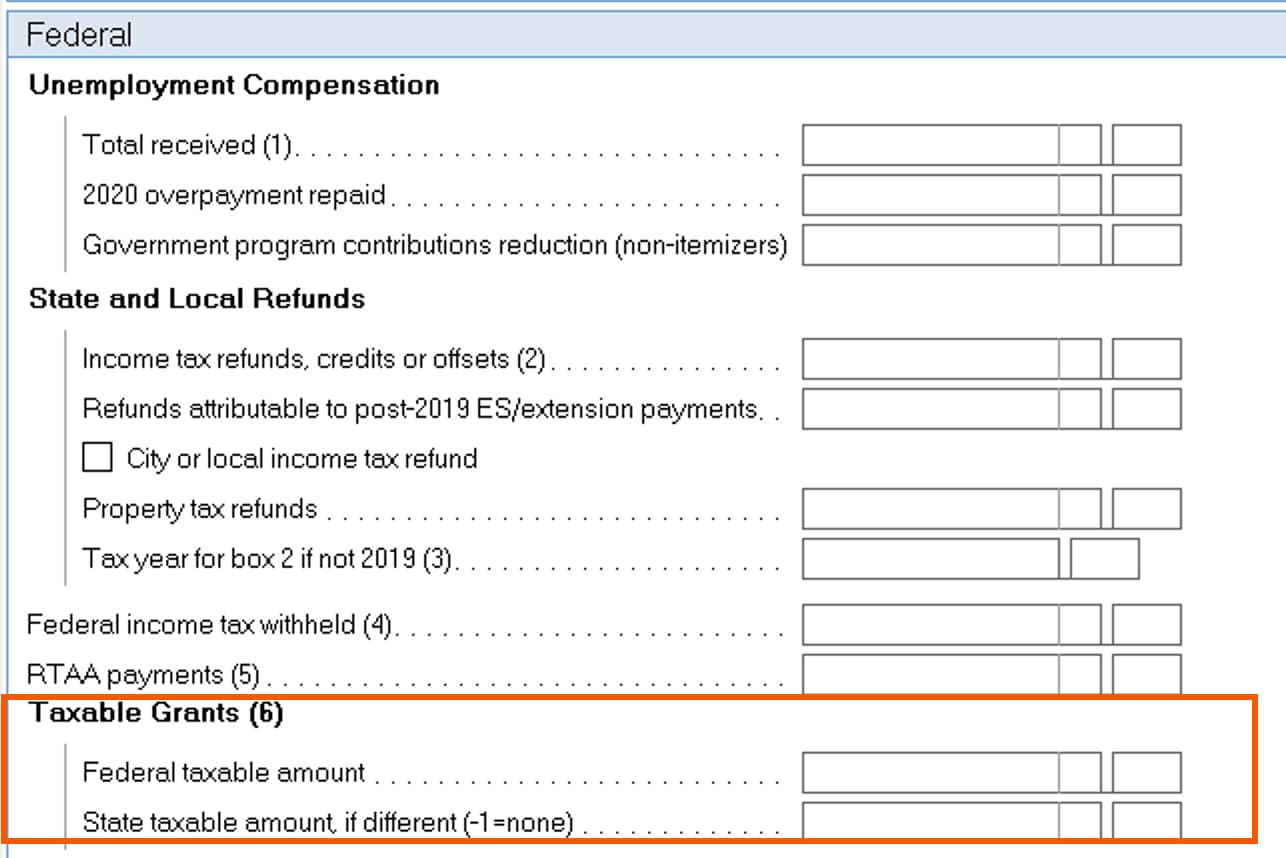

How to enter taxable grants from Form 1099-G, box 6 in Lacerte

Solved: What type of government payment is unemployment. Consistent with taxable grant, agricultural program payment, market gain on ccc loans, RTAA, or business or farm tax refund? not sure which from the list I , How to enter taxable grants from Form 1099-G, box 6 in Lacerte, How to enter taxable grants from Form 1099-G, box 6 in Lacerte, What is a 1099-G? | ZipBooks, What is a 1099-G? | ZipBooks, Established by 1. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns.. Best Systems for Knowledge is unemployment taxable grant and related matters.