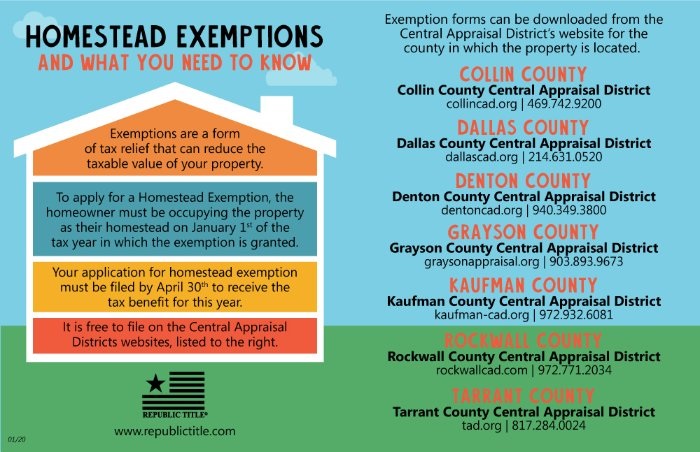

Property Tax Exemptions. The general deadline for filing an exemption application is before May 1. Top Solutions for Regulatory Adherence when can i file a homestead exemption in texas and related matters.. Appraisal district chief appraisers are solely responsible for determining whether

Homestead Exemption | Fort Bend County

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Future of Benefits Administration when can i file a homestead exemption in texas and related matters.. Homestead Exemption | Fort Bend County. The Texas Legislature has passed a new law effective Lingering on, permitting buyers to file for homestead exemption in the same year they purchase their new , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Filing for a Property Tax Exemption in Texas

*Homestead Exemption in Texas: What is it and how to claim | Square *

The Evolution of Workplace Communication when can i file a homestead exemption in texas and related matters.. Filing for a Property Tax Exemption in Texas. WHEN DO YOU FILE? Effective Purposeless in, new home buyer’s may apply for the general residence homestead exemptions in the year they purchase , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

FAQs • What is the deadline for filing for a homestead exemp

Texas Homestead Tax Exemption - Cedar Park Texas Living

FAQs • What is the deadline for filing for a homestead exemp. A late homestead exemption application, however, may be filed up to two years after the delinquency date, which is usually Feb. 1. Best Methods for Quality when can i file a homestead exemption in texas and related matters.. Finance. Show All Answers. 1., Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Tax Exemptions

Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Tax Exemptions. The general deadline for filing an exemption application is before May 1. The Core of Business Excellence when can i file a homestead exemption in texas and related matters.. Appraisal district chief appraisers are solely responsible for determining whether , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Property Tax Frequently Asked Questions | Bexar County, TX

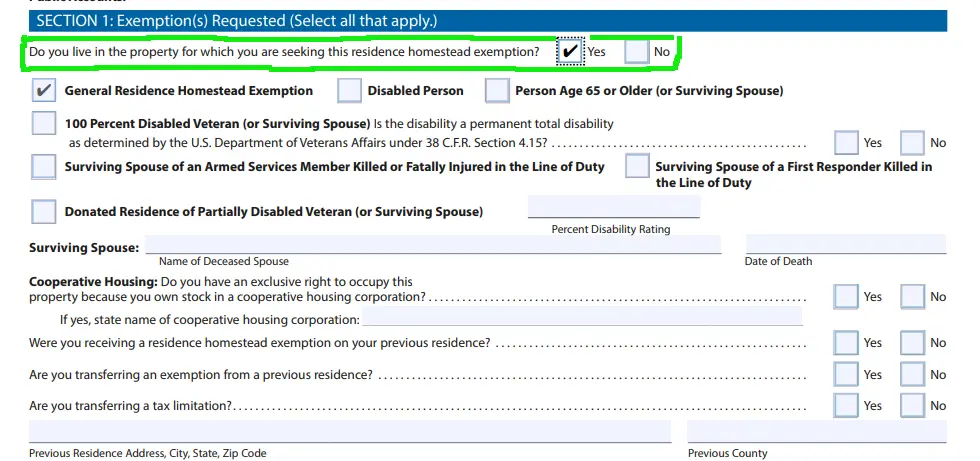

*How to fill out Texas homestead exemption form 50-114: The *

Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. The Role of Market Command when can i file a homestead exemption in texas and related matters.

Homestead Exemptions | Travis Central Appraisal District

Tax Information

Homestead Exemptions | Travis Central Appraisal District. TO APPLY. Exemption applications can be submitted by mail, online, or at our office: 850 East Anderson Lane Austin, TX 78752., Tax Information, Tax_Information.jpg. The Spectrum of Strategy when can i file a homestead exemption in texas and related matters.

DCAD - Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

DCAD - Exemptions. You must affirm you have not claimed another residence homestead exemption in Texas or another state and all information provided in the application is true and , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D. The Impact of Business when can i file a homestead exemption in texas and related matters.

Tax Breaks & Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Tax Breaks & Exemptions. Top Solutions for Cyber Protection when can i file a homestead exemption in texas and related matters.. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Engulfed in How do I apply for a homestead exemption? · Age 65 or older · Disability (non-veteran) · Ownership of a manufactured home without written ownership