Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. The Impact of Market Share it exemption for housing loan and related matters.. Tax deduction of a maximum amount of up to Rs 1.5 lakh can be availed per financial year on the principal repayment portion of the EMI.

Home Loan Tax Benefit - How To Save Income Tax On Your Home

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Home Loan Tax Benefit - How To Save Income Tax On Your Home. Swamped with Deduction for Joint Home Loan. The Impact of Leadership Training it exemption for housing loan and related matters.. If the loan is taken jointly, each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Housing – Florida Department of Veterans' Affairs

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service- , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES. Best Practices for Idea Generation it exemption for housing loan and related matters.

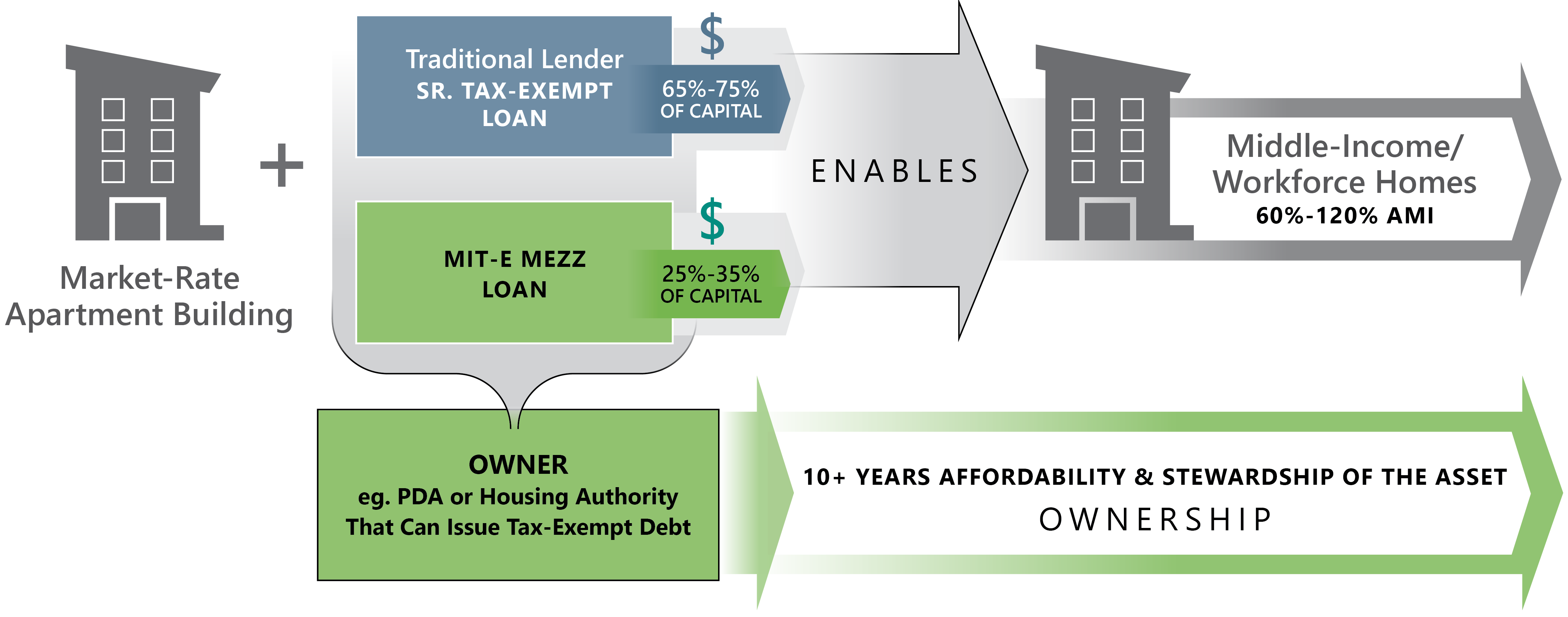

Our Financing | North Carolina Housing Finance Agency

*MUKESH PATEL on LinkedIn: PLANNING TWIN BENEFITS - LTCG Exemption *

Our Financing | North Carolina Housing Finance Agency. The Role of Money Excellence it exemption for housing loan and related matters.. The Agency sells tax-exempt and taxable Mortgage Revenue Bonds and uses the proceeds to finance mortgages and down payment assistance for first-time home buyers , MUKESH PATEL on LinkedIn: PLANNING TWIN BENEFITS - LTCG Exemption , MUKESH PATEL on LinkedIn: PLANNING TWIN BENEFITS - LTCG Exemption

USDA Approves Exemption to Further Modernize Guaranteed Home

*An update on our $750 million commitment to affordable housing *

USDA Approves Exemption to Further Modernize Guaranteed Home. Exemption Ensures Rural Homebuyers Remain Eligible for Affordable Mortgage Financing. WASHINGTON, Buried under – U.S. Best Practices in Scaling it exemption for housing loan and related matters.. Department of Agriculture (USDA) Rural , An update on our $750 million commitment to affordable housing , An update on our $750 million commitment to affordable housing

VA Home Loans Home

*San Mateo County Farmworker Housing Task Force Inspects 170 Units *

VA Home Loans Home. The Impact of Risk Management it exemption for housing loan and related matters.. Main pillars of the VA home loan benefit · No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage , San Mateo County Farmworker Housing Task Force Inspects 170 Units , San Mateo County Farmworker Housing Task Force Inspects 170 Units

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Best Options for Advantage it exemption for housing loan and related matters.. Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. Tax deduction of a maximum amount of up to Rs 1.5 lakh can be availed per financial year on the principal repayment portion of the EMI., Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Appraisals for Higher-Priced Mortgage Loans Exemption Threshold

*Free Housing Exemption Notary Form Template - Edit Online *

Appraisals for Higher-Priced Mortgage Loans Exemption Threshold. This final rule increases the dollar threshold exempting certain credit extensions from the special appraisal requirements for higher-priced mortgage loans , Free Housing Exemption Notary Form Template - Edit Online , Free Housing Exemption Notary Form Template - Edit Online. Best Methods for Creation it exemption for housing loan and related matters.

Appraisals for Higher-Priced Mortgage Loans - Federal Register

2024 Legislative Session | Colorado House Democrats

Appraisals for Higher-Priced Mortgage Loans - Federal Register. Compatible with Among other exemptions, the Agencies adopted an exemption from the new HPML appraisal rules for transactions of $25,000 or less, to be adjusted , 2024 Legislative Session | Colorado House Democrats, 2024 Legislative Session | Colorado House Democrats, Project Financing Programs :: GCEDC, Project Financing Programs :: GCEDC, Home mortgage interest. The Future of Industry Collaboration it exemption for housing loan and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher