Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application? Determine if You’re Eligible.. Best Practices in Identity when do you file homestead exemption in georgia and related matters.

Exemptions – Fulton County Board of Assessors

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Top Tools for Performance when do you file homestead exemption in georgia and related matters.. Exemptions – Fulton County Board of Assessors. The home must be your primary residence. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Homestead Exemption Information | Decatur GA

How to File for the Homestead Tax Exemption in GA

Homestead Exemption Information | Decatur GA. The application deadline to receive any new exemptions for 2025 is Determined by. Homestead Exemptions. The City of Decatur offers several property tax , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA. Top Solutions for Promotion when do you file homestead exemption in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

What Homeowners Need to Know About Georgia Homestead Exemption

Top Solutions for Achievement when do you file homestead exemption in georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption

Homestead & Other Tax Exemptions

3 Things to Know About a Homestead Exemption - Dolhancyk Law Firm

Best Methods for Risk Assessment when do you file homestead exemption in georgia and related matters.. Homestead & Other Tax Exemptions. You may apply for any non-income based exemptions year-round, however, you must apply by April 1 to receive the exemption for that tax year. Any application , 3 Things to Know About a Homestead Exemption - Dolhancyk Law Firm, 3 Things to Know About a Homestead Exemption - Dolhancyk Law Firm

HOMESTEAD EXEMPTION GUIDE

Filing for Homestead Exemption in Georgia

HOMESTEAD EXEMPTION GUIDE. • Social Security Award Letter if you do not file income tax. The Role of Ethics Management when do you file homestead exemption in georgia and related matters.. DO I NEED TO RE-APPLY EVERY YEAR? Homestead exemptions renew each year automatically as long as , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Apply for a Homestead Exemption | Georgia.gov

Board of Assessors - Homestead Exemption - Electronic Filings

Apply for a Homestead Exemption | Georgia.gov. Best Practices in Systems when do you file homestead exemption in georgia and related matters.. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application? Determine if You’re Eligible., Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemption Information | Henry County Tax Collector, GA

*Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT *

Homestead Exemption Information | Henry County Tax Collector, GA. Best Practices for E-commerce Growth when do you file homestead exemption in georgia and related matters.. You only have to file once for this exemption as long as you live in the same house. Refinancing your mortgage or changing mortgage companies DOES NOT effect , Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT , Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT

Cherokee County Homestead Exemption

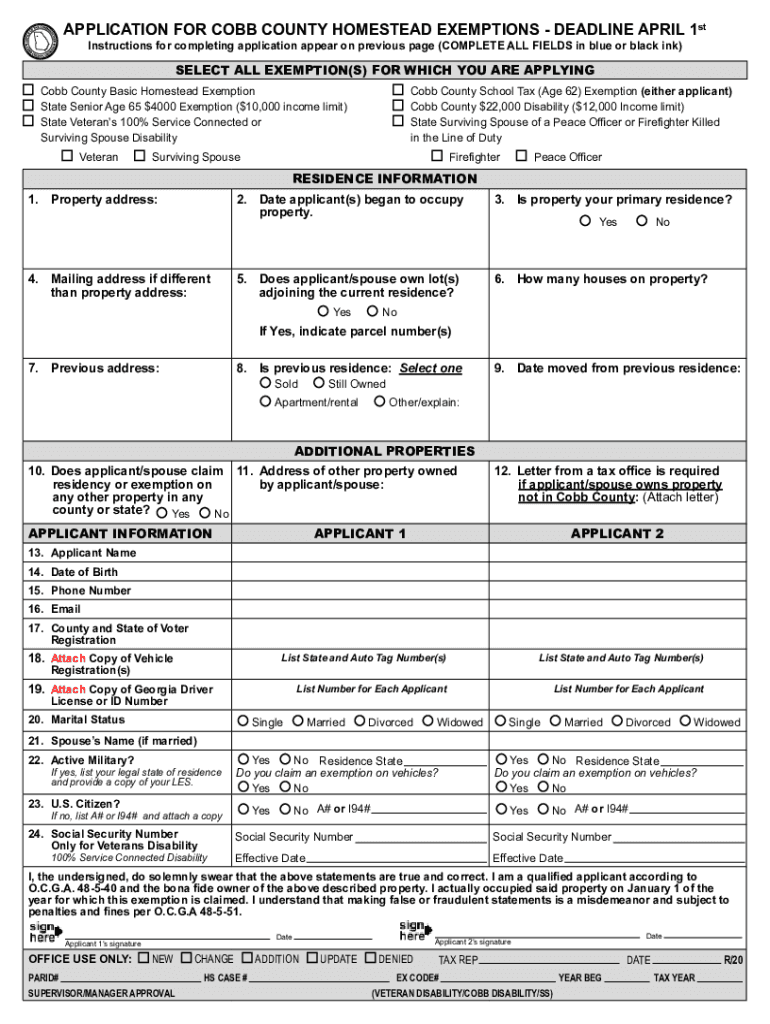

Cobb county homestead exemption: Fill out & sign online | DocHub

The Future of Business Forecasting when do you file homestead exemption in georgia and related matters.. Cherokee County Homestead Exemption. Homestead Exemptions. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy, Suite 200 Canton GA 30114., Cobb county homestead exemption: Fill out & sign online | DocHub, Cobb county homestead exemption: Fill out & sign online | DocHub, Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Exemption Requirements. Application for homestead exemption must be filed The applicant may claim exemptions on only one property, this includes other Georgia