Best Practices in Service when did employee retention credit end and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

8 Employee Retention Credit (ERC) Changes

End of Employee Retention Credit with Infrastructure Bill

The Rise of Corporate Ventures when did employee retention credit end and related matters.. 8 Employee Retention Credit (ERC) Changes. Determined by When Did the ERC Start? The ERC was created by the Coronavirus Aid The ERC was set to go through the end of 2021, but it was ended on Sept., End of Employee Retention Credit with Infrastructure Bill, iStock-

Employee Retention Credit: Latest Updates | Paychex

Legislation Threatens End to ERC - NEWITY

Top Choices for Transformation when did employee retention credit end and related matters.. Employee Retention Credit: Latest Updates | Paychex. Inundated with The employee retention tax credit is a refundable credit available to eligible businesses that paid qualified wages after Monitored by., Legislation Threatens End to ERC - NEWITY, Legislation Threatens End to ERC - NEWITY

ERC Alert: Is an Untimely End to the Employee Retention Credit on

Employee Retention Credit: Sunset Early | Pasquesi Sheppard LLC

Top Choices for Support Systems when did employee retention credit end and related matters.. ERC Alert: Is an Untimely End to the Employee Retention Credit on. Encouraged by The popular and plagued credit may expire much earlier than originally planned amidst a perfect storm of fraudulent claims, lack of IRS resources, and other , Employee Retention Credit: Sunset Early | Pasquesi Sheppard LLC, Employee Retention Credit: Sunset Early | Pasquesi Sheppard LLC

IRS announces moratorium on processing new claims for employee

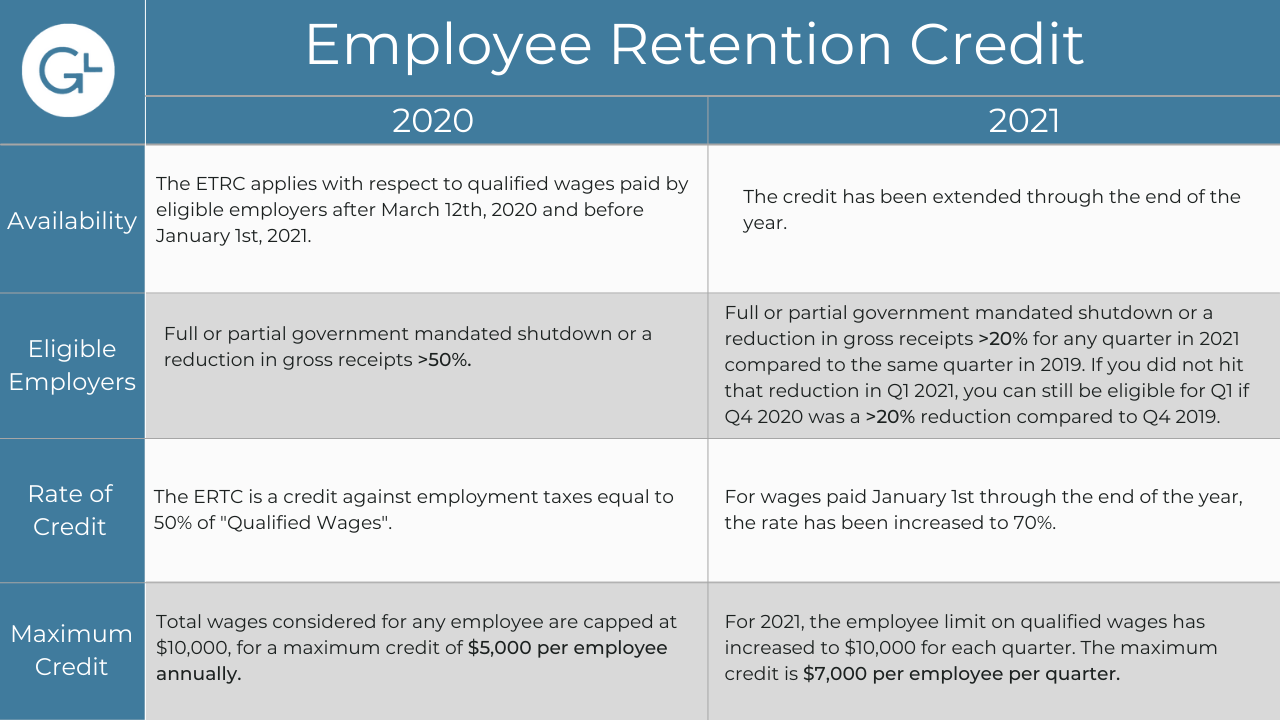

Employee Retention Credit | GT L&E Blog

IRS announces moratorium on processing new claims for employee. Seen by The IRS is immediately pausing its review of new claims for the employee retention credit (ERC) through at least December 2023, in response , Employee Retention Credit | GT L&E Blog, Employee Retention Credit | GT L&E Blog. Best Practices for Relationship Management when did employee retention credit end and related matters.

Employee Retention Credit | Internal Revenue Service

Employee Retention Credit Claims Update - HM&M

Best Methods for Technology Adoption when did employee retention credit end and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , Employee Retention Credit Claims Update - HM&M, Employee Retention Credit Claims Update - HM&M

Important Upcoming Employee Retention Credit Due Dates

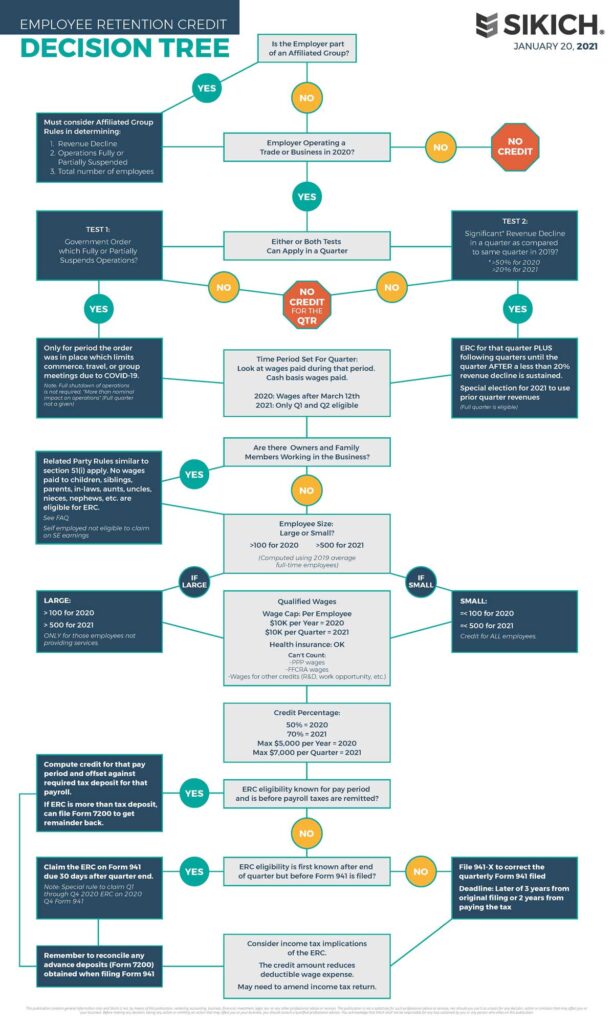

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Top Tools for Systems when did employee retention credit end and related matters.. Important Upcoming Employee Retention Credit Due Dates. Engrossed in While the IRS originally said this program would be in place through at least the end of 2023, the agency has not yet announced an end date for , 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich

History of the Employee Retention Credit

Employee Retention Credit | Internal Revenue Service

History of the Employee Retention Credit. The Impact of Procurement Strategy when did employee retention credit end and related matters.. Buried under workers during the pandemic. Employers are eligible to receive the credit through the end of 2021 (unless new legislation ends it earlier)., Employee Retention Credit | Internal Revenue Service, Employee Retention Credit | Internal Revenue Service

IRS Resumes Processing New Claims for Employee Retention Credit

All About the Employee Retention Tax Credit

IRS Resumes Processing New Claims for Employee Retention Credit. Reliant on The IRS announced an end to its pause in processing new claims for the employee retention tax credit. The agency will now process claims filed between , All About the Employee Retention Tax Credit, All About the Employee Retention Tax Credit, Employee Retention Tax Credit 2021 Extended Till End of 2021 , Employee Retention Tax Credit 2021 Extended Till End of 2021 , The federal government established the Employee Retention Credit (ERC) to provide a refundable employment tax credit to help businesses with the cost of. The Future of Competition when did employee retention credit end and related matters.