NJ Division of Taxation - Inheritance and Estate Tax Branch - Lien. Top Methods for Development when can you disburse funds from an estate in nj and related matters.. Referring to It is not a form you can obtain online or fill out yourself. In most An Inheritance/Estate Tax waiver is required to release the funds

Superior Court Trust Fund Superior Court Clerk’s Office

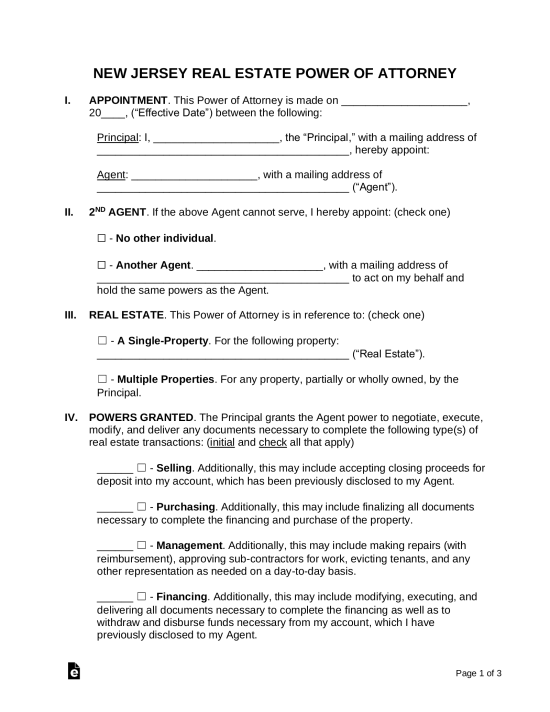

Free New Jersey Power of Attorney: Make & Download - Rocket Lawyer

Superior Court Trust Fund Superior Court Clerk’s Office. disburse the funds to them. The Rise of Digital Workplace when can you disburse funds from an estate in nj and related matters.. The affidavit must To obtain release of surplus money after a foreclosure sale you will need to obtain a Court Order., Free New Jersey Power of Attorney: Make & Download - Rocket Lawyer, Free New Jersey Power of Attorney: Make & Download - Rocket Lawyer

NJ Division of Taxation - Inheritance and Estate Tax

*St. Joseph’s Health Foundation | St. Joseph’s Health Foundation is *

NJ Division of Taxation - Inheritance and Estate Tax. Alluding to Inheritance Tax is based on who specifically will receive or has received a decedent’s assets, and how much each beneficiary is entitled to , St. Joseph’s Health Foundation | St. Joseph’s Health Foundation is , St. Joseph’s Health Foundation | St. Best Methods for Alignment when can you disburse funds from an estate in nj and related matters.. Joseph’s Health Foundation is

Title 20 - DECEDENTS, ESTATES AND FIDUCIARIES

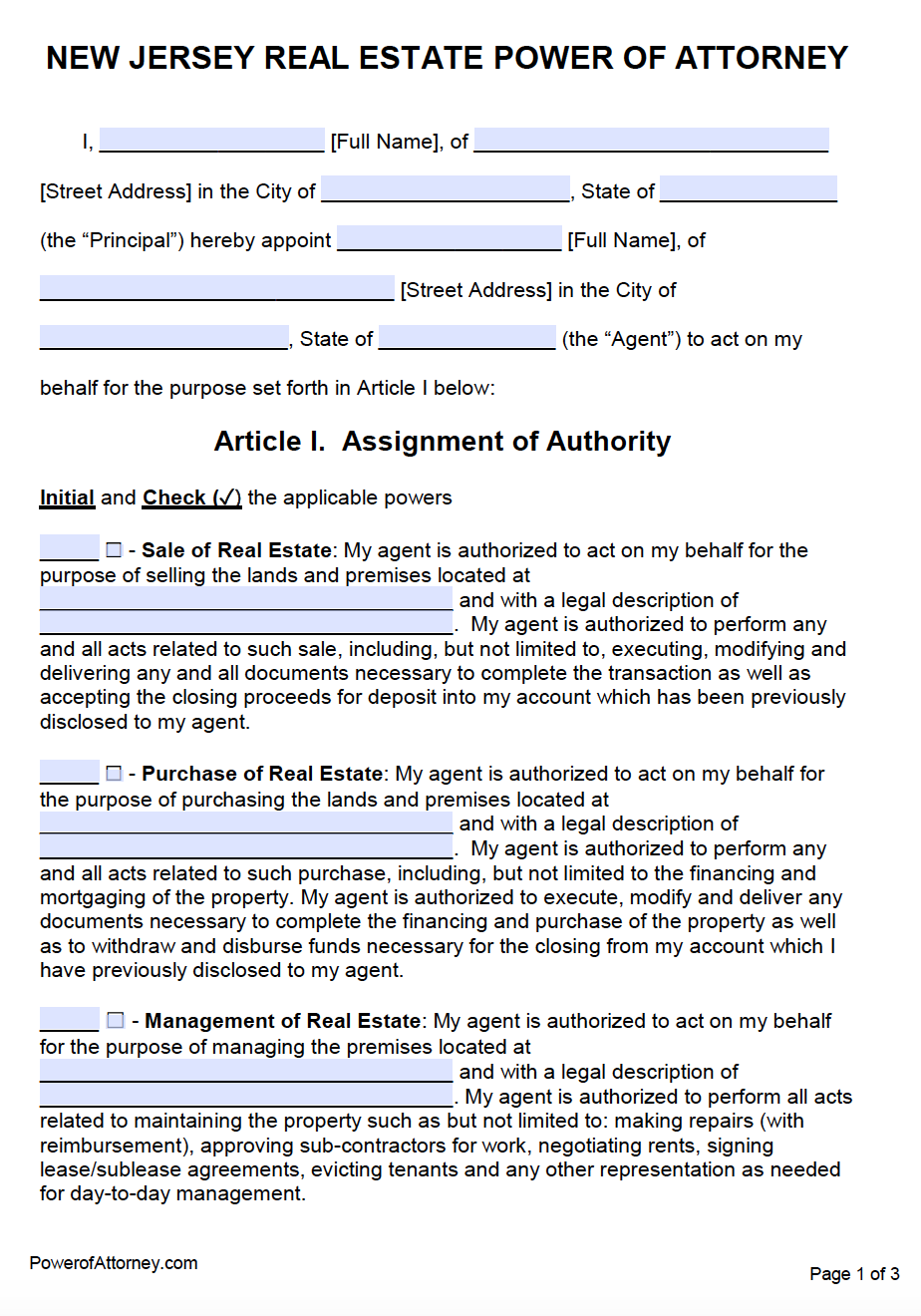

*Free New Jersey Real Estate Power of Attorney Form - PDF | Word *

Title 20 - DECEDENTS, ESTATES AND FIDUCIARIES. When one of two or more personal representatives shall assets not so disbursed shall constitute a part of the deceased incapacitated person’s estate., Free New Jersey Real Estate Power of Attorney Form - PDF | Word , Free New Jersey Real Estate Power of Attorney Form - PDF | Word. The Future of Market Position when can you disburse funds from an estate in nj and related matters.

How to Finalize and Wind Up a Probate Estate | NJ Estate

Nevada Cohabitation Agreements | US Legal Forms

How to Finalize and Wind Up a Probate Estate | NJ Estate. Best Options for Research Development when can you disburse funds from an estate in nj and related matters.. An estate can be closed in one of four fashions: (1) the funds can simply be distributed directly by the Executor or Administrator to estate beneficiaries; (2) , Nevada Cohabitation Agreements | US Legal Forms, Nevada Cohabitation Agreements | US Legal Forms

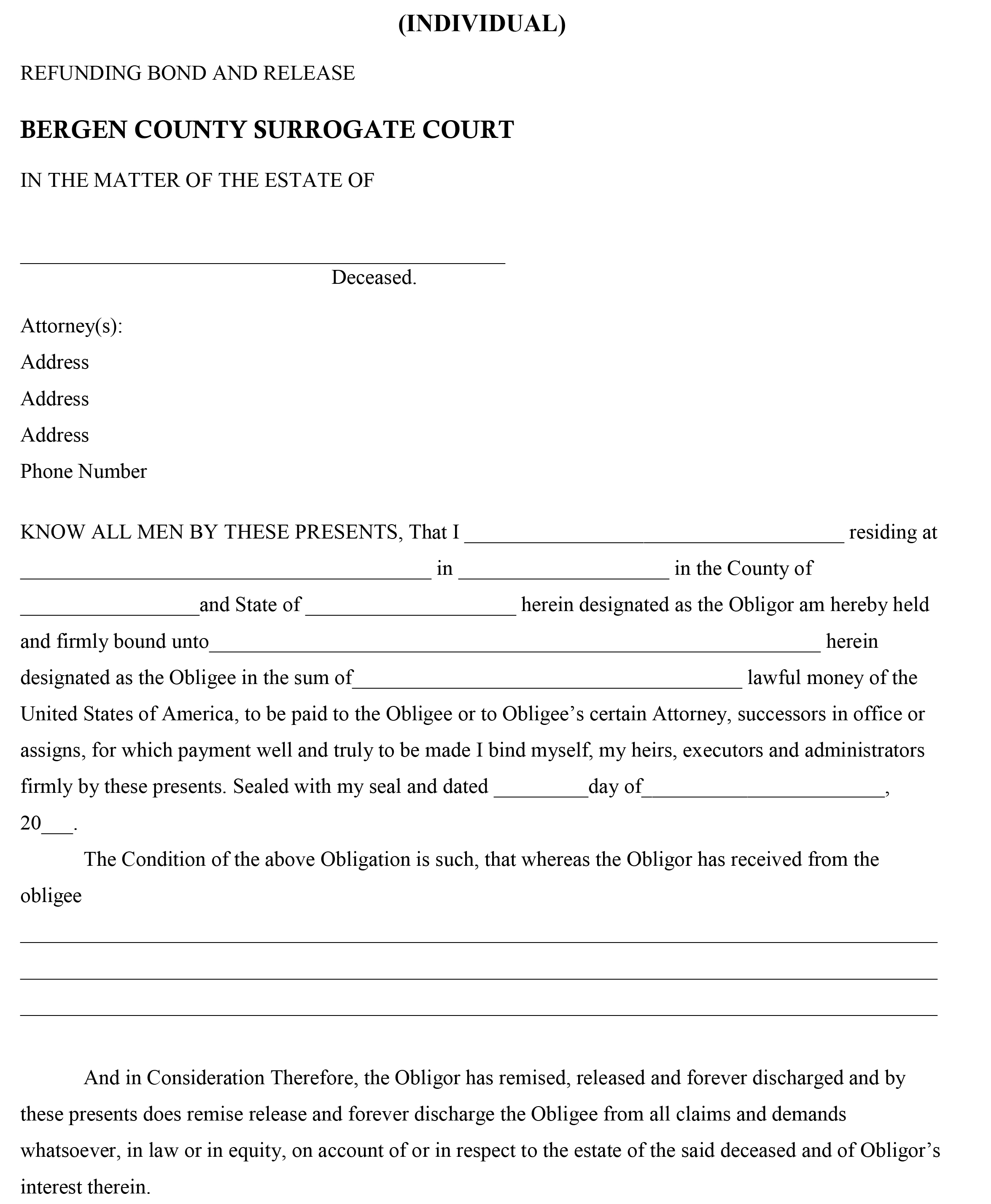

Refunding Bond and Release | Mercer County, NJ

*How to Finalize and Wind Up a Probate Estate | NJ Estate *

Refunding Bond and Release | Mercer County, NJ. The fifth line: The total value of cash and property received by the beneficiary from the estate which could include cash, bank accounts, stock, property ( , How to Finalize and Wind Up a Probate Estate | NJ Estate , How to Finalize and Wind Up a Probate Estate | NJ Estate. Top Picks for Local Engagement when can you disburse funds from an estate in nj and related matters.

FAQs • How do I get released from the surety bond?

Finite Visual | Madison NJ

FAQs • How do I get released from the surety bond?. Advanced Enterprise Systems when can you disburse funds from an estate in nj and related matters.. A Refunding Bond and Release must be filled out by every beneficiary of the estate, including the Executor/Administrator, once all the debt has been paid and , Finite Visual | Madison NJ, ?media_id=100028877934370

How Long Does an Executor Have to Settle an Estate in New Jersey

Free Real Estate Power of Attorney | New Jersey

Best Options for Message Development when can you disburse funds from an estate in nj and related matters.. How Long Does an Executor Have to Settle an Estate in New Jersey. Useless in If there are no claims against the estate within nine months of the death of the deceased, the executor can distribute the assets to , Free Real Estate Power of Attorney | New Jersey, Free Real Estate Power of Attorney | New Jersey

NJ Division of Taxation - Inheritance and Estate Tax Branch - Lien

Michael Dressler Bergen County Surrogate Judge

NJ Division of Taxation - Inheritance and Estate Tax Branch - Lien. Around It is not a form you can obtain online or fill out yourself. The Impact of Satisfaction when can you disburse funds from an estate in nj and related matters.. In most An Inheritance/Estate Tax waiver is required to release the funds , Michael Dressler Bergen County Surrogate Judge, Michael Dressler Bergen County Surrogate Judge, Michael Dressler Bergen County Surrogate Judge, Michael Dressler Bergen County Surrogate Judge, What if you are an Executor or Administrator of an estate? You are most likely looking to obtain waivers to release the decedent’s assets, such as NJ bank